Qualcomm Inc (QCOM) Q2 Fiscal 2024 Earnings: Surpasses Analyst Revenue Forecasts

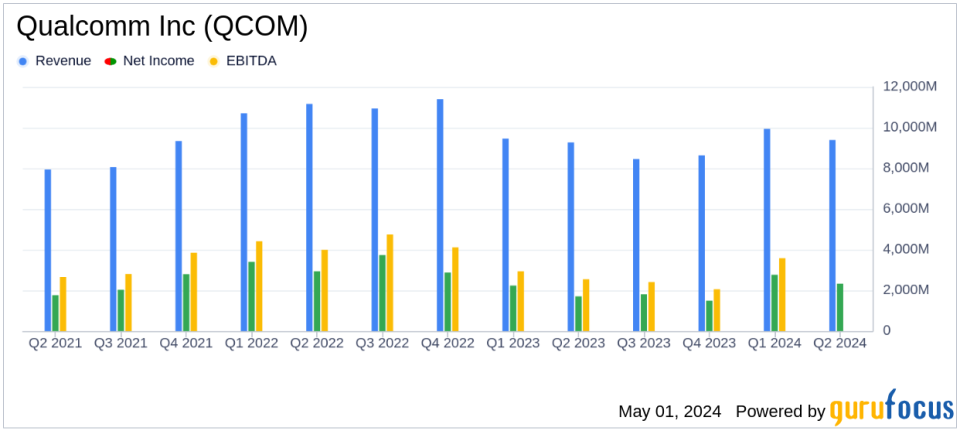

Revenue: Reported at $9.4 billion, showing a slight increase of 1% year-over-year, surpassing the estimated $9.338 billion.

Net Income: Reached $2.326 billion, marking a significant increase of 37% from the previous year, but did not exceed the estimate of $2.621 billion.

Earnings Per Share (EPS): GAAP EPS was $2.06, up 36% year-over-year, while Non-GAAP EPS was $2.44, exceeding the estimated EPS of $2.32.

Automotive Revenue: Saw a robust growth of 35%, totaling $603 million, highlighting strong performance in the automotive sector.

Dividends: Increased quarterly cash dividend to an annualized payout of $3.40 per share, enhancing shareholder returns.

Stock Repurchase: Returned $1.6 billion to stockholders, including $731 million through the repurchase of 5 million shares.

Outlook for Q3 FY24: Projected revenues between $8.8 billion and $9.6 billion, with Non-GAAP EPS forecasted to be between $2.15 and $2.35.

On May 1, 2024, Qualcomm Inc (NASDAQ:QCOM) unveiled its fiscal second quarter results, showcasing revenue and earnings that exceeded analyst expectations. Detailed in their recent 8-K filing, the company reported a revenue of $9.4 billion and a Non-GAAP EPS of $2.44, both surpassing the estimated figures of $9.338 billion and $2.32 respectively.

Qualcomm, a leading developer of wireless technology and designer of chips for smartphones, continues to dominate the semiconductor industry with its innovative Snapdragon platforms and extensive patent portfolio in CDMA and OFDMA technologies. These technologies are crucial for all 3G, 4G, and 5G networks, positioning Qualcomm as a pivotal player in the global wireless market.

Financial and Operational Highlights

For Q2 2024, Qualcomm reported a significant increase in net income to $2.326 billion, up 37% from the previous year, and a robust 36% increase in GAAP EPS to $2.06. The Non-GAAP figures were similarly impressive, with EPS climbing 13% to $2.44. This growth is attributed to strong performance across multiple sectors, particularly in QCT Automotive, where revenue soared by 35% to $603 million, reflecting the company's expanding influence in the automotive industry.

The company's strategic focus on diversifying its revenue streams is evident from its record QCT Automotive revenues for the third consecutive quarter and the growth in its design win pipeline, now valued at approximately $45 billion. This diversification strategy is crucial as it reduces dependency on the volatile smartphone market and positions Qualcomm to capitalize on the next wave of technological advancements in the automotive sector.

Challenges and Forward-Looking Statements

Despite the strong quarterly performance, Qualcomm faces ongoing challenges, including dependency on a limited number of customers and the impact of geopolitical tensions, particularly between the U.S. and China. The company's forward-looking statements suggest cautious optimism, with projected Q3 revenues between $8.8 billion and $9.6 billion, and Non-GAAP EPS estimates ranging from $2.15 to $2.35.

President and CEO Cristiano Amon expressed confidence in the company's trajectory, stating,

We are pleased to report strong quarterly results, with EPS exceeding the high end of our guidance. We are excited about our continued growth and diversification, including achieving our third consecutive quarter of record QCT Automotive revenues, upcoming launches with our Snapdragon X platforms, and enabling leading on-device AI capabilities across multiple product categories."

Investor and Market Implications

Qualcomm's ability to exceed analyst expectations and its strategic positioning in high-growth areas like automotive and AI technologies make it an attractive prospect for investors. The increase in quarterly cash dividends to an annualized payout of $3.40 per share further underscores its commitment to shareholder value.

Overall, Qualcomm's latest earnings report not only reflects its strong financial performance but also highlights its strategic initiatives that are likely to drive future growth. As the company continues to innovate and expand into new markets, it remains a significant player in the semiconductor industry, poised for continued success.

Explore the complete 8-K earnings release (here) from Qualcomm Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance