Red Violet Inc (RDVT) Reports Substantial Growth in Q1 2024 Earnings

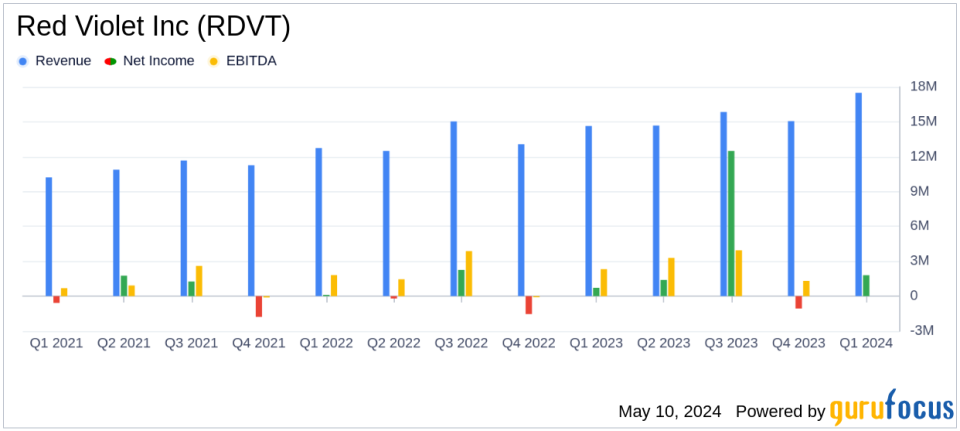

Total Revenue: Reached $17.5 million, marking a 20% increase year-over-year.

Gross Profit: Grew by 20% to $11.5 million; gross margin stable at 66%.

Net Income: Surged 149% to $1.8 million, with net income margin doubling to 10%.

Earnings Per Share: Increased to $0.13 per basic and diluted share.

Adjusted EBITDA: Rose 54% to $5.7 million; Adjusted EBITDA margin improved to 32% from 25%.

Operating Cash Flow: Jumped 181% to $4.3 million.

Cash and Cash Equivalents: Stood at $32.1 million as of March 31, 2024.

On May 8, 2024, Red Violet Inc (NASDAQ:RDVT), a prominent player in analytics and information solutions, disclosed its financial outcomes for the first quarter ended March 31, 2024, through its 8-K filing. The company reported a significant 20% increase in revenue, reaching a record $17.5 million, alongside a dramatic 149% rise in net income to $1.8 million.

Red Violet Inc specializes in big data analysis with its CORE data fusion platform, providing essential information solutions across various industries. This technology-driven approach has evidently paid dividends, as seen in the company's latest financial achievements.

Financial Performance Insights

The first quarter of 2024 has set a robust pace for Red Violet, with total revenue soaring to $17.5 million, a 20% increase year-over-year. This growth was mirrored in both gross profit and adjusted gross profit, each also rising by 20% to $11.5 million and $13.8 million respectively. Notably, the adjusted gross margin improved slightly to 79% from the previous year's 78%.

Net income saw an impressive leap, increasing by 149% to $1.8 million, which translated to earnings of $0.13 per share on both a basic and diluted basis. The net income margin effectively doubled to 10%. Adjusted EBITDA grew by 54% to $5.7 million, with its margin expanding significantly to 32% from 25%.

Operational cash flow was another area of strength, witnessing a 181% increase to $4.3 million. The company's liquidity position remains solid with $32.1 million in cash and cash equivalents as of March 31, 2024.

Strategic and Operational Highlights

During the quarter, Red Violet added 366 customers to its IDI platform and a record 51,259 users to its FOREWARN service. The company also continued its share repurchase program, buying back 291,879 shares at an average price of $19.81 per share.

CEO Derek Dubner commented on the results, stating, "We started 2024 by delivering record sales and strong operating results which reflect the inherent strength of our innovative technology and solutions, and our teams relentless commitment to delivering superior value to our customers." He further highlighted the strategic initiatives aimed at expanding technology and product suites, which are expected to fuel sustainable growth.

Financial Health and Future Outlook

The balance sheet remains robust with total assets increasing to $94.026 million from the prior quarter's $92.990 million. Shareholders' equity also showed a healthy balance, although slightly decreased from $86.112 million at the end of 2023 to $83.847 million.

With these strong Q1 results, Red Violet not only demonstrates its financial resilience but also reinforces its strategic positioning for continued growth in 2024. The company's focus on expanding its technological capabilities and market reach suggests a proactive approach to leveraging opportunities in the dynamic data analytics and business intelligence sectors.

For more detailed information about Red Violet's financial performance and future prospects, interested parties can access the full earnings report and join the upcoming conference call as detailed in the company's 8-K filing.

Explore the complete 8-K earnings release (here) from Red Violet Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance