Nektar's (NKTR) Q1 Earnings and Revenues Surpass Estimates

Nektar Therapeutics NKTR incurred an adjusted loss per share of 18 cents in first-quarter 2024, which was narrower than the Zacks Consensus Estimate of a loss of 21 cents.

The adjusted loss excluded the impact of restructuring costs. After including restructuring costs, the loss was 19 cents per share compared with a loss of 73 cents in the year-ago quarter.

Total revenues were almost flat year over year at $21.6 million in the first quarter. Revenues beat the Zacks Consensus Estimate of $15 million.

Quarter in Detail

In the first quarter, product sales increased around 27.9% year over year to $6.0 million. Product sales beat the Zacks Consensus Estimate of $4.94 million.

Non-cash royalty revenues were $15.5 million, down 8% from the year-ago quarter. Non-cash royalty revenues beat the Zacks Consensus Estimate of $14.79 million.

Research and development (R&D) expenses declined 3.3% to $27.4 million as lower employee costs were partially offset by higher costs for pipeline development.

General and administrative (G&A) expenses declined 4.7% year over year to $20.1 million.

Nektar’s stock was up 6.3% in after-hours trading on Thursday in response to the better-than-expected earnings performance.

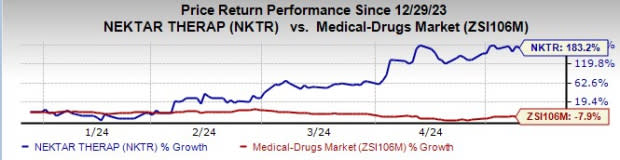

Shares of Nektar have shot up 183.2% year to date against the industry’s decline of 7.9%.

Image Source: Zacks Investment Research

2024 Guidance

Nektar expects revenues in the range of $75-$85 million for 2024, which includes $55-$65 million in non-cash royalties and $20-$25 million in product sales.

R&D costs are expected to be between $120 million and $130 million. G&A costs are anticipated to be between $70 million and $75 million. Nektar expects to end 2024 with $200-$225 million in cash and investments, which are expected to extend the cash runaway through the third quarter of 2026.

Pipeline Updates

Nektar’s lead pipeline candidate is rezpegaldesleukin (rezpeg), which is being developed as a self-administered injection for several autoimmune and inflammatory diseases. NKTR regained full rights to rezpeg from Eli Lily (LLY) in April 2023 and took charge of its clinical development. Rezpeg was earlier developed in collaboration with Lilly for several autoimmune indications.

Rezpeg is now a wholly owned asset of Nektar and the company owes no royalty payments to LLY.

A phase IIb study is ongoing in patients with moderate-to-severe atopic dermatitis, also called eczema. Initial data from this study is expected in the first half of 2025.

Nektar initiated a phase IIb study on rezpeg for treating patients with severe to very severe alopecia areata in March 2024. Top-line data from this study is expected in the first half of 2025.

Another candidate, NKTR-255, is being developed as a cell therapy enhancer to boost the anti-tumor immune response of other cancer therapies, especially CAR T therapies.

Zacks Rank & Stocks to Consider

Nektar currently carries a Zacks Rank #4 (Sell).

Nektar Therapeutics Price and Consensus

Nektar Therapeutics price-consensus-chart | Nektar Therapeutics Quote

Some top-ranked stocks in the drug/biotech sector are ANI Pharmaceuticals ANIP and Ligand Pharmaceuticals LGND, both carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, the Zacks Consensus Estimate for ANI Pharmaceuticals has improved from $4.40 per share to $4.44 per share for 2024. For 2025, earnings estimates have improved from $5.01 per share to $5.04 per share in the past 60 days. So far this year, shares of ANIP have risen 19.4%.

Earnings of ANI Pharmaceuticals beat estimates in each of the last four quarters, delivering a four-quarter average earnings surprise of 109.06 %.

In the past 60 days, the Zacks Consensus Estimate for Ligand Pharmaceuticals has improved from $4.42 per share to $4.56 per share for 2024. For 2025, earnings estimates have improved from $5.11 per share to $5.27 per share in the past 60 days. So far this year, shares of LGND have risen 19.2%

Earnings of Ligand Pharmaceuticals beat estimates in each of the last four quarters. LGND delivered a four-quarter average earnings surprise of 56.02%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Nektar Therapeutics (NKTR) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance