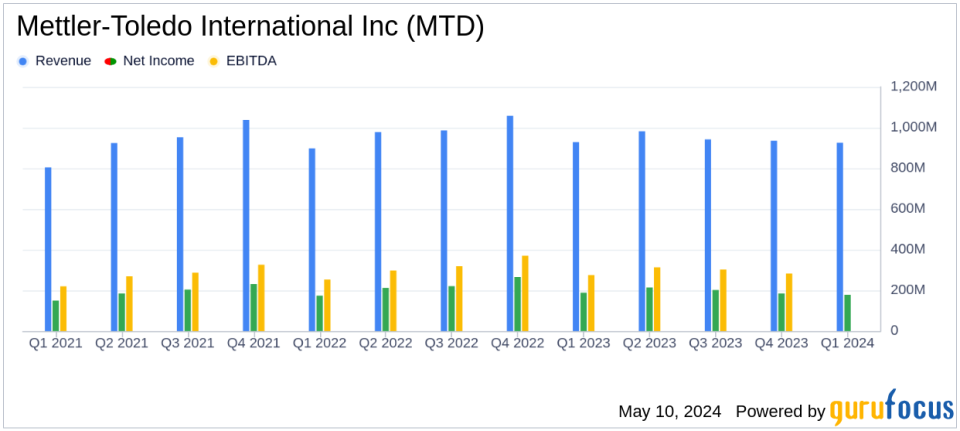

Mettler-Toledo International Inc. Reports First Quarter 2024 Results

Reported Revenue: $925.9M, flat year-over-year, slightly above estimates of $879.72M.

Net Income: $177.5M, down 5.8% from $188.4M in the prior year, exceeded estimates of $163.84M.

Diluted EPS: $8.24, a decrease from $8.47 year-over-year, surpassed the estimate of $7.64.

Adjusted EPS: $8.89, showing a 2% increase from the previous year's $8.69.

Sales by Region: Increased by 8% in Europe and 3% in the Americas, while declining 12% in Asia/Rest of World.

Adjusted Operating Profit: $267.3M, marginally higher than the previous year's $266.5M.

Future Outlook: Anticipates a decline in local currency sales by approximately 4% for Q2 2024, with Adjusted EPS expected to be between $8.90 and $9.05, reflecting a decrease of 11% to 13%.

Mettler-Toledo International Inc. (NYSE:MTD), a global leader in precision instruments for the life sciences, industrial, and food retail industries, announced its first-quarter results for 2024 on May 9, 2024. The company disclosed its earnings in a recent 8-K filing. Despite facing significant market challenges, including reduced demand in China and adverse currency effects, Mettler-Toledo managed to deliver earnings that aligned with analyst expectations, showcasing the resilience and strategic execution of its business model.

Company Overview

Mettler-Toledo is renowned for its extensive range of high-precision instruments such as laboratory and retail scales, pipettes, and pH meters, among others. The company holds a dominant market position, controlling over 50% of the market for lab balances. Geographically diversified, Mettler-Toledo garners about 30% of its sales from the United States, 30% from Europe, 20% from China, and the remaining 20% from other parts of the world.

Quarterly Financial Highlights

The company reported flat sales compared to the previous year, with total revenue amounting to $925.9 million. This stability in sales reflects the recovery of delayed shipments from Q4 2023, which positively impacted the revenue by 6%. However, regional performance varied, with sales in Europe and the Americas experiencing growth, while Asia and the Rest of the World saw a decline.

Net earnings per diluted share (EPS) for the quarter stood at $8.24, a slight decrease from $8.47 in the same period last year. The adjusted EPS, which excludes certain non-recurring items, was $8.89, marking a 2% increase from the previous year's $8.69. This adjustment reflects the company's ongoing efforts to optimize its cost structure and enhance productivity amidst challenging market conditions.

Operational and Strategic Developments

Despite the flat sales growth, Mettler-Toledo demonstrated strong operational performance with an adjusted operating profit of $267.3 million, slightly up from $266.5 million in the prior year. The company's focus on productivity and cost-saving initiatives has been crucial in mitigating the impacts of foreign exchange fluctuations and other external challenges.

President and CEO Patrick Kaltenbach highlighted the company's robust execution and strategic measures which have been essential in navigating reduced market demand, particularly in China. Kaltenbach remains optimistic about the company's growth strategies and product innovations moving forward.

Future Outlook

Looking ahead, Mettler-Toledo anticipates a challenging second quarter in 2024, with expected local currency sales to decline by approximately 4%. The adjusted EPS for the upcoming quarter is projected to be between $8.90 and $9.05, reflecting an 11% to 13% decrease, influenced partly by currency headwinds. For the full year, the company expects a modest increase in local currency sales and adjusted EPS growth of 5% to 6%.

Conclusion

As Mettler-Toledo continues to adapt to dynamic market conditions and execute its long-term growth strategies, the company is well-positioned to maintain its leadership in the precision instrument industry. Investors and stakeholders are encouraged to attend the upcoming conference call, detailed on the company's investor relations page, to discuss these results and future plans more comprehensively.

Explore the complete 8-K earnings release (here) from Mettler-Toledo International Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance