Is Nvidia the Next Stock Split?

Written by Brian Paradza, CFA at The Motley Fool Canada

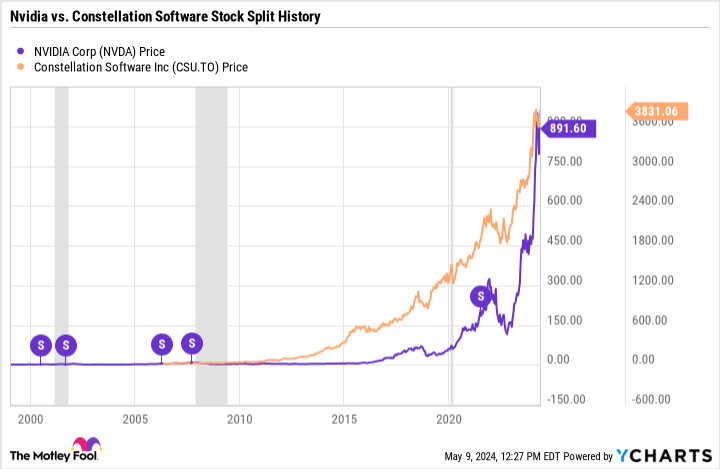

Shareholders in energy giant Canadian Natural Resources (TSX:CNQ) voted to approve management’s proposed two-for-one (2:1) stock split on May 2, 2024. The forward stock split, the company’s fifth since 1993, will double CNQ stock’s total common shares outstanding to 2,136,208,846 shares on June 10. Following its 600% recent rally, semiconductor giant Nvidia (NASDAQ:NVDA) could also announce a stock split ahead of another highly priced candidate Constellation Software (TSX:CSU) stock.

Companies that have announced stock splits before are more likely to do so again. I bet on Nvidia announcing a stock split ahead of Constellation Software stock. However, a discussion on stock splits, why they happen, and for whose benefit could help substantiate my position on whether Nvidia could be the next stock split ahead of CSU stock or Fairfax Financial stock.

Stock splits explained: Why do successful companies conduct stock splits?

Shares represent ownership units in a business’ equity. Companies whose stock prices have risen considerably may split their shares (break down the units’ size) to keep prices “low and affordable” to their target investor groups. Target investors may include retail investors with relatively small trading accounts who may benefit from lower prices per share.

Stock splits do not dilute current shareholders’ interest in the business’ equity; however, they may improve liquidity in a stock as more investors, including retail traders, can increasingly afford to buy smaller share units without sacrificing their portfolio’s diversification.

Most noteworthy, share splits usually signal successful business models. Some investors choose stocks to buy based on the stock split signal, believing shares may generate positive capital gains after a split.

Why Constellation Software might not split shares soon

Constellation Software’s success as a Canadian tech industry consolidator has generated an astounding 20,790% gain in its stock price to almost $4,000 per share since going public. A new investor with $1,000 to add to their account may not be able to afford to buy a single CSU share (unless their broker offers fractional share trading capabilities). The high prices may deter some retail investors.

Although someone with $4,000 in new investment capital may purchase a single CSU share, the investment would be concentrated in one stock. Any bad news specific to the company may significantly hurt them financially and emotionally. Diversification is usually necessary.

Therefore, a Constellation Software stock split could increase the pool of investors in its stock, improve its liquidity, and benefit the entire financial market.

A company’s decision to split shares depends on its management’s philosophy and target investor group. Companies that care about increasing and retaining retail investor ownership will split their shares whenever share prices rise substantially.

However, Constellation Software seems content with its current investor base, which may not prioritize retail investors. That could change at some point, especially if there’s a management change. But Nvidia seems more inclined to maintain a stock affordable to retail investors.

Could Nvidia be the next stock split

Artificial intelligence (AI) inspired a 650% parabolic rally on Nvidia stock since October 2022. Shares trade at prices close to US$900 apiece – beyond the reach of some small account holders. A share split split could make NVDA stock accessible to retail investors, again.

And here’s the good news: Nvidia has a long-established history of stock splits. The symbol “S” in a graphic below denotes a historical share split (and Constellation Software has none).

The wildly successful AI stock has split its shares five times over the past 24 years. Its most recent stock split was a four-for-one (4:1) split in 2021. At the time, the share price was approaching US$800. Current trading levels around US$900 per share in 2024 may have ignited another stock split conversation in Nvidia’s boardrooms again.

Nvidia has increased its outstanding common shares by 48 times, cumulatively, following historical stock splits of 2000, 2001, 2006, 2007, and 2021. Had the company ignored share splits, its stock price could have risen beyond US$42,000 a share by 2024.

Given Nvidia’s focus on affordability for retail investors and management’s past actions, a stock split seems more likely for NVDA than Constellation Software stock.

The post Is Nvidia the Next Stock Split? appeared first on The Motley Fool Canada.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor Canada analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could potentially produce monster returns in the coming years.

Consider MercadoLibre, which we first recommended on January 8, 2014 ... if you invested $1,000 in the “eBay of Latin America” at the time of our recommendation, you’d have $15,578.55!*

Stock Advisor Canada provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month – one from Canada and one from the U.S. The Stock Advisor Canada service has outperformed the return of S&P/TSX Composite Index by 32 percentage points since 2013*.

See the 10 stocks * Returns as of 3/20/24

More reading

Can You Guess the 10 Most Popular Canadian Stocks? (If You Own Them, You Might Be Losing Out.)

How to Build a Bulletproof Monthly Passive-Income Portfolio in 2024 With Just $25,000

Fool contributor Brian Paradza has no position in any of the stocks mentioned. The Motley Fool recommends Canadian Natural Resources, Constellation Software, and Nvidia. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance