Mark Hillman's Strategic Exits and Acquisitions in Q1 2024: Spotlight on ASML Holding NV

Insights into Hillman Capital's Latest 13F Filings

Mark Hillman (Trades, Portfolio), the seasoned investor and president of Hillman Capital Management, has made significant portfolio adjustments in the first quarter of 2024. With a career that spans decades, Hillman's investment strategy focuses on identifying undervalued companies with strong competitive advantages and temporary market mispricings. His latest 13F filing reveals new stock acquisitions, increased stakes, complete exits, and reduced positions, providing a comprehensive view of his investment maneuvers during this period.

New Additions to the Portfolio

Mark Hillman (Trades, Portfolio)'s strategic acquisitions included four new stocks in his portfolio. Notably, he invested in:

Campbell Soup Co (NYSE:CPB), purchasing 144,803 shares, which now represent 2.07% of his portfolio, valued at $6.44 million.

Nike Inc (NYSE:NKE), with 63,000 shares, making up about 1.9% of the portfolio, totaling $5.92 million.

Medtronic PLC (NYSE:MDT), adding 3,493 shares, accounting for 0.1% of the portfolio, with a total value of $304,420.

Significant Increases in Existing Positions

Mark Hillman (Trades, Portfolio) also strategically increased his holdings in 29 stocks. Key increases include:

Comcast Corp (NASDAQ:CMCSA), with an additional 142,991 shares, bringing the total to 149,516 shares. This adjustment represents a significant 2,191.43% increase in share count and a 1.99% impact on the current portfolio, valued at $6.48 million.

CarMax Inc (NYSE:KMX), with an additional 35,555 shares, bringing the total to 114,979 shares. This adjustment represents a 44.77% increase in share count, valued at $10.02 million.

Complete Exits from Certain Holdings

During the first quarter of 2024, Mark Hillman (Trades, Portfolio) decided to exit completely from five holdings, including:

ASML Holding NV (NASDAQ:ASML), where he sold all 12,475 shares, impacting the portfolio by -3.26%.

Lam Research Corp (NASDAQ:LRCX), liquidating all 9,063 shares, which had a -2.45% impact on the portfolio.

Reductions in Key Positions

Furthermore, Hillman reduced his positions in 19 stocks. Notable reductions include:

Simon Property Group Inc (NYSE:SPG), reduced by 9,123 shares, resulting in a -12.86% decrease in shares and a -0.45% impact on the portfolio. The stock traded at an average price of $146.65 during the quarter and has returned 3.15% over the past three months and 7.03% year-to-date.

The Walt Disney Co (NYSE:DIS), reduced by 3,243 shares, resulting in a -5.57% reduction in shares and a -0.1% impact on the portfolio. The stock traded at an average price of $104.45 during the quarter and has returned -8.84% over the past three months and 13.53% year-to-date.

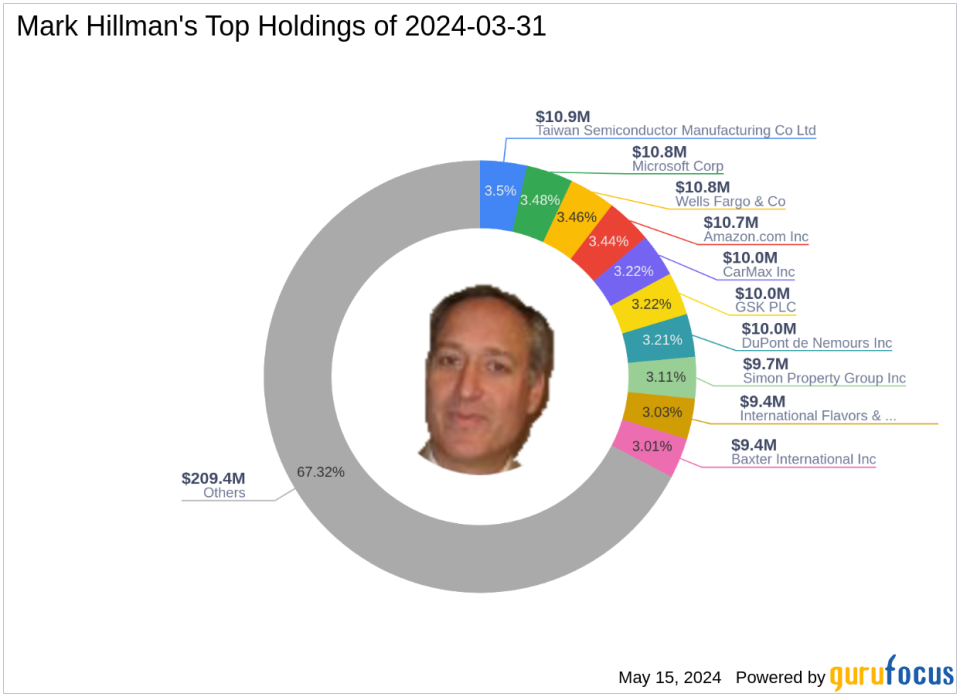

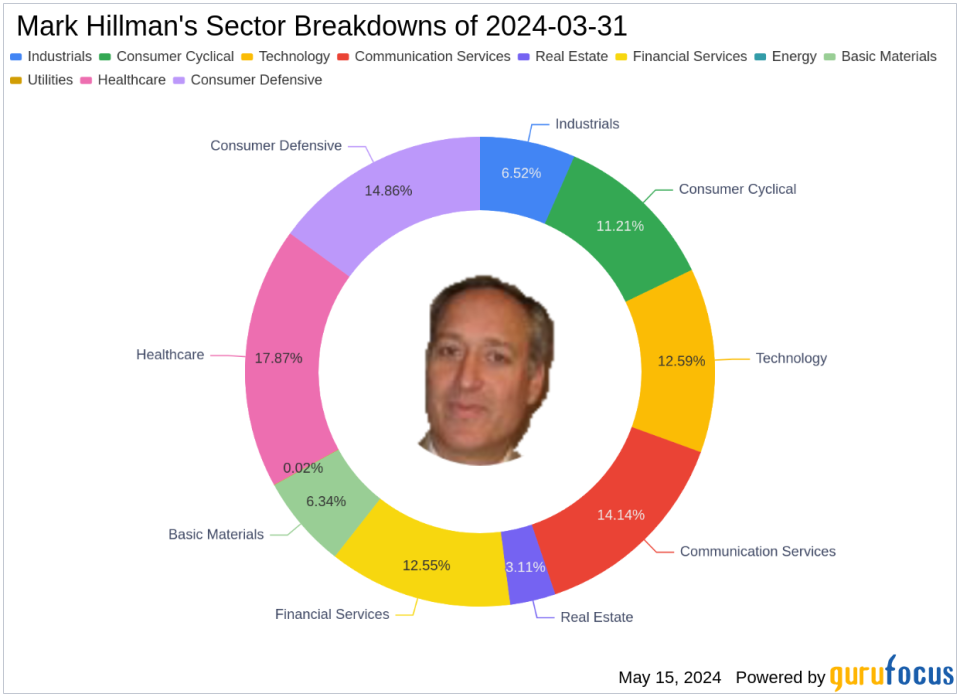

Portfolio Overview and Sector Allocation

As of the first quarter of 2024, Mark Hillman (Trades, Portfolio)'s portfolio included 54 stocks. The top holdings were 3.5% in Taiwan Semiconductor Manufacturing Co Ltd (NYSE:TSM), 3.48% in Microsoft Corp (NASDAQ:MSFT), 3.46% in Wells Fargo & Co (NYSE:WFC), 3.44% in Amazon.com Inc (NASDAQ:AMZN), and 3.22% in CarMax Inc (NYSE:KMX). The holdings are mainly concentrated across 10 of the 11 industries, including Healthcare, Consumer Defensive, Communication Services, Technology, Financial Services, Consumer Cyclical, Industrials, Basic Materials, Real Estate, and Utilities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance