Meme Coin Institutional Holdings Surged Since January, Led by DOGE, SHIB, PEPE

Institutional allocations to meme coins have surged over 300% this year, touching a high of almost $300 million in April.

The influx highlights professional investors' growing interest in the sector, according to Bybit.

Dogecoin and shiba inu were favored for their liquidity, with BONK the most popular new meme coin.

Institutional allocations to meme coins have climbed more than 300% this year, hitting an April peak of almost $300 million, according to crypto exchange Bybit.

The influx indicates how the sector is enjoying newfound favor among professional investors, Bybit said in a Wednesday report. Popular picks among institutional investors were dogecoin {{DOGE}} and shiba inu {{SHIB}}, mainly owing to their ample spot-market liquidity. Holdings were tracked exclusively on Bybit and do not include those on other exchanges.

Solana meme token BONK emerged as the most favored of the new meme coins that have come to prominence this year, attracting over $75 million in institutional bets.

Holdings dropped to by almost half to $125 million in May as the institutions took profits.

Stablecoin holdings fell during the period to $1.4 billion from $1.7 billion, while exposure to bitcoin {{BTC}}, ether {{ETH}} and meme coins increased.

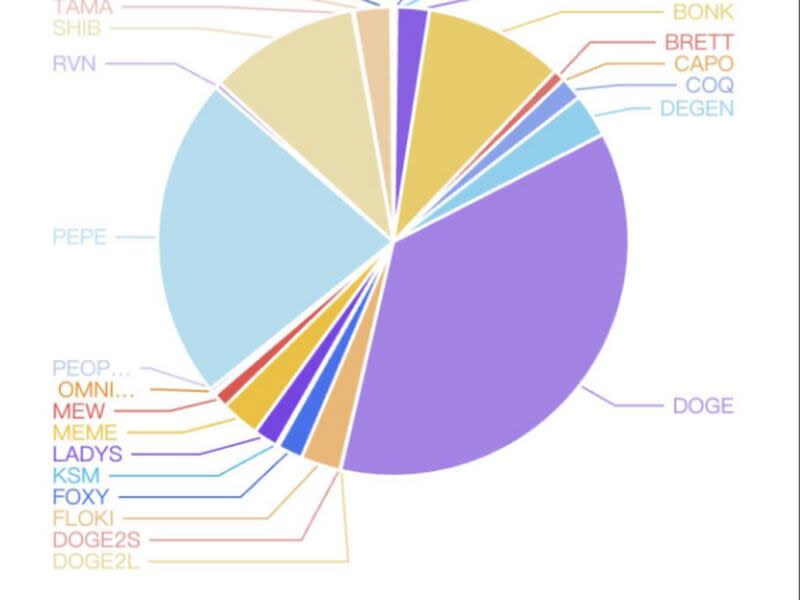

As of May 1, DOGE had the largest share of meme coin holdings for both retail and institutional investors. Institutions allocated a larger proportion of funds to DOGE: 36% compared with retail investors' 24.5%.

“This suggests that while both groups view DOGE as a staple asset within the memecoin space, institutions favor it more, perhaps due to its higher liquidity and relative stability,” Bybit said. “Both cohorts also enjoy Ethereum-based memecoins (PEPE) and (SHIB), with retail users holding 20.95% and 14.61% respectively, compared to institutions' 22.23% and 10.39%.”

In recent months, meme tokens of the Ethereum and Solana ecosystem have gained prominence as a way to bet on the growth of a blockchain.

Yahoo Finance

Yahoo Finance