Netgear Inc (NTGR) Q1 2024 Earnings: Misses Analyst Forecasts Amidst Market Challenges

Revenue: Reported at $164.6 million, slightly above the estimated $163.85 million.

Net Loss per Share: GAAP net loss per share was $0.63, significantly above the estimated loss per share of $0.28.

Service Revenue Growth: Increased by 21.2% year-over-year, indicating strong performance in service segments.

Cash Flow from Operations: Grew by 88.4% year-over-year to $17.2 million, showcasing improved operational efficiency.

Stock Repurchase: Repurchased approximately 783,000 shares, highlighting ongoing shareholder return efforts.

Inventory Management: Reduced own inventory levels by $37.6 million, aligning with strategic efforts to optimize working capital.

Future Guidance: Expects Q2 revenue to be between $125 million and $140 million, reflecting planned destocking activities.

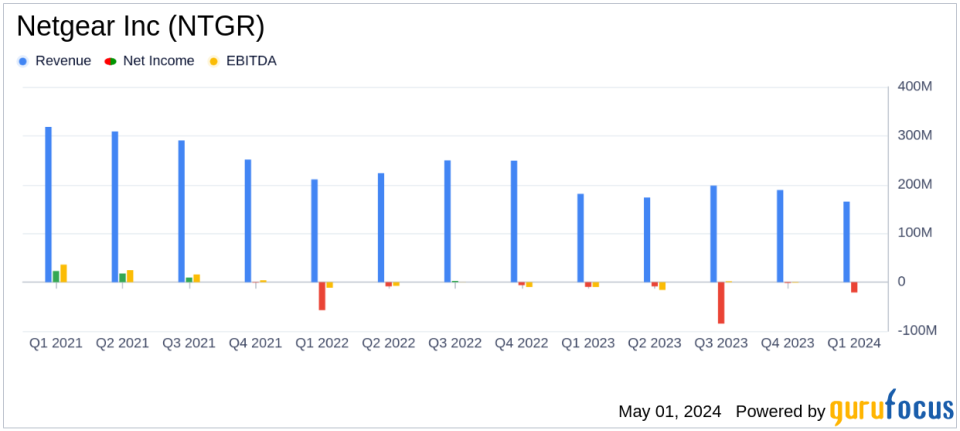

On May 1, 2024, Netgear Inc (NASDAQ:NTGR) released its 8-K filing, reporting a challenging first quarter with financial figures falling below analyst expectations. The company, a renowned provider of innovative networking solutions, disclosed a net revenue of $164.6 million, which, despite surpassing the midpoint of their guidance, marked a 9.0% decrease from the previous year. The reported GAAP net loss per diluted share was $0.63, significantly underperforming against the estimated loss of $0.28 per share.

Company Overview

Netgear operates through two main segments: Connected Home and SMB (Small and Medium Businesses). The Connected Home segment caters to consumers with robust, high-performance networking solutions like the Orbi Voice smart speakers and Meural digital canvas. The SMB segment, on the other hand, provides a range of business-oriented networking solutions, including wireless LAN and security systems.

Financial Performance and Market Challenges

The first quarter of 2024 was particularly tough for Netgear, with a GAAP operating loss of $21.6 million, a deterioration from the $12.0 million loss reported in the same quarter the previous year. This decline in profitability was primarily attributed to a challenging macroeconomic environment, high inflation, and rising interest rates, which pressured channel partners to reduce inventory significantly.

CEO CJ Prober highlighted the unexpected increase in channel destocking activities and a shift towards more promotional retail market conditions as key factors impacting profitability. Despite these challenges, Netgear is implementing strategic measures to align sell-through with revenue more closely and aggressively manage inventory levels to enhance financial health and operational efficiency.

Strategic Measures and Future Outlook

Netgear's management is actively working on reducing inventory levels, which saw a substantial decrease of $37.6 million in Q1. The company also repurchased approximately 783,000 shares of common stock, reflecting confidence in its long-term strategy despite short-term hurdles.

Looking ahead to Q2 2024, Netgear anticipates further challenges with expected net revenue between $125 million and $140 million, as it accelerates destocking activities. These efforts are aimed at normalizing inventory costs and improving channel efficiency in subsequent quarters. The company also forecasts a GAAP operating margin between (30.9)% and (27.9)%, and a non-GAAP operating margin between (25.0)% and (22.0)%.

Investor Implications

While Netgear faces significant near-term challenges, the strategic adjustments and proactive inventory management are steps towards stabilizing the business and positioning it for future profitability. Investors should consider the potential for recovery and long-term value creation, particularly as the company navigates through these transitional adjustments.

Netgear's commitment to innovation and market adaptability continues to be central to its strategy, aiming to leverage growth opportunities within both the Connected Home and SMB segments as market conditions improve.

For detailed financial figures and further information, refer to Netgear's full 8-K filing.

Explore the complete 8-K earnings release (here) from Netgear Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance