Reddit (RDDT) Q1 Earnings Beat Estimates, Revenues Up Y/Y

Reddit RDDT reported first-quarter 2024 adjusted earnings of 29 cents per share, which beat the Zacks Consensus Estimate by 2.63%.

Including stock-based compensation of $595.5 million, the GAAP loss was $8.19 per share, much wider than the $1.05 reported in the year-ago quarter.

Revenues of $243 million surpassed the Zacks Consensus Estimate by 14.62%. The figure jumped 48.4% year over year. Ad revenues increased 39% year over year to $222.7 million. Other revenues surged 454% year over year to $20 million, driven by new data licensing agreements, including Google.

Daily Active Uniques (“DAUq”) increased 37% year over year to 82.7 million. U.S. DAUq jumped 45% year over year to 41.5 million, while International DAUq increased 30% year over year to 41.2 million.

Weekly Active Uniques (“WAUq”) surged 40% year over year to 306.2 million. U.S. WAUq jumped 53% year over year to 151.3 million, while International WAUq increased 30% year over year to 154.9 million.

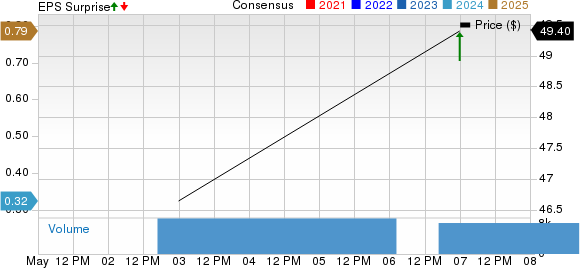

Reddit Inc. Price, Consensus and EPS Surprise

Reddit Inc. price-consensus-eps-surprise-chart | Reddit Inc. Quote

Average Revenue Per User (ARPU) increased 8% year over year to $2.94. U.S. ARPU increased 3% to $4.77 while International climbed 10% on a year-over-year basis to $1.10.

Quarter Details

First-quarter 2024 U.S. revenues (contributed 82% to revenues) jumped 53% year over year to $199.8 million. International revenues (18% of revenues) increased 30.5% year over year to $43.2 million.

The gross margin on a non-GAAP basis was 88.7%, expanding 500 basis points year over year.

Adjusted EBITDA was $10 million in the reported quarter against adjusted EBITDA loss of $50.2 million in the year-ago quarter.

Sales & Marketing expenses surged 114.3% year over year to $124.1 million. Research & development expenses soared to $437 million from the year-ago quarter’s figure of $108.8 million. General & Administrative expenses surged to $243.5 million from the year-ago quarter’s figure of $40.8 million.

Balance Sheet

As of Mar 31, 2024, Reddit had cash and cash equivalents, including marketable securities of $1.67 billion compared with $1.21 billion as of Dec 31, 2023.

In the first quarter, Reddit generated $32.1 million of cash from operating activities and a free cash flow of $29.2 million.

Guidance

For the second quarter of 2024, Reddit expects revenues between $240 million and $255 million.

Adjusted EBITDA is expected between $0 million and $15 million.

Zacks Rank & Stocks to Consider

Currently, Reddit carries a Zacks Rank #3 (Hold).

Babcock & Wilcox BW, Dropbox DBX and NVIDIA NVDA are some better-ranked stocks that investors can consider in the Zacks Computer and Technology sector, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Babcock shares have declined 21.9% in the year-to-date period. BW is set to report its first-quarter 2024 results on May 9.

Dropbox shares have declined 19.9% year to date. DBX is set to report its first-quarter 2024 results on May 9.

NVIDIA shares have gained 82.9% year to date. NVDA is set to report its first-quarter fiscal 2025 results on May 22.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Babcock (BW) : Free Stock Analysis Report

Dropbox, Inc. (DBX) : Free Stock Analysis Report

Reddit Inc. (RDDT): Free Stock Analysis Report

Yahoo Finance

Yahoo Finance