Monolithic Power Systems Q1 Earnings: A Mixed Bag with Revenue Upsurge but Earnings Dip

Revenue: Reported at $457.9 million for the quarter, up 1.5% year-over-year and surpassing estimates of $447.72 million.

Net Income: GAAP net income was $92.5 million, falling short of estimates of $129.96 million.

Earnings Per Share (EPS): GAAP EPS at $1.89, below the estimated $2.66.

Gross Margin: GAAP gross margin decreased to 55.1% from 57.4% year-over-year.

Operating Expenses: GAAP operating expenses rose to $157.0 million, up from $134.5 million in the prior year's quarter.

Operating Income: GAAP operating income was $95.5 million, a decrease from $124.3 million year-over-year.

Other Income, Net: Reported at $9.5 million, an increase from $5.3 million in the same quarter the previous year.

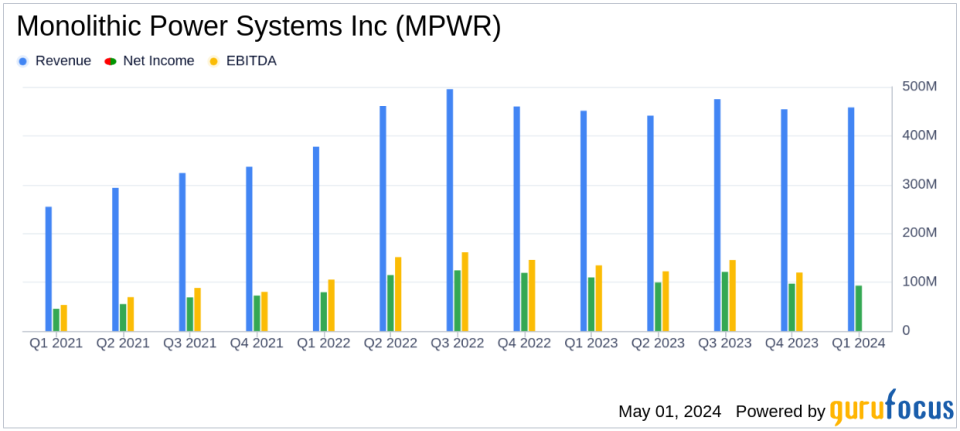

On May 1, 2024, Monolithic Power Systems Inc (NASDAQ:MPWR), a leader in semiconductor-based power electronics solutions, disclosed its financial outcomes for the first quarter ended March 31, 2024, through its 8-K filing. The company reported a revenue of $457.9 million, surpassing the analyst's expectation of $447.72 million. However, the earnings per share (EPS) of $1.89 fell short of the estimated $2.66, reflecting a mixed financial performance.

About Monolithic Power Systems

Monolithic Power Systems is an analog and mixed-signal chipmaker, known for its power management solutions. The firm operates on a fabless model, leveraging third-party foundries for manufacturing, which supports its mission to reduce total energy consumption in end systems. It serves diverse markets including computing, automotive, industrial, and consumer sectors.

Financial Highlights and Challenges

The company's revenue saw a modest year-over-year increase of 1.5% from $451.1 million. Despite the revenue growth, MPS experienced a decline in profitability with GAAP net income dropping to $92.5 million from $109.8 million in the previous year, and GAAP operating income decreased to $95.5 million from $124.3 million. This reduction can be attributed to increased operating expenses and a lower gross margin, which declined from 57.4% to 55.1%.

Segment Performance and Future Outlook

Revenue by end market shows significant growth in the Enterprise Data sector, which more than tripled year-over-year. However, other sectors like Automotive and Consumer saw declines. For the upcoming quarter, MPS remains cautious but optimistic about adapting to market changes, emphasizing its long-term growth strategy.

Detailed Financial Analysis

The balance sheet reflects a strong position with total assets increasing to $2.58 billion from $2.43 billion in the previous quarter. This growth is supported by a rise in short-term investments and cash reserves, although there was a slight increase in total liabilities.

In terms of operational efficiency, non-GAAP adjustments were significant, with stock-based compensation and related expenses impacting both gross margin and operating expenses. The non-GAAP net income stood at $137.5 million, or $2.81 per diluted share, compared to $146.0 million, or $3.00 per diluted share in the prior year.

Investor and Analyst Insights

The earnings report has mixed implications for investors. While the revenue growth is a positive signal, the decline in profitability and EPS might raise concerns about cost management and margin pressures. The company's cautious outlook for the second half of 2024 suggests potential volatility, which could influence investment decisions.

For detailed commentary and further discussion, Monolithic Power Systems will host an earnings webinar, providing an opportunity for investors and analysts to engage directly with the management.

Overall, Monolithic Power Systems demonstrates resilience in revenue growth amidst challenging conditions, but must navigate cost pressures to enhance profitability in upcoming quarters.

Explore the complete 8-K earnings release (here) from Monolithic Power Systems Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance