Prudential Financial Inc. (PRU) Q1 Earnings: Meets EPS Estimates, Reveals Strategic Progress

Net Income: $1.138 billion, below the estimated $1.130.32 million, with earnings per share at $3.12, slightly below the estimate of $3.13.

Revenue: Details not provided in the text, comparison to estimated revenue of $14,496.11 million cannot be made.

Assets Under Management: Increased to $1.496 trillion, up from $1.417 trillion in the previous year.

Book Value Per Share: Decreased to $75.00 from $85.33 year-over-year.

Dividends: Paid $1.30 per common share in the first quarter, representing a 5% yield on adjusted book value.

Capital Return: $726 million returned to shareholders, including $250 million in share repurchases and $476 million in dividends.

Adjusted Operating Income: Rose to $1.141 billion from $1.004 billion in the prior year, with earnings per share also increasing to $3.12 from $2.70.

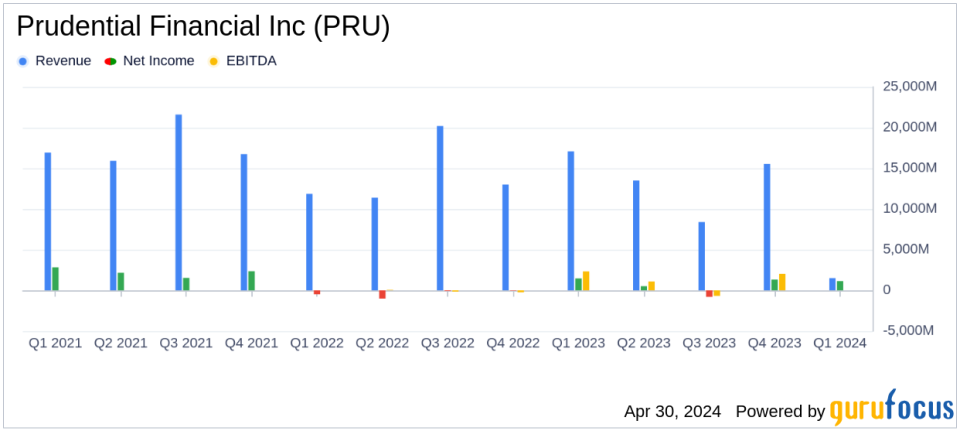

On April 30, 2024, Prudential Financial Inc. (NYSE:PRU) released its first quarter earnings report for the year, detailing a mix of financial achievements and strategic advancements. The company announced net income of $1.138 billion, translating to $3.12 per common share, aligning closely with analyst expectations of $3.13 per share. This performance, however, represents a decline from the previous year's $1.462 billion, or $3.93 per share. The detailed earnings report can be accessed through Prudential's 8-K filing.

Prudential Financial, a prominent global financial services leader, is known for its extensive portfolio of insurance, investment management, and retirement services, primarily across the United States and Japan. With its investment management business, PGIM, contributing significantly to its earnings, Prudential manages approximately $1.5 trillion in assets. The company's U.S. operations, which account for about half of its earnings, include diverse sectors such as Institutional and Individual Retirement Strategies, Group Insurance, and Individual Life Insurance.

Strategic Advances and Financial Highlights

According to Charles Lowrey, Chairman and CEO, Prudential has made significant strides in its strategic initiatives aimed at fostering higher growth and enhancing capital efficiency. The company reported a robust balance sheet and positive momentum across its business segments, particularly noting substantial inflows in PGIM and strong sales growth in both U.S. and International Businesses. These efforts are reflective of Prudential's goal to expand global access to financial services.

Segment Performance

Prudential's U.S. Businesses saw an increase in adjusted operating income to $839 million from $760 million in the prior year, driven by improved investment results and underwriting outcomes. The International Businesses segment also reported growth, with adjusted operating income rising to $896 million from $840 million, supported by higher net investment results and joint venture earnings.

Challenges and Market Position

Despite these gains, Prudential faced challenges including a decrease in book value per share from the previous year and a slight reduction in highly liquid assets. The company also navigated through market fluctuations and strategic adjustments, such as the decision to exit the Assurance IQ business, which impacted its financials.

Investor Considerations

For investors, Prudential's consistent earnings per share in line with estimates and strategic advancements present a balanced view of stability and progressive growth. The company's ability to maintain robust dividend payments, evidenced by a $1.30 per share dividend in the first quarter, aligns with its strong financial discipline and shareholder value focus.

As Prudential continues to execute its strategic plans and adapt to global market dynamics, investors and stakeholders will likely monitor its ability to sustain growth and profitability in a competitive and ever-evolving financial landscape.

Conclusion

Prudential Financial Inc. stands as a testament to resilient operational strategies and financial management. With a clear focus on expanding its market-leading positions and enhancing capital efficiency, Prudential is poised to navigate the complexities of the global financial services industry. The company's first quarter performance, marked by strategic successes and financial steadiness, underscores its commitment to long-term growth and shareholder returns.

For detailed insights and further information about Prudential Financial Inc.'s financial performance, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Prudential Financial Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance