Northwest Pipe Co Surpasses Analyst Revenue Forecasts with Record Q1 Results

Net Sales: Reached $113.2 million, a 14.2% increase from $99.1 million in the previous year, surpassing the estimate of $103.80 million.

Gross Profit: Grew by 21.5% to $20.1 million, representing 17.8% of net sales, compared to 16.7% in the prior year.

Earnings Per Share (EPS): Reported at $0.52 per diluted share, significantly exceeding the estimated $0.34.

Net Income: Totaled $5.2 million, surpassing the estimated $3.39 million.

Backlog: Ended the quarter with a backlog of $255 million, and $337 million including confirmed orders for the Engineered Steel Pressure Pipe segment.

Precast Segment Performance: Saw a decline with net sales dropping 6.6% to $33.2 million, despite a 23% increase in volume shipped.

Stock Repurchase: Bought back approximately 127,000 shares at an average price of $29.39, totaling $3.7 million during the quarter.

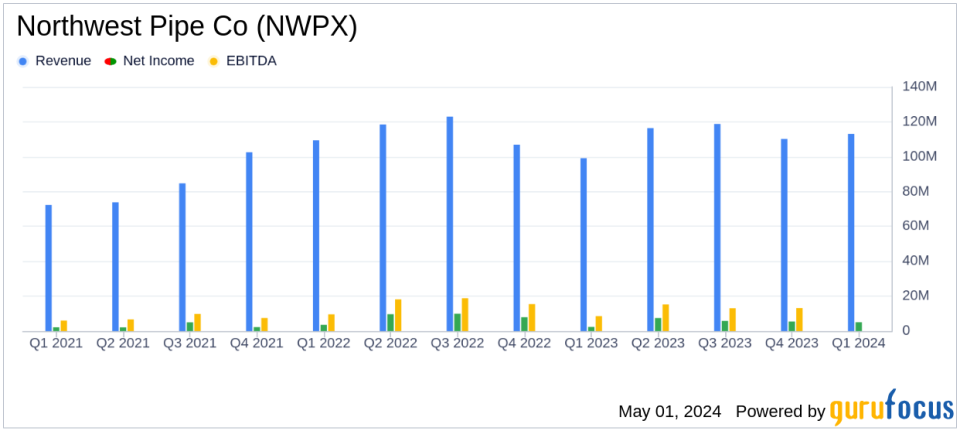

On May 1, 2024, Northwest Pipe Co (NASDAQ:NWPX), a prominent manufacturer of water-related infrastructure products, announced a significant increase in its first quarter financial results, revealing a robust performance that exceeded analyst expectations. The details of these results can be explored in their recent 8-K filing.

Company Overview

Founded in 1966 and headquartered in Vancouver, Washington, Northwest Pipe Co operates through two main segments. The Engineered Steel Pressure Pipe segment manufactures large-diameter steel pipeline systems for water infrastructure, catering to various applications such as drinking water systems and hydroelectric power systems. The Precast Infrastructure and Engineered Systems segment offers a range of products including stormwater and wastewater technology products and reinforced concrete products.

First Quarter Financial Highlights

The company reported net sales of $113.2 million, marking a 14.2% increase from $99.1 million in the same quarter the previous year, surpassing the estimated revenue of $103.80 million. This growth was primarily driven by a 25.9% increase in sales in the Engineered Steel Pressure Pipe segment, which reached $80 million. The segment benefited notably from a 54% increase in production volume, despite a decrease in selling price per ton due to product mix changes.

Gross profit also saw a significant rise, reaching $20.1 million, or 17.8% of net sales, up from $16.6 million in the first quarter of 2023. This represents a 21.5% year-over-year increase, highlighting the highest first-quarter gross profit in 11 years. Net income stood at $5.2 million, or $0.52 per diluted share, significantly up from $2.4 million, or $0.23 per diluted share, in the prior-year period, and well above the estimated earnings per share of $0.34.

Segment Performance and Challenges

While the Engineered Steel Pressure Pipe segment showed strong performance with increased backlog and confirmed orders totaling $337 million, the Precast Infrastructure and Engineered Systems segment faced some challenges. Net sales in this segment decreased by 6.6% to $33.2 million, despite a 23% increase in volume shipped. This decline was attributed to a 24% decrease in selling prices driven by changes in product mix. The gross profit for this segment also decreased by 33.0% to $5.9 million.

Management Commentary

"Despite the strength of the incoming order book, our non-residential Precast business shipments were weak in the first quarter resulting in depressed margins. The residential portion of our Precast business continues to maintain a strong order book, production levels, and shipments. However, as we expected, the margins have come under some modest pressure due to regional differences in market demand. Following a slow first quarter, which is generally the case in our Precast segment, we are expecting fairly strong improvement in both revenue and margins for the second quarter and a strong remainder of the year," said Scott Montross, President and CEO of Northwest Pipe Company.

Financial Stability and Future Outlook

The company's balance sheet remains solid with $89.9 million of outstanding revolving loan borrowings and an additional borrowing capacity of approximately $34 million under the revolving credit facility. Looking forward, Northwest Pipe Co anticipates continued strength throughout 2024, backed by robust bidding activity and production levels in the SPP business.

For detailed insights and further information, investors and stakeholders are encouraged to refer to the full earnings report and join the upcoming earnings conference call scheduled for May 2, 2024.

For more detailed financial analysis and up-to-date news on Northwest Pipe Co, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Northwest Pipe Co for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance