RenaissanceRe Holdings Ltd (RNR) Q1 2024 Earnings Analysis: A Detailed Review Against Analyst ...

Net Income: Reported $364.8 million, falling short of the estimated $491.24 million.

EPS: Achieved $6.94 per diluted share, below the estimated $9.41.

Revenue: Gross premiums written increased to $3.99 billion, significantly surpassing the estimated revenue of $2.59 billion.

Operating Income: Reached $636.4 million, indicating robust operational performance.

Combined Ratio: Improved to 77.9%, reflecting efficient underwriting profitability.

Investment Income: Net investment income rose by 53.6% to $390.8 million, highlighting strong gains from investments.

Fee Income: Grew by 86.6% to $83.6 million, driven by increased management and performance fees.

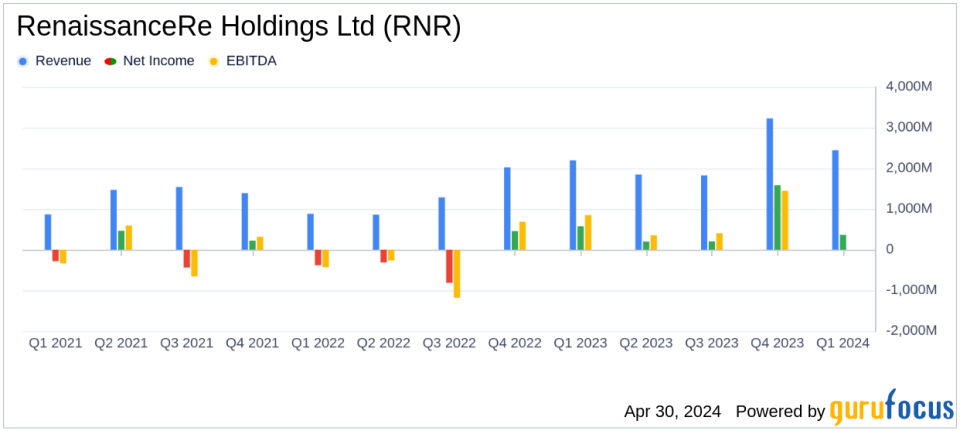

RenaissanceRe Holdings Ltd (NYSE:RNR) released its 8-K filing on April 30, 2024, revealing a mixed financial performance for the first quarter of 2024. The company reported a net income available to common shareholders of $364.8 million and an operating income of $636.4 million. Despite these strong figures, the reported earnings per share (EPS) of $6.94 fell short of the estimated EPS of $9.41. However, the reported revenue of $2,443.91 million was closely aligned with the estimated revenue of $2,587.63 million.

RenaissanceRe Holdings Ltd, a global provider of reinsurance and insurance solutions, focuses on property, casualty, and specialty reinsurance. The company's revenue streams include net premiums earned, net investment income, and other income from joint ventures and advisory services. For Q1 2024, the Property segment and the Casualty and Specialty segment, which is the major revenue contributor, demonstrated significant growth and strategic advancements, particularly following the acquisition of Validus Holdings.

Financial Highlights and Strategic Initiatives

The first quarter saw a substantial increase in gross premiums written, up by $1.2 billion or 43.0%, with the Property and Casualty and Specialty segments growing by 44.9% and 41.4%, respectively. This growth was largely fueled by the strategic acquisition of Validus Holdings, enhancing RenaissanceRe's market positioning and product offerings. The combined ratio stood at a commendable 77.9%, with an adjusted combined ratio of 75.4%, indicating strong underwriting profitability.

Net investment income rose by 53.6% to $390.8 million, driven by higher average invested assets and higher yielding assets, reflecting prudent investment management. Fee income also saw a notable increase, up by 86.6% to $83.6 million, thanks to enhanced management and performance fees from expanded joint ventures and managed funds.

Challenges and Market Conditions

Despite the positive financial outcomes, RenaissanceRe faced challenges including the impact of the Baltimore Bridge Collapse, which influenced the Casualty and Specialty segment's combined ratio. The event underscores the inherent volatility and exposure to large loss events in the reinsurance industry. Additionally, the integration of Validus and the management of acquisition-related adjustments pose ongoing challenges that could impact future performance.

Investor and Market Implications

The robust growth in premiums and strategic acquisitions are likely to bolster investor confidence in RenaissanceRe's market strategy and execution capabilities. However, the EPS falling short of analyst expectations might raise concerns about valuation and earnings stability. The company's ability to manage catastrophic events and integrate acquisitions will be crucial in maintaining its competitive edge and financial health.

Kevin J. O'Donnell, President and CEO of RenaissanceRe, commented on the quarter's results, stating:

"We are pleased to deliver another exceptional quarter, characterized by strong profitability, substantial growth, and persistent tailwinds behind our Three Drivers of Profit. The successful renewal of the RenaissanceRe and Validus portfolio is deepening our partnerships with our customers while broadening our access to attractive risk."

This statement highlights the company's strategic focus on leveraging its core strengths to enhance shareholder value and market position.

Conclusion

RenaissanceRe's first quarter of 2024 demonstrates a solid financial performance with strategic advancements, albeit with some challenges. The company's focus on expanding its underwriting portfolio and enhancing investment income has paid dividends, positioning it well for future growth. Investors and stakeholders will be watching closely how the company navigates market challenges and capitalizes on opportunities in subsequent quarters.

Explore the complete 8-K earnings release (here) from RenaissanceRe Holdings Ltd for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance