Medical Properties Trust Inc. Reports Q1 2024 Results: A Challenging Quarter Amidst Strategic ...

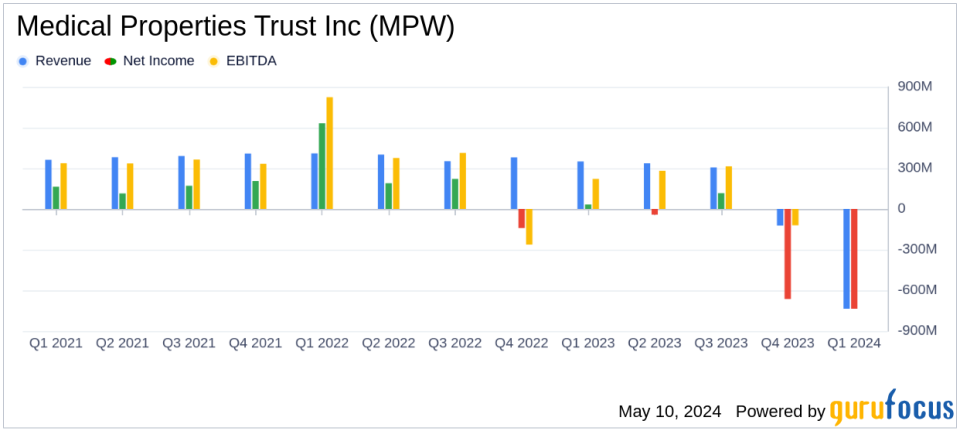

Net Loss: Reported a net loss of $735.4 million for Q1 2024, a significant increase from a net income of $33 million in Q1 2023, primarily due to $693 million in impairment charges.

Revenue: Total revenue for Q1 2024 was $271.3 million, falling short of the estimated $276.45 million and down from $350.2 million year-over-year.

Earnings Per Share (EPS): Reported a loss of $1.23 per share, significantly below the estimated earnings of $0.07 per share.

Debt Reduction: Reduced debt, net of cash, by approximately $1.6 billion since Q1 2023, aligning with strategic financial management.

Portfolio Update: As of March 31, 2024, holds assets totaling approximately $17.4 billion, including diverse healthcare facilities across multiple countries.

Operational Highlights: Achieved GOLD recognition as a 2024 Green Lease Leader for integrating environmentally beneficial standards in leases.

Outlook: Expects to exceed the initial target of $2 billion in liquidity transactions for 2024, despite current challenges including a major tenant's bankruptcy.

On May 9, 2024, Medical Properties Trust Inc. (NYSE:MPW) disclosed its financial outcomes for the first quarter ending March 31, 2024, through its 8-K filing. The company, a leading healthcare facility Real Estate Investment Trust (REIT), reported a substantial net loss due to significant impairments but highlighted its ongoing strategic efforts in liquidity transactions and debt reduction.

Medical Properties Trust Inc. specializes in acquiring and leasing healthcare facilities, generating most of its revenue in the U.S., followed by Germany and the U.K. The company's portfolio includes a diverse range of facility types across multiple geographies, supporting a broad spectrum of healthcare services.

Financial Highlights and Challenges

The first quarter of 2024 was marked by a net loss of $736 million, a stark contrast to the net income of $33 million reported in the same period last year. This loss included approximately $693 million in impairments related to various assets, including a significant reserve of the company's loan to Steward Health Care. Despite these challenges, MPW's normalized funds from operations (NFFO) stood at $142 million, down from $222 million year-over-year, primarily due to decreased revenues from Steward.

Edward K. Aldag, Jr., Chairman, President, and CEO of MPW, commented on the ongoing strategic initiatives, stating, "We continue to execute a capital allocation strategy that we now expect will exceed our initial target of $2.0 billion in liquidity transactions in 2024." He also noted the provision of $75 million in debtor-in-possession financing to Steward Health Care to ensure continuity of care amidst their Chapter 11 bankruptcy proceedings.

Operational and Portfolio Developments

MPW's portfolio update revealed assets totaling approximately $17.4 billion, with significant holdings in general acute, behavioral health, and post-acute facilities. The company's U.S. operations, excluding those managed by Steward and Prospect Medical Holdings, showed an increase in admissions and a successful reduction in contract labor costs. Additionally, MPW achieved GOLD recognition as a 2024 Green Lease Leader, reflecting its commitment to environmental sustainability in its lease agreements.

Analysis of Financial Statements

The balance sheet as of March 31, 2024, shows total assets of $17.44 billion, slightly down from $18.30 billion at the end of 2023. The decrease is primarily due to the impairments recorded during the quarter. MPW's efforts to reduce its debt were evident, with a net debt reduction of approximately $1.6 billion since Q1 2023.

Revenue for the quarter stood at $271.3 million, a decrease from $350.2 million in the prior year's quarter, mainly due to lower income from Steward. Expenses, including significant impairment charges, dominated the quarter, leading to the reported net loss.

Looking Forward

Despite the financial setbacks primarily associated with Steward's bankruptcy, MPW is focused on maintaining its role in the healthcare ecosystem by providing necessary financing solutions to operators. The company's diversified portfolio and strategic capital management are expected to support long-term cash flow generation and debt reduction efforts.

MPW has scheduled a conference call and webcast for May 9, 2024, at 11:00 a.m. Eastern Time to discuss detailed quarterly results and provide more insights into its operational strategies and outlook.

For more detailed information and future updates, investors are encouraged to consult the Investor Relations page on MPW's website and follow their official communications.

Explore the complete 8-K earnings release (here) from Medical Properties Trust Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance