Qurate Retail Inc (QRTEA) Q1 2024 Earnings: Adjusted EPS Meets Analyst Expectations Amidst ...

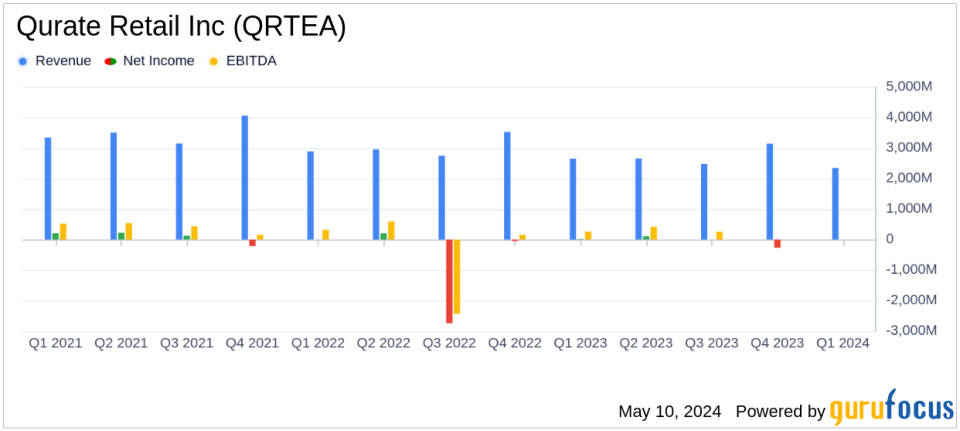

Revenue: Reported at $2.342 billion for Q1 2024, a decrease of 11% year-over-year, falling short of estimates of $2.398 billion.

Net Income: Transitioned to a loss of $1 million in Q1 2024 from a profit of $20 million in Q1 2023, significantly below the estimated net income of $15.97 million.

Adjusted EPS: Achieved $0.04, meeting the estimated earnings per share of $0.04.

Adjusted OIBDA: Increased by 45% to $259 million, indicating strong operational efficiency and cost management.

Gross Margin: Improved as evidenced by a decrease in the Cost of Goods Sold percentage from 69.0% to 65.4% for QxH segment.

Free Cash Flow: Enhanced year-over-year, contributing to a fifth consecutive quarter of growth, reflecting effective cash management and operational improvements.

eCommerce Revenue: Slightly declined to $958 million from $961 million, maintaining a significant portion of total revenue at 62.2%.

On May 8, 2024, Qurate Retail Inc (NASDAQ:QRTEA) disclosed its first-quarter results for the year, highlighting a series of financial dynamics and strategic initiatives aimed at sustaining its market position. The detailed financial outcomes were released in its 8-K filing.

Qurate Retail Inc, operating through its subsidiaries, is entrenched in the video and online commerce sectors. Its business segments include QxH, encompassing QVC U.S. and HSN, QVC International, and Zulily, each contributing to a diverse geographical footprint with the U.S. as its primary revenue source.

Financial Performance Overview

The company reported a consolidated revenue of $2,342 million for Q1 2024, marking an 11% decline from the previous year, aligning closely with analyst expectations of $2,397.96 million. This downturn reflects a reduction across most segments, with notable decreases in QxH and QVC International revenues by 4% and 3% respectively, and a significant 11% drop in Cornerstone revenues. Despite these challenges, Qurate Retail achieved an adjusted EPS of $0.04, meeting the estimated projections and demonstrating effective cost management and operational efficiency.

Strategic Highlights and Operational Achievements

David Rawlinson, President and CEO of Qurate Retail, emphasized the company's strategic advancements, including the expansion of gross margins for the fourth consecutive quarter and a significant 40% increase in Adjusted OIBDA. The company's focus on transformation initiatives such as cost reduction and product margin improvements was evident, alongside efforts to enhance merchandise offerings and brand partnerships, pivotal for the QVC and HSN brands.

The launch of the "Age of Possibility" campaign was a highlight of Q1, aiming to resonate with its core demographic through partnerships with influential figures. This strategic move is part of Qurate's broader initiative to revitalize its brand and connect with a broader audience.

Challenges and Market Dynamics

Despite the strategic gains, Qurate Retail faced several market challenges. The revenue decline in QxH was primarily due to a 4% decrease in units shipped, impacted by softness in home and apparel segments. QVC International also saw a dip due to unfavorable currency exchange rates, although this was partially mitigated by a slight increase in units shipped.

Operational income and Adjusted OIBDA margins saw improvements, largely attributed to higher product margins and reduced costs in fulfillment and administration, reflecting the company's robust management of operational efficiencies.

Financial Health and Future Outlook

Qurate Retail's financial health showed mixed signals. While there was a slight increase in total debt, the company managed to maintain compliance with all debt covenants. The cash position slightly decreased by $19 million, settling at $1,102 million as of March 31, 2024.

Looking forward, Qurate Retail aims to continue its focus on operational efficiency and strategic initiatives to navigate the challenging retail landscape and drive sustainable growth.

In conclusion, Qurate Retail Inc's first quarter of 2024 reflected a resilient performance amidst revenue challenges, with strategic initiatives poised to bolster its market position. The company's ability to meet adjusted EPS estimates while navigating revenue declines and operational hurdles highlights its potential for recovery and growth in upcoming quarters.

For further details, join the earnings call discussion or access the webcast through the investor relations section of Qurate Retail's website.

Explore the complete 8-K earnings release (here) from Qurate Retail Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance