Outset Medical Inc (OM) Q1 2024 Earnings: Misses Revenue Estimates and Widens Losses

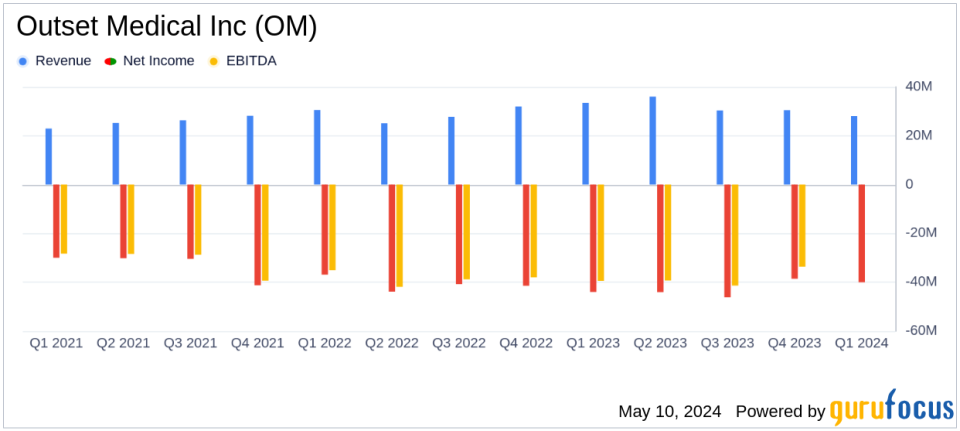

Revenue: Reported $28.2 million, down from $33.5 million in the prior year, falling short of estimates of $30.34 million.

Net Loss: Increased to $(39.9) million, or $(0.78) per share, compared to $(44.0) million, or $(0.90) per share year-over-year, but above the estimated $(27.79) million.

Gross Margin: Improved significantly to 29.2% from 19.2% in the previous year, indicating enhanced profitability per dollar of revenue.

Operating Expenses: Decreased by 10% to $45.1 million, reflecting effective cost management and operational efficiencies.

Product Gross Profit: Increased to $7.8 million with a margin of 38.4%, up from $7.0 million and a margin of 25.1% in the prior year, showing strong performance in product sales.

Service Revenue: Grew by 36.1% to $7.7 million, demonstrating expanding service capabilities and customer adoption.

2024 Full-Year Guidance: Reaffirmed revenue expectations of $145 million to $153 million, projecting a growth of 12% to 18% over 2023, with a non-GAAP gross margin in the low-30% range.

On May 8, 2024, Outset Medical Inc (NASDAQ:OM), a trailblazer in medical technology for dialysis, disclosed its financial outcomes for the first quarter ended March 31, 2024, through its 8-K filing. The company reported a decrease in quarterly revenue and an increase in net loss compared to the same period last year, alongside strategic advancements in its product offerings and operational efficiencies.

Company Overview

Outset Medical Inc specializes in innovative technology that simplifies and reduces the costs associated with dialysis treatment. Its flagship product, the Tablo Hemodialysis System, is designed for ease of use across various care settings, including hospitals, dialysis centers, and home care, making it a versatile solution in the renal care sector.

Financial Highlights

The reported revenue for Q1 2024 was $28.2 million, a decrease from $33.5 million in Q1 2023, falling short of the estimated $30.34 million. This decline was primarily due to a decrease in product revenue, which dropped to $20.4 million from $27.8 million in the previous year. However, service and other revenue saw a significant increase of 36.1%, amounting to $7.7 million. Despite the revenue shortfall, gross margin improved notably from 19.2% to 29.2%, reflecting enhanced operational efficiency and cost management.

Operational and Strategic Developments

Outset Medical has continued to expand its market presence with the recent FDA 510(k) clearance for its new TabloCart with Prefiltration. The company also reported its 12th consecutive quarter of gross margin expansion and robust sales pipeline growth. CEO Leslie Trigg highlighted significant new customer acquisitions in both acute and home-care settings, which are expected to bolster future revenues.

"With our recent 510(k) clearance for TabloCart with Prefiltration, 12th consecutive quarter of gross margin expansion and strong sales pipeline growth during the quarter, we are well positioned to capitalize on the $11 billion U.S. dialysis market opportunity," said Leslie Trigg, Chair and Chief Executive Officer.

Challenges and Forward-Looking Statements

Despite the positive developments, Outset Medical faced challenges, including a net loss of $39.9 million, or $0.78 per share, which widened from a net loss of $44.0 million, or $0.90 per share, year-over-year. This performance was worse than the anticipated net loss of $27.79 million. The company remains focused on achieving cash-flow breakeven sooner than previously expected, driven by ongoing cost-reduction initiatives and expected continuous gross margin improvements.

Financial Position and Outlook

As of March 31, 2024, Outset Medical reported a strong cash position of $230.2 million, providing a solid foundation for continued investment in growth and innovation. The company reaffirmed its full-year 2024 revenue guidance, projecting $145 million to $153 million, which represents a 12% to 18% increase over 2023.

In conclusion, while Outset Medical Inc faces short-term hurdles with its Q1 revenue and earnings performance, strategic initiatives and a focus on operational efficiencies are expected to drive long-term growth and profitability. Investors and stakeholders will be watching closely to see if these efforts can translate into sustained financial improvement in the upcoming quarters.

Explore the complete 8-K earnings release (here) from Outset Medical Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance