Bank of Canada: The economy isn't ready for higher interest rates...yet

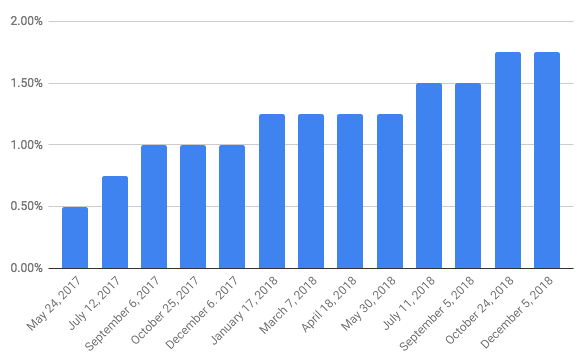

As expected, the Bank of Canada announced the economy isn’t ready for an interest rate hike yet. The benchmark interest rate stays at 1.75 per cent. But a more dovish tone sent the loonie lower by more than half cent.

“The Bank of Canada rarely does a complete U-turn without a new economic forecast in hand, but today’s statement acknowledged some new concerns about what lies ahead, and importantly, argues that ‘there may be additional room for non-inflationary growth’,” says CIBC chief economist Avery Shenfeld. “The latter point owes to downward revisions to growth over the past couple of years, and may also be a reflection of the lack of wage momentum to drive inflation forward.”

Unimpressive economic growth and falling oil prices all but wiped out expectations of a rate hike today. Core inflation is close to the bank’s target range, but wage pressures have eased. Signs of a slowing global economy are also emerging.

“The global economic expansion is moderating largely as expected, but signs are emerging that trade conflicts are weighing more heavily on global demand,” says the Bank of Canada. “Recent encouraging developments at the G20 meetings are a reminder that there are upside as well as downside risks around trade policy.”

About 56 per cent of economists polled by Reuters expect the Bank of Canada to raise interest rates early next year, followed by two more by the end of 2019. That’s down from 60 per cent in the previous poll taken in October. They also say the central bank needs to tread carefully on its rate hike path.

“A January hike now depends on seeing much better economic data for October and an OPEC production cut that firms up oil prices.” says Shenfeld.

Other economists are more sceptical about further hikes. Capital Economics thinks the impact of tumbling oil prices and disappointing business investment will keep keep the Bank of Canada at bay.

“While we still wouldn’t rule out one more rate hike in the New Year, we doubt that the Bank will raise interest rates beyond 2.0%,” says Capital Economics.

The bank raised interest rates at its previous meeting in October, for the third hike in 2018. It also said it’s removing the word “gradual” when referring to future increases, because too many traders were misinterpreting its meaning. But the change created the impression the bank had turned more hawkish.

Download the Yahoo Finance app, available for Apple and Android.

Yahoo Finance

Yahoo Finance