Neogen (NEOG) Faces Macroeconomic Issues, Fierce Competition

Neogen's NEOG vast international trade continues to be impacted by global macroeconomic issues. Also, a tough competitive landscape weighs on the stock. Neogen currently carries a Zacks Rank #4 (Sell).

Neogen’s business continues to be impacted by the ongoing complex geopolitical situation globally, which is driving a higher-than-anticipated increase in expenses in terms of raw materials and freight. It is also likely to have broader economic impacts and security concerns, affecting the company’s business in the upcoming months. Industrywide, it has been seen that the deteriorating global economic environment is reducing demand for several MedTech products, resulting in lower sales and lower product prices while increasing the cost of goods and operating expenses of the businesses of MedTech companies.

Given sustained macroeconomic pressure, Neogen may struggle to keep its cost of revenues and operating expenses in check. In the fiscal third quarter, sales and marketing expenses rose 30.9% year over year.

Further, Neogen faces intense competition from companies ranging from small businesses to divisions of large multinational companies. Some of these organizations have substantially greater financial resources than the company. Historically, Neogen has faced intense competition resulting from the development of new technologies by the company’s competitors. The development of more such technologies can affect the marketability and profitability of Neogen’s products.

On a positive note, Neogen’s Animal Safety segment is gaining from strong performances of a complete line of consumable products marketed to veterinarians and animal health product distributors. Further, its genomic identification and related interpretive bioinformatics services too are showing strong prospects.

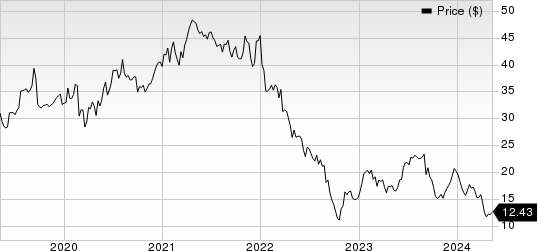

Neogen Corporation Price

Neogen Corporation price | Neogen Corporation Quote

The Animal Safety business continues to grow, led by sales of vet instruments and disposables and a new line of business at a large retail customer. Within the biosecurity portfolio, Neogen continues to grow solidly in cleaners, disinfectants and rodenticides. In the fiscal third quarter, revenues in the Animal Safety segment were $71.1 million, up 6.5% year over year. Following a period of choppy scenario in terms of inventory level destocking, Animal Safety has started to witness a favorable trend. The end-market environment, too, is gradually improving in favor of the global Genomics business.

Further, revenues from the Food Safety segment in the fiscal third quarter increased 4.1% year over year, including core growth of 5.8%. Core growth within this segment was led by Indicator Testing, Culture Media & Other product category, which benefited from higher sales of Petrifilm, as well as sample handling and nutritional analysis products.

Key Picks

Some better-ranked stocks in the broader medical space that have announced quarterly results are Align Technology, Inc. ALGN, Ecolab ECL and Boston Scientific Corporation BSX.

Align Technology, carrying a Zacks Rank #2 (Buy) at present, reported first-quarter 2024 adjusted earnings per share (EPS) of $2.14, which beat the Zacks Consensus Estimate by 8.1%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Revenues of $997.4 million outpaced the consensus mark by 2.6%. Align Technology has a long-term estimated growth rate of 6.9%.

Ecolab, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 13.3%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 1.7%.

Ecolab’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 1.3%.

Boston Scientific reported first-quarter 2024 adjusted EPS of 56 cents, which beat the Zacks Consensus Estimate by 9.8%. Revenues of $3.86 billion surpassed the Zacks Consensus Estimate by 4.9%. The company currently carries a Zacks Rank #2.

BSX has a long-term estimated growth rate of 12.5%. Its earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 7.5%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Ecolab Inc. (ECL) : Free Stock Analysis Report

Align Technology, Inc. (ALGN) : Free Stock Analysis Report

Neogen Corporation (NEOG) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance