Q1 Earnings Roundup: DraftKings (NASDAQ:DKNG) And The Rest Of The Gaming Solutions Segment

Wrapping up Q1 earnings, we look at the numbers and key takeaways for the gaming solutions stocks, including DraftKings (NASDAQ:DKNG) and its peers.

Gaming solution companies operate in a dynamic and evolving market, and the digital transformation of the gaming industry presents significant opportunities for innovation and growth, whether it be immersive slot machine terminals or mobile sports betting. However, the gaming solution industry is not without its challenges. Regulatory compliance is a crucial consideration as companies must navigate a complex and often fragmented regulatory landscape across different jurisdictions. Changes in regulations can impact product offerings, operational practices, and market access, requiring companies to maintain flexibility and adaptability in their business strategies. Additionally, the competitive nature of the industry necessitates continuous investment in research and development to stay ahead of competitors and meet evolving consumer demands.

The 8 gaming solutions stocks we track reported a decent Q1; on average, revenues beat analyst consensus estimates by 3.3%. Valuation multiples for many growth stocks have not yet reverted to their early 2021 highs, but the market was optimistic at the end of 2023 due to cooling inflation. The start of 2024 has been a different story as mixed signals have led to market volatility, but gaming solutions stocks have shown resilience, with share prices up 5.2% on average since the previous earnings results.

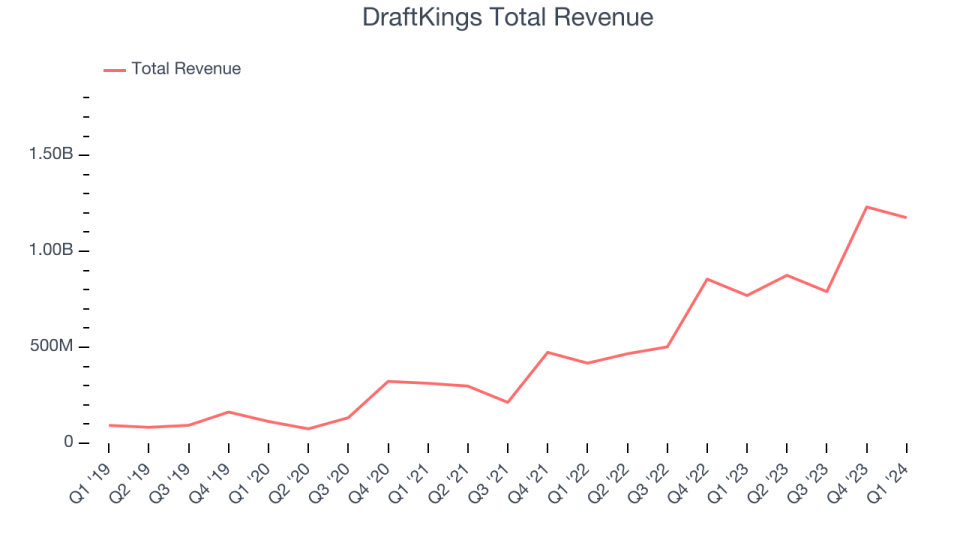

DraftKings (NASDAQ:DKNG)

Getting its start in daily fantasy sports, DraftKings (NASDAQ:DKNG) is a digital sports entertainment and gaming company.

DraftKings reported revenues of $1.17 billion, up 52.7% year on year, exceeding analysts' expectations by 4.6%. Overall, it was a decent quarter for the company with full-year revenue guidance exceeding analysts' expectations.

“DraftKings’ performance in the first quarter of 2024 was outstanding, reflecting healthy revenue growth and a scaled fixed cost structure that positions us to drive rapidly improving Adjusted EBITDA,” said Jason Robins, DraftKings’ Chief Executive Officer and Co-founder.

DraftKings achieved the fastest revenue growth of the whole group. The stock is down 11.9% since reporting and currently trades at $37.91.

Is now the time to buy DraftKings? Access our full analysis of the earnings results here, it's free.

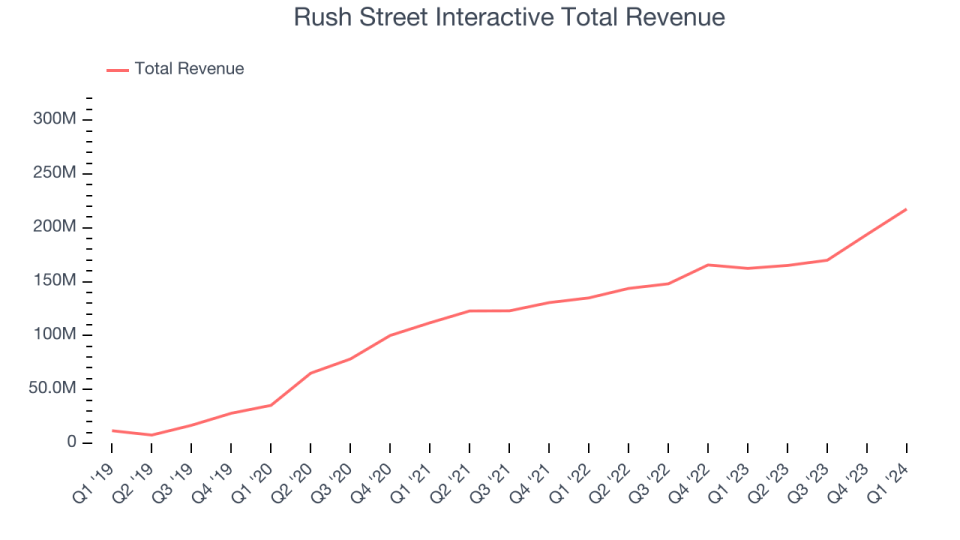

Best Q1: Rush Street Interactive (NYSE:RSI)

Specializing in online casino gaming and sports betting, Rush Street Interactive (NYSE:RSI) is an operator of digital gaming platforms.

Rush Street Interactive reported revenues of $217.4 million, up 33.9% year on year, outperforming analysts' expectations by 9.8%. It was an incredible quarter for the company with an impressive beat of analysts' earnings estimates and full-year revenue guidance exceeding analysts' expectations.

Rush Street Interactive pulled off the biggest analyst estimates beat and highest full-year guidance raise among its peers. The market seems happy with the results as the stock is up 40.3% since reporting. It currently trades at $8.98.

Is now the time to buy Rush Street Interactive? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Inspired (NASDAQ:INSE)

Specializing in digital casino gaming, Inspired (NASDAQ:INSE) is a provider of gaming hardware, virtual sports platforms, and server-based gaming systems.

Inspired reported revenues of $63.1 million, down 2.8% year on year, falling short of analysts' expectations by 2.8%. It was a weak quarter for the company with a miss of analysts' earnings estimates.

Inspired posted the weakest performance against analyst estimates in the group. As expected, the stock is down 1.2% since the results and currently trades at $9.34.

Read our full analysis of Inspired's results here.

Accel Entertainment (NYSE:ACEL)

Established in Illinois, Accel Entertainment (NYSE:ACEL) is a provider of electronic gaming machines and interactive amusement terminals to bars and entertainment venues.

Accel Entertainment reported revenues of $301.8 million, up 2.9% year on year, surpassing analysts' expectations by 2.1%. Taking a step back, it was a solid quarter for the company with a decent beat of analysts' earnings and video gaming terminals sold estimates.

The stock is down 10.8% since reporting and currently trades at $10.37.

Read our full, actionable report on Accel Entertainment here, it's free.

Everi (NYSE:EVRI)

Formed between the 2015 merger of Global Cash Access and Multimedia Games, Everi (NYSE:EVRI) is a producer of games and financial infrastructure for the casino and hospitality industries.

Everi reported revenues of $189.3 million, down 5.5% year on year, in line with analysts' expectations. Zooming out, it was a weak quarter for the company with a miss of analysts' earnings estimates.

Everi had the slowest revenue growth among its peers. The stock is up 7.2% since reporting and currently trades at $8.67.

Read our full, actionable report on Everi here, it's free.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

Yahoo Finance

Yahoo Finance