Red Rock Resorts Q1 2024 Earnings: A Close Call with Analyst Projections

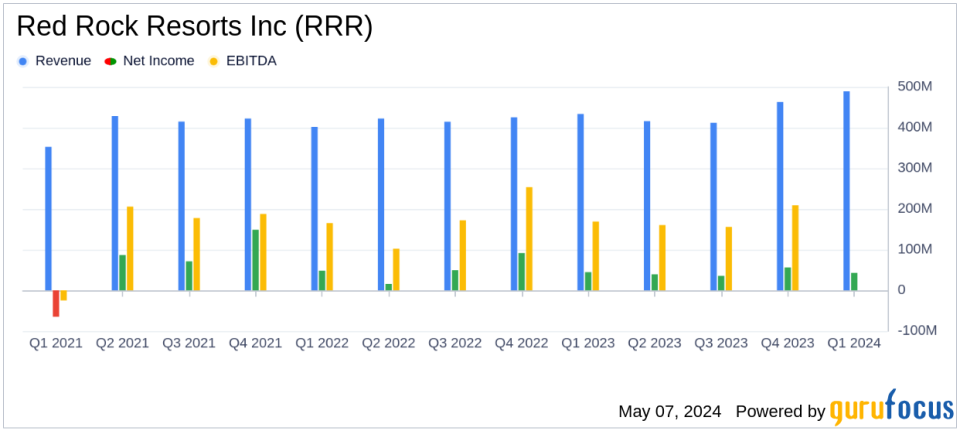

Net Income: Reported at $42.835 million, falling short of the estimated $58.01 million.

Revenue: Totalled $488.897 million, slightly below the estimated $489.64 million.

Earnings Per Share (EPS): Basic EPS was $0.73, diluted EPS was $0.68, both above the estimated $0.66.

Dividends: Declared a quarterly dividend of $0.25 per Class A common share, payable on June 28, 2024.

Adjusted EBITDA: Reached $209.136 million, reflecting a solid operational performance.

Debt Levels: Reported a total principal amount of debt standing at $3.5 billion as of March 31, 2024.

Cash Position: Held $129.7 million in cash and cash equivalents at the end of the quarter.

On May 7, 2024, Red Rock Resorts Inc (NASDAQ:RRR) disclosed its financial outcomes for the first quarter ended March 31, 2024, through an 8-K filing. The company, a prominent player in the gaming, development, and management sector, primarily focuses on strategically situated casino and entertainment properties, generating most of its revenue from its casino operations.

Quarterly Financial Highlights

For Q1 2024, Red Rock Resorts reported net revenues of $488.9 million, a significant increase from $433.6 million in the same quarter the previous year. This performance aligns closely with analyst expectations, which projected revenues of approximately $489.64 million. The net income for the quarter stood at $78.4 million, translating to earnings per share (EPS) of $0.68 on a diluted basis, which is slightly above the estimated EPS of $0.66.

The company's balance sheet showed $129.7 million in cash and cash equivalents. However, it also reported a substantial total debt of $3.5 billion, highlighting a key area of financial leverage and risk.

Operational and Segment Performance

Red Rock Resorts' operational success in the quarter was driven by robust performances across its segments. The casino segment alone brought in $316.9 million, up from $288.2 million in Q1 2023. Other segments, including food and beverage, and room revenues, also saw significant increases, contributing to the overall growth. The company's Las Vegas operations, which are central to its portfolio, generated $485.6 million in net revenues.

Strategic Dividends and Shareholder Returns

In a move to enhance shareholder value, the Board of Directors declared a quarterly dividend of $0.25 per Class A common share, payable in June 2024. This decision reflects the company's commitment to returning value to its shareholders while maintaining a stable financial footing.

Adjusted EBITDA and Financial Metrics

Adjusted EBITDA, a critical measure of operational efficiency for Red Rock Resorts, stood at $209.1 million for the quarter, up from $194.2 million in the prior year. This increase is indicative of improved operational efficiency and cost management across the board.

Market and Future Outlook

The company's performance is set against a backdrop of economic challenges, including inflation and competitive pressures in the Las Vegas market. Despite these hurdles, Red Rock Resorts has demonstrated resilience, adapting to market dynamics and consumer demand shifts. The strategic location of its properties and the breadth of entertainment and gaming options continue to attract a steady flow of patrons.

Investor and Analyst Perspectives

Investors and analysts might see the near alignment of Red Rock Resorts' financial outcomes with market estimates as a sign of stability and prudent management. However, the high level of indebtedness could be a concern that needs continuous monitoring, especially in an uncertain economic environment.

As the company moves forward, its ability to manage debt, drive revenue growth, and enhance shareholder returns through strategic initiatives will be critical in maintaining its market position and ensuring long-term profitability.

Explore the complete 8-K earnings release (here) from Red Rock Resorts Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance