Marcus & Millichap Inc Reports Challenging First Quarter in 2024 Amid Market Disruptions

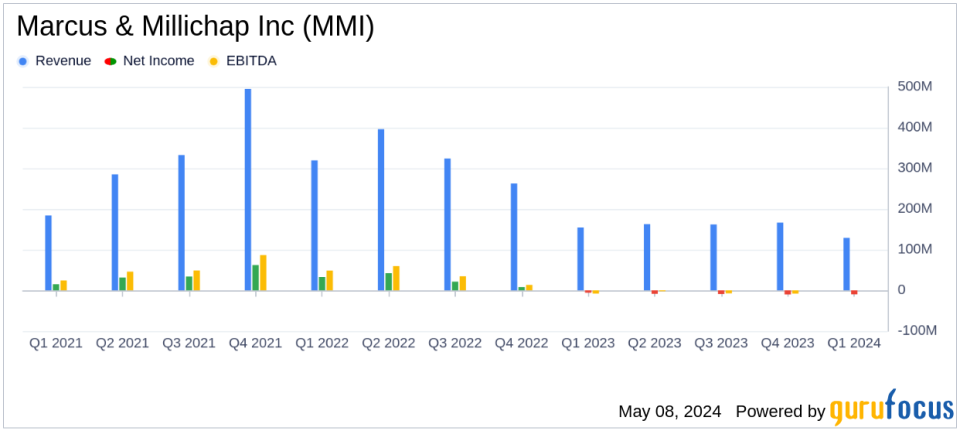

Total Revenue: $129.1M, down 16.6% from $154.8M in the prior year.

Brokerage Commissions: $109.5M, a decrease of 18.9% year-over-year.

Financing Fees: $14.4M, down 9.1% from $15.9M in the previous year.

Net Loss: $10.0M, or $0.26 per diluted share, compared to a net loss of $5.8M, or $0.15 per diluted share, year-over-year.

Adjusted EBITDA: $(10.1)M, worsening from $(7.4)M in the same quarter last year.

Operating Expenses: Reduced to $149.2M from $170.9M, a decrease primarily due to lower cost of services and administrative expenses.

Marcus & Millichap Inc (NYSE:MMI), a prominent national brokerage firm specializing in commercial real estate investment sales, financing, research, and advisory services, disclosed its first quarter results for 2024 on May 8, 2024. The company reported a decrease in total revenue to $129.1 million from $154.8 million in the first quarter of 2023, marking a 16.6% decline. This financial downturn was primarily due to a significant reduction in the number of transactions influenced by rising interest rates and tighter lending conditions. The detailed financial outcomes can be examined in the company's 8-K filing.

Company Overview

Marcus & Millichap Inc offers three primary services: commercial real estate investment brokerage, financing, and ancillary services including research and advisory. The firm earns revenue through commissions on property sales and fees from financing services.

Financial Performance Analysis

The firm's brokerage commissions fell to $109.5 million from $135.0 million in the previous year, a decrease of 18.9%. This drop was linked to a 13.8% decrease in transaction numbers, reflecting ongoing market disruptions from rapidly increasing interest rates and constrained lending conditions. Similarly, financing fees decreased by 9.1% to $14.4 million due to a 16.1% decline in transaction numbers, despite slight increases in average fees and transaction sizes.

Operating expenses were reduced to $149.2 million from $170.9 million, driven by a 19.4% decrease in cost of services and a 4.6% reduction in selling, general, and administrative expenses. Despite these cost reductions, the company reported a net loss of $10.0 million, or $0.26 per diluted share, compared to a net loss of $5.8 million, or $0.15 per diluted share, in the first quarter of 2023. Adjusted EBITDA also reflected a downturn, standing at $(10.1) million compared to $(7.4) million in the prior year.

Strategic Insights and Future Outlook

President and CEO Hessam Nadji emphasized the company's strategic positioning to navigate the current challenging market, highlighting the potential for a market rebound once clarity on inflation and interest rates is achieved. He noted, "With record capital on the sidelines, once clarity and stability on inflation and interest rates emerge, real estate transactions are poised to rebound albeit with a delayed timeline."

"Our expanded talent pool, technology, and strong brand position us to reach new milestones as the market recovers. Meanwhile, our healthy balance sheet enables strategic investments while consistently returning capital to our shareholders," Nadji added.

The company continues to execute its capital return program, with $71.0 million remaining available for share repurchases. The board also declared a semi-annual dividend of $0.25 per share, underscoring its commitment to shareholder returns despite current market challenges.

Market Challenges and Adjustments

The real estate market is still adjusting to high interest rates and a significant bid-ask spread, which could continue affecting transaction volumes throughout 2024. However, Marcus & Millichap remains optimistic about the long-term prospects of the real estate market, citing the substantial capital waiting on the sidelines and the enduring appeal of real estate investments.

Overall, Marcus & Millichap faces a tough market environment but maintains a strong strategic position with robust resources to manage through the current downturn and capitalize on future market recoveries.

Explore the complete 8-K earnings release (here) from Marcus & Millichap Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance