Microvision Inc (MVIS) Q1 2024 Earnings: Misses Analyst Forecasts with Increased Losses

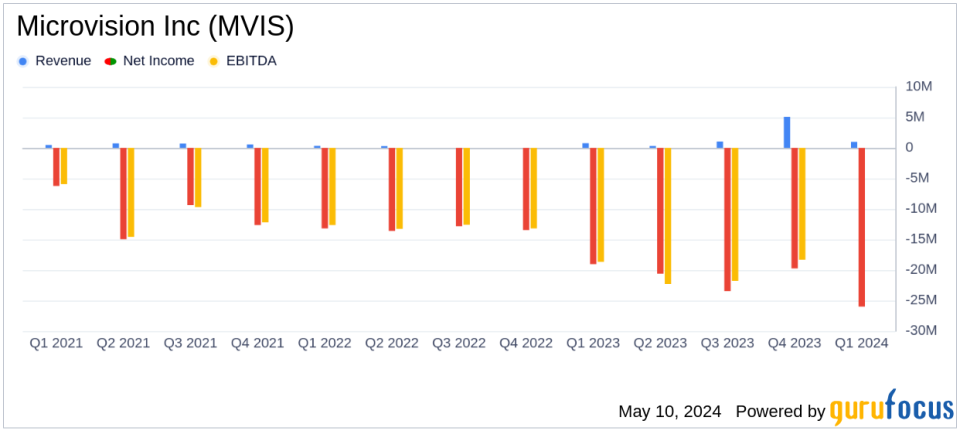

Revenue: Reported at $1.0 million for Q1 2024, up from $0.8 million in Q1 2023, surpassing the estimate of $0.75 million.

Net Loss: Increased to $26.3 million in Q1 2024 from $19.0 million in Q1 2023, exceeding the estimated loss of $18.97 million.

Earnings Per Share (EPS): Recorded at -$0.13, below the estimated -$0.12.

Cash Usage: Cash used in operations rose to $20.8 million in Q1 2024 from $13.5 million in the previous year.

Cash Position: Ended Q1 2024 with $73.1 million in cash and cash equivalents, slightly down from $73.8 million at the end of 2023.

Adjusted EBITDA: Loss increased to $18.7 million in Q1 2024 from a loss of $15.7 million in Q1 2023.

On May 9, 2024, Microvision Inc (NASDAQ:MVIS) disclosed its first quarter financial results through an 8-K filing. The company, known for its advanced MEMS-based lidar and ADAS solutions, reported a mixed financial performance with a slight increase in revenue but a significant rise in net losses compared to the same period last year.

Company Overview

Microvision Inc specializes in developing lidar sensors for automotive safety and autonomous driving applications. Their technology portfolio includes laser beam scanning (LBS) systems that integrate MEMS, laser diodes, optics, electronics, and software. The company also ventures into Augmented Reality, Interactive Displays, and Consumer Lidars, aiming to expand its market reach and application spectrum.

Financial Performance Insights

For Q1 2024, Microvision reported revenues of $1.0 million, primarily driven by sales to a global commercial trucking OEM. This marks an improvement from the $0.8 million recorded in Q1 2023. Despite this revenue growth, the company's net loss widened to $26.3 million, or $0.13 per share, from a net loss of $19.0 million, or $0.11 per share, in the previous year. This increase in losses includes $3.7 million of non-cash, share-based compensation expense.

The adjusted EBITDA for the quarter was a loss of $18.7 million, deteriorating from a loss of $15.7 million in Q1 2023. Cash used in operations also increased significantly to $20.8 million from $13.5 million in the prior year's first quarter. By the end of Q1 2024, Microvision's cash and cash equivalents, including investment securities, totaled $73.1 million, slightly down from $73.8 million at the end of 2023.

Strategic and Operational Highlights

CEO Sumit Sharma emphasized the company's engagement with top-tier automotive OEMs and its focus on expanding near-term revenue opportunities through direct sales in industrial markets. Microvision is also actively seeking non-dilutive cash sources through partnerships and licensing opportunities, coupled with disciplined fiscal management to increase its cash runway.

Analysis and Forward Outlook

Despite the revenue increase, the widening net loss underscores ongoing challenges in scaling operations and managing costs, particularly in a competitive and capital-intensive industry. The company's strategic initiatives to engage with automotive OEMs and expand into industrial markets are critical as it aims to stabilize its financial footing and achieve long-term profitability.

Microvision's ability to manage its burn rate and secure additional non-dilutive funding will be crucial for sustaining operations and pursuing growth opportunities. Investors should watch for further developments in OEM partnerships and market expansion efforts that might influence the company's financial trajectory in upcoming quarters.

For detailed insights and updates, stakeholders are encouraged to view the full earnings report and tune into the scheduled conference call and webcast.

Explore the complete 8-K earnings release (here) from Microvision Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance