Kulicke & Soffa Industries Inc (KLIC) Faces Significant Q2 Losses, Deviating from Analyst ...

Revenue: Reported $172.1 million, slightly above estimates of $170.16 million.

Net Loss: Reported a significant loss of $102.7 million, significantly below the estimated net income of $14.13 million.

Earnings Per Share (EPS): Reported $(1.83), significantly below the estimated EPS of $0.24.

Gross Margin: Dropped to 9.6%, reflecting a substantial decline from previous periods.

Operating Margin: Reported at -(61.1)%, indicating a substantial decrease in profitability.

Free Cash Flow: Adjusted free cash flow was negative at $(26.7) million, indicating challenges in cash generation.

Stock Repurchase: Repurchased 0.8 million shares for $37.3 million, demonstrating ongoing return of capital to shareholders.

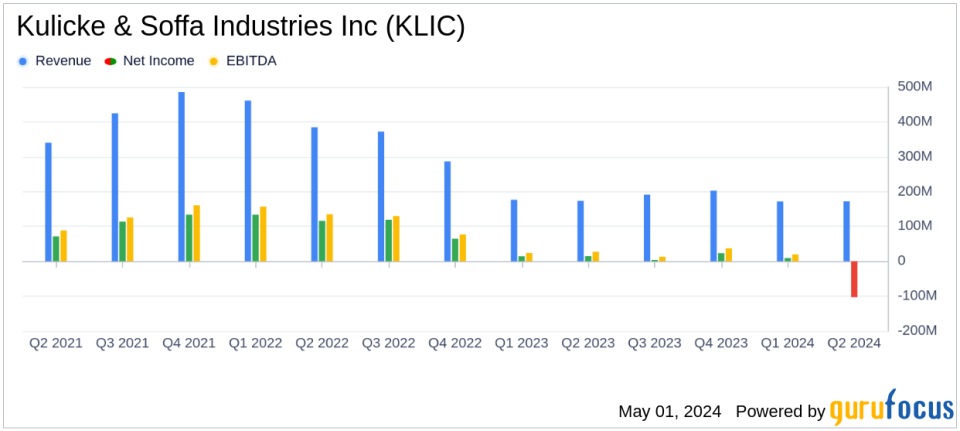

Kulicke & Soffa Industries Inc (NASDAQ:KLIC) disclosed its financial outcomes for the second quarter ended March 30, 2024, revealing a stark deviation from analyst expectations. The company reported a substantial net loss of $102.7 million, translating to a loss per share of $(1.83), which sharply contrasts with the anticipated earnings per share of $0.24. This financial update, released on May 1, 2024, is detailed in the company's recent 8-K filing.

Company Overview

Kulicke & Soffa Industries Inc, headquartered in the United States, specializes in designing, manufacturing, and selling capital equipment and tools for semiconductor device assembly. The company operates through segments including Ball Bonding and Wedge Bonding Equipment, Advanced Solutions, and Aftermarket Products and Services, with a significant revenue contribution from the Asia-Pacific region.

Quarterly Financial Performance

The reported revenue for Q2 stood at $172.1 million, marginally up by 0.5% from the previous quarter but down by 0.5% year-over-year. This figure slightly surpasses the estimated revenue of $170.16 million. However, the gross margin dramatically declined to 9.6%, influenced by a one-time charge of $57.3 million due to inventory write-downs and cancellations related to Project W.

The operational challenges were further compounded by a loss from operations of $(105.2) million, a significant downturn from the prior year. The net loss margin reached (59.7)%, exacerbated by one-time impairment charges and restructuring costs.

Strategic Adjustments and Future Outlook

In response to these challenges, CEO Fusen Chen emphasized the company's agility and focus on operational efficiency. "Despite a shifting Advanced Display market, we remain nimble and efficiency focused," Chen stated. The company is realigning resources to capitalize on growing demands in Thermocompression and Advanced Dispense technologies, aiming for recovery and new market penetrations in the upcoming quarters.

Despite a shifting Advanced Display market, we remain nimble and efficiency focused. We are preparing for broader Ball Bonder demand recovery and have reallocated Advanced Display resources to support growing demand and activity within Thermocompression and Advanced Dispense. We look forward to achieve new customer and market adoption milestones over the coming quarters.

The company also reported a significant increase in Ball Bonder revenue and is preparing to ramp up its supply chain and production capabilities in response to recovering general semiconductor demand.

Financial Health and Shareholder Returns

Despite the net losses, KLIC maintains a strong liquidity position with $634.7 million in cash, cash equivalents, and short-term investments. The company continued its shareholder return policy by repurchasing 0.8 million shares at a cost of $37.3 million during the quarter.

Looking Ahead

For the third quarter of fiscal 2024, Kulicke & Soffa anticipates net revenues to be around $180 million, with GAAP and non-GAAP diluted EPS expected to be approximately $0.17 and $0.30, respectively. These projections reflect the company's cautious optimism about its strategic realignments and market recovery efforts.

This quarter's results, marked by significant financial deviations, underscore the volatile nature of the semiconductor industry and the impact of strategic project cancellations on Kulicke & Soffa's financial health. Investors and stakeholders will be watching closely to see how the company's adjustments will steer its performance in the coming months.

Explore the complete 8-K earnings release (here) from Kulicke & Soffa Industries Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance