Posthaste: This 'sticky' inflation could soon nudge the Bank of Canada to cut rates

The Bank of Canada has been trying for almost two years to tame inflation and we are still not able to say, battle won.

The uncertainty was highlighted in the central bank’s summary of deliberations for its October meeting released last week which revealed the governing council was split on whether more hikes were needed.

Some members thought it was “more likely than not” that more were needed to get inflation back to the target 2 per cent, while others thought the current 5 per cent policy rate would do the job as long as it was held there for long enough.

In his weekly note Friday, CIBC chief economist Avery Shenfeld says where interest rates go next comes down to two questions: will the economy remain fragile and will that bring inflation down?

The Bank appears to agree on sluggish growth, but is more divided on inflation.

Some of their concerns aren’t likely to persist, said Shenfeld. Oil prices, for instance, which spiked at the outbreak of the Hamas-Israel war, have since dropped back because of growing concerns over global demand. Brent crude has dropped below US$81 a barrel, after falling about 12 per cent over the past three weeks.

Wage increases are still higher, but the unemployment rate has been rising and job vacancies falling. “We know of no persuasive argument that would suggest that labour market slack will fail to show up in less robust pay hikes in the coming year,” said Shenfeld.

The central bank has also expressed concern about businesses seeking bigger and more frequent price increases, but Shenfeld argues that supply and demand will ultimately solve that price pressure.

“Weaker spending power as the job market softens should ensure that firms testing out larger price jumps will find their products piling up on shelves and their services going unwanted,” he said.

There is, however, one inflation component that remains sticky and increasing interest rates won’t solve it — shelter costs.

One of the key drivers, home prices, is cooling. National prices slipped 0.3 per cent in September from the month before, the first decline since March.

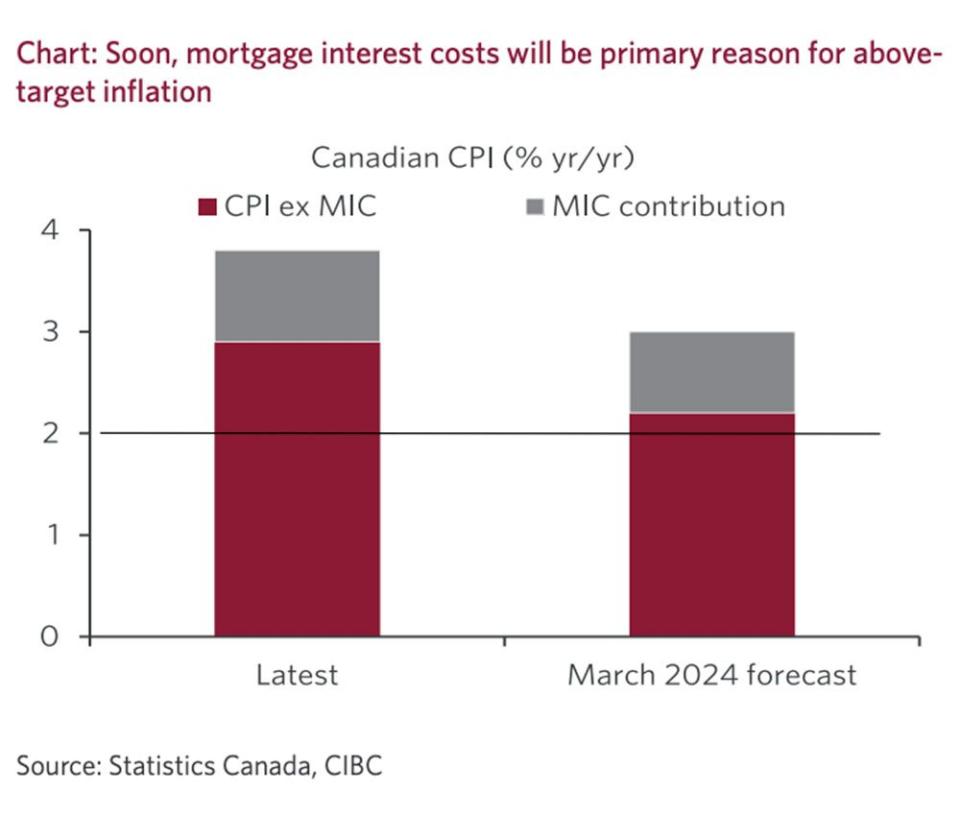

But the others — mortgage costs and rents — are both being driven up by higher interest rates, said Shenfeld. Mortgage interest costs (MIC) reflect the increasing payments of homeowners who have had to renew at higher rates. Rents are also driven higher by rising interest rates as they prevent more Canadians from buying their own home and the supply of new rental units slows because of higher financing costs.

Bank of Canada governor Tiff Macklem recently said that rate cuts could begin before inflation slowed to the 2 per cent target if there was evidence of a reduction in core inflation, which removes the more volatile price movements.

Canada’s inflation rate slowed to 3.8 per cent in September, but core measures, have been stuck in the 3.5 to 4 per cent range over the past year, the central bank said in its summary.

CIBC predicts that core inflation will also come down in the months ahead as the economy continues to cool.

“If, as we expect, Q1 core inflation falls, but the overall CPI ends up near 3 per cent due to the outsized contribution from MIC (mortgage interest costs), we’ll be set up for rate cuts before mid-year,” said Shenfeld.

“Oddly enough, sticky inflation in this case will be a reason to ease up on rates.”

_____________________________________________________________________

Was this newsletter forwarded to you? Sign up here to get it delivered to your inbox.

_____________________________________________________________________

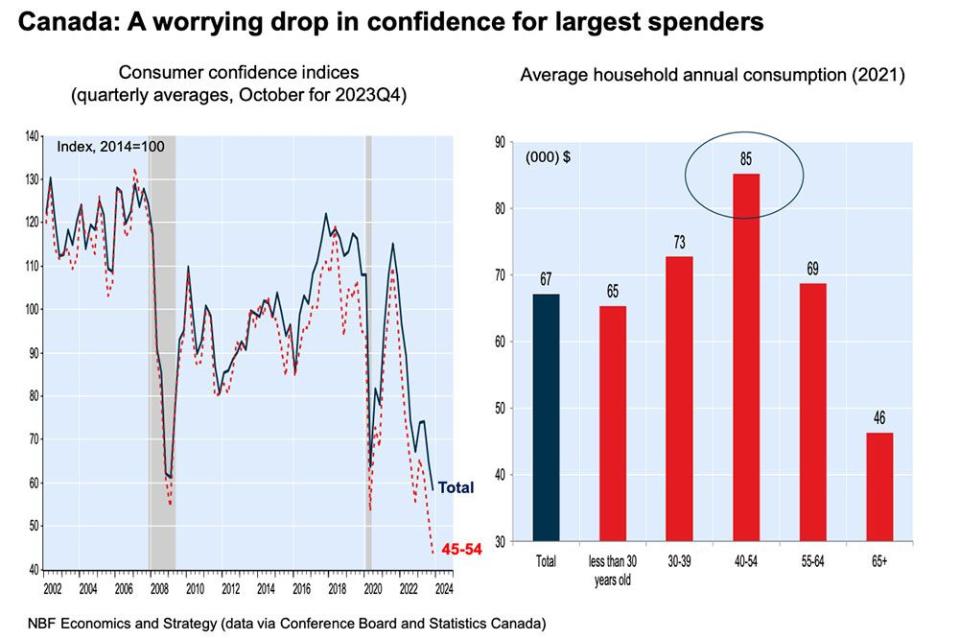

Consumer confidence is lower than it was during the past two recessions, according to Conference Board of Canada data, and one group shows a particularly sharp drop — 45- to 54-year-olds.

“This is not surprising given that this cohort has not experienced such high inflation in their adult lives and, along with the 35-44 age group, is the most indebted,” said National Bank economist Matthieu Arseneau, who brings us today’s chart.

Unfortunately, this age also tends to spend the most money, which doesn’t bode well for consumption, he said.

Bond markets closed for Remembrance Day

Earnings: EQB, Sun Life Financial, Power Corp of Canada, Tyson Foods

Get all of today’s top breaking stories as they happen with the Financial Post’s live news blog, highlighting the business headlines you need to know at a glance.

_______________________________________________________

The trouble with the new normal is that investors still don’t believe in it

David Rosenberg: Canada can’t count to a million — and it’s skewing the data policymakers need

Higher for longer — and maybe forever: Bank of Canada deputy says ultra-low rates may not return

The rush into short-term mortgages is reversing as higher-rate reality sets in, says CMHC

The trillion-dollar questions today are: Will inflation return to target levels in the near term? And what is currently being reflected in asset prices? Veteran investor Noah Solomon has some answers, but you may not like them. Read on

____________________________________________________

Today’s Posthaste was written by Pamela Heaven, @pamheaven, with additional reporting from The Canadian Press, Thomson Reuters and Bloomberg.

Have a story idea, pitch, embargoed report, or a suggestion for this newsletter? Email us at posthaste@postmedia.com, or hit reply to send us a note.

Bookmark our website and support our journalism: Don’t miss the business news you need to know — add financialpost.com to your bookmarks and sign up for our newsletters here.

Yahoo Finance

Yahoo Finance