Reasons to Add PG&E Corp. (PCG) to Your Portfolio Right Now

PG&E Corporation PCG is poised to benefit from positive developments like steady infrastructural investments, addition of clean energy projects and initiatives to build California’s electric vehicle (EV) charging infrastructure.

Let’s focus on the factors that make this Zacks Rank #2 (Buy) stock a good investment option at the moment.

Rising Estimates

The Zacks Consensus Estimate for PCG’s 2024 and 2025 earnings per share suggests growth of 9.8% and 8.4%, respectively, from the year-ago levels.

The Zacks Consensus Estimate for PCG’s 2024 and 2025 sales indicates a rise of 6.5% and 3.8%, respectively, from the prior-year figures.

Capital Expenditure

PG&E Corp. continues to make considerable investments in gas-related projects, and electric system safety and reliability to further strengthen its grid and thereby boost customer satisfaction. To this end, the company invested $9.8 billion in 2023. Looking ahead, management aims to make investments worth $10.4 billion in 2024. For 2024-2028, the company expects to invest $62 billion.

Return on Equity (ROE)

PG&E Corp.’s ROE of 11.3% outperformed the industry average of 9.9%. This indicates the company’s efficiency in utilizing its shareholders’ funds.

Solvency

The times interest earned ratio at the end of first-quarter 2024 is 1.42, which indicates financial strength of the company and its ability to meet short-term obligations or dues within the next 12 months.

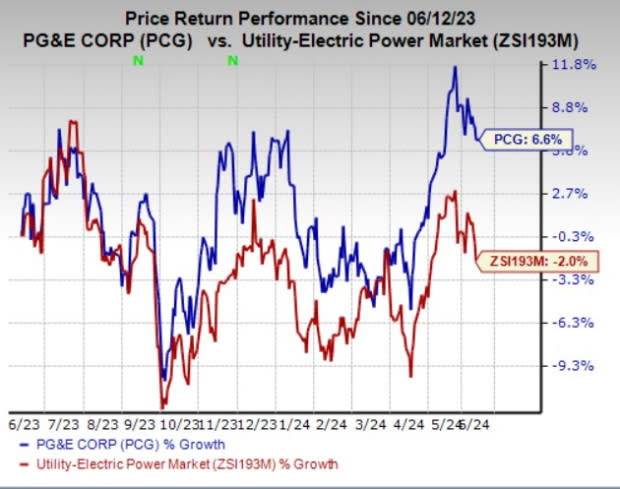

Price Movement

In the past year, PG&E Corp.’s shares have gained 6.6% against its industry’s decline of 2%.

Image Source: Zacks Investment Research

Other Key Picks

Some other top-ranked stocks from the same industry are CenterPoint Energy CNP, DTE Energy Company DTE and Pinnacle West Capital PNW, each carrying a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for 2024 earnings for CenterPoint Energy, DTE Energy and Pinnacle West Capital suggests growth of 8%, 16.9% and 8.2%, respectively, from the year-earlier levels.

The long-term (three-to-five years) earnings growth of CenterPoint Energy, DTE Energy and Pinnacle West Capital is pinned at 7%, 8.2% and 8.2%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Pacific Gas & Electric Co. (PCG) : Free Stock Analysis Report

DTE Energy Company (DTE) : Free Stock Analysis Report

CenterPoint Energy, Inc. (CNP) : Free Stock Analysis Report

Pinnacle West Capital Corporation (PNW) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance