How Much Will TransAlta Renewables Pay in Dividends This Year?

Written by Brian Paradza, CFA at The Motley Fool Canada

Dividend income investing helps make passive income, but the strategy can also be fraught with unforeseen risks, as demonstrated in 2022 when highly indebted assets with stable cash flows suffered huge value losses due to record interest rate increases. This challenge was particularly severe for leveraged utilities and real estate portfolios, which couldn’t raise rates quickly enough to keep up with soaring financing costs.

TransAlta Renewables (RNW) stock was no exception in 2023. Despite its monthly dividends offering an 8.5% yield, its shares became undervalued, attracting institutional investors and culminating in its acquisition by TransAlta Corporation (TSX:TA) in October 2023. However, investors could still expect some dividends in 2024.

The renewable energy producer faced significant contract expirations at a time when renewal rates were unsatisfactory, leading to increased uncertainty, unsustainable dividends, and a plunge in share value.

TransAlta Corporation, an independent energy producer with assets in the United States, Canada, and Australia, seized the opportunity to acquire long-term strategic assets at discounted prices. The corporation already owned 60% of TransAlta Renewables, and offered $13 per share (an 18.3% premium) to buy the remaining equity from minority shareholders, valuing the acquisition at $1.4 billion. The compensation included an $800 million cash component, and a maximum of 46,441,764 TA shares at a conversion rate of 1.0337 TA shares for each RNW share held.

So, how much will a TransAlta Renewables investment pay in dividends in 2024?

None. TransAlta Renewables stock no longer exists. However, investors who chose to receive TA stock during the 2023 acquisition deal will instead receive dividends from TransAlta Corporation stock, another utility stock, this year.

RNW stock investors oversubscribed to the TA stock offer, opting for 72,056,140 shares, valuing the dividend-paying shares at more than the cash offer. However, they could only receive the maximum limit of 46,441,764 shares. These newly issued shares will receive $0.24 each in total dividends, amounting to $11.1 million in total payouts for 2024. Given a fair value of $13 per share and the conversion rates applied, the current dividend payout could yield 1.9% to former RNW investors.

Should you buy TransAlta Corporation stock for the dividend?

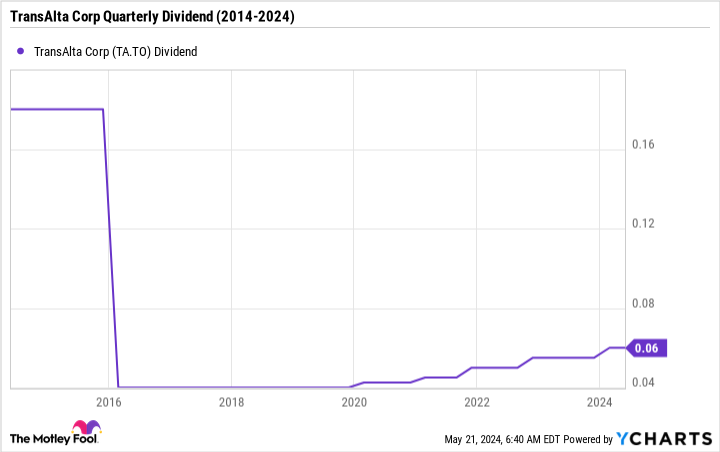

TransAlta Corporation stock will pay a $0.06 per share quarterly dividend in 2024. The payout currently yields 2.4% annually. The utility stock has paid increasing dividends since 2020, but the current quarterly payout remains far below a pre-dividend-cut level of $0.18 per share in 2015. The company is rebuilding a reputation as a dividend growth stock, even though the business faces significant market headwinds.

TA Dividend data by YCharts

Despite a weaker energy market in Alberta and lower natural gas prices, TransAlta may pay out less than 16.3% of its free cash flow in dividends this year. Free cash flow represents the cash generated from normal business operations, less capital expenditures during the year. The payout is well covered by recurring cash flow and appears sustainable.

Additionally, the company may spend up to $150 million on an enhanced common share repurchase program for 2024. Management aims to distribute up to 42% of the company’s free cash flow through dividends and stock repurchases.

Management is keen to make a TA stock investment pay off positively for loyal investors, despite a tough operating environment.

Consider waiting for clearer skies

TA stock has lost about 25% of its value over the past 12 months due to significant drops in natural gas prices and warmer weather conditions, weakening its revenue base and potentially resulting in lower cash flow yields this year. Market forecasts predict a sustained dip in average electricity prices through 2025.

While aggressive share repurchases and growing dividends could help support the utility stock, the company is burdened with $3.8 billion in net debt, exceeding its $3 billion market value. Leverage remains a significant problem if interest rates stay elevated for an extended period.

Even if TA stock can increase dividends, its current 2.4% dividend yield may not be enticing enough to justify buying TransAlta Corporation stock today given the associated capital risks. Total returns do matter over the long term, and with new capital to deploy more attractive opportunities might be found elsewhere.

The post How Much Will TransAlta Renewables Pay in Dividends This Year? appeared first on The Motley Fool Canada.

Should you invest $1,000 in TransAlta right now?

Before you buy stock in TransAlta, consider this:

The Motley Fool Stock Advisor Canada analyst team just identified what they believe are the 10 best stocks for investors to buy now… and TransAlta wasn’t one of them. The 10 stocks that made the cut could potentially produce monster returns in the coming years.

Consider MercadoLibre, which we first recommended on January 8, 2014 ... if you invested $1,000 in the “eBay of Latin America” at the time of our recommendation, you’d have $18,271.97!*

Stock Advisor Canada provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month – one from Canada and one from the U.S. The Stock Advisor Canada service has outperformed the return of S&P/TSX Composite Index by 32 percentage points since 2013*.

See the 10 stocks * Returns as of 5/21/24

More reading

Can You Guess the 10 Most Popular Canadian Stocks? (If You Own Them, You Might Be Losing Out.)

How to Build a Bulletproof Monthly Passive-Income Portfolio in 2024 With Just $25,000

Fool contributor Brian Paradza has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

2024

Yahoo Finance

Yahoo Finance