'Nobody has a clue what’s happening': Bumper jobs growth after Poloz calls economy disappointing

The Canadian economy pumped out 94,100 new jobs last month, the biggest monthly gain since March 2012.

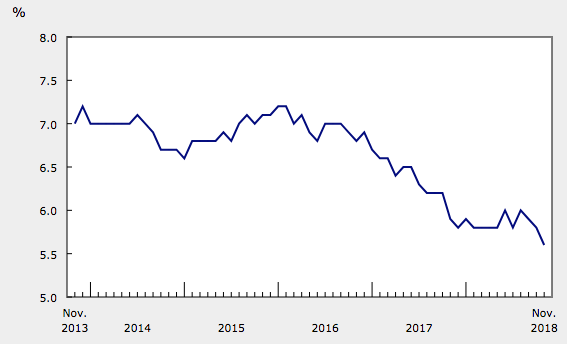

At 5.6 per cent, the unemployment rate fell to the lowest level since Statistics Canada started measuring it more than 40 years ago. A strong November was driven largely by 89,900 new full-time jobs.

And yet Bank of Canada governor Stephen Poloz just yesterday told us “recent data on the Canadian economy have been disappointing.” The day before, he announced the economy isn’t ready for higher interest rates. So what gives?

“Alberta saw the second largest increase of any province, at 24,000. Given the recent slump in oil prices, that’s likely to be reversed in the coming months.” says Stephen Brown, senior Canada economist at Capital Economics.

The other data point to consider is wage growth, which fell to 1.7 per cent from 2.2 per cent in October.

“The further drop in wage growth leaves scope for the Bank of Canada to err on the side of caution in the coming months,” says Brown.

Rate hike path isn’t set in stone

These are indeed confusing times in what’s been something of a roller coaster of economic data points.

“Let’s face it. Nobody has a clue what’s happening. Two months ago the Bank of Canada was all cheers, talking about raising rates all the way to its neutral territory of around 3%. Earlier this week the Bank was much gloomier, pointing to an already weaker economy and the oil shock as major negatives—suggesting that that illusive neutral rate might be only 2%,” says Benjamin Tal, deputy chief economist at CIBC.

“And then just when the market was pricing out a January move, we got a larger-than-expected OPEC cut, and 94K new jobs. Go figure. The reality is that, at this point, Governor Poloz really does not know when his next move is. And it would not be a total stretch to suggest that maybe he is not even sure what direction his next move will be.”

The loonie shot up more than a cent. Currency traders placed their bets that today’s numbers would nudge Poloz toward a rate hike sooner rather than later.

“The jobs report—and most of its underlying details—serves as a reminder that the BoC is still data dependent and that there are both downside and upside risks to developments,” says Derek Holt, VP at Scotiabank Banks Economics.

Holt says it’s hard to deny the jobs numbers look strong, but suggests some caution is order.

“The report is notoriously volatile and has had issues in the past so let’s not over react,” says Holt.

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance