KRX Growth Leaders With High Insider Ownership And At Least 24% Revenue Growth

Recently, the South Korean stock market experienced a slight retreat, halting its two-day winning streak and closing modestly lower amid mixed sector performances. This fluctuation sets a complex backdrop for investors looking for growth opportunities in this vibrant market. In such conditions, stocks with high insider ownership and robust revenue growth can be particularly compelling as insiders' substantial equity stakes often align their interests with those of external shareholders, potentially signaling confidence in the company's prospects.

Top 10 Growth Companies With High Insider Ownership In South Korea

Name | Insider Ownership | Earnings Growth |

ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

Seojin SystemLtd (KOSDAQ:A178320) | 26.2% | 48.1% |

Park Systems (KOSDAQ:A140860) | 33.1% | 35.8% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

Vuno (KOSDAQ:A338220) | 19.5% | 118.4% |

HANA Micron (KOSDAQ:A067310) | 20% | 96.3% |

INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

Let's review some notable picks from our screened stocks.

JUSUNG ENGINEERINGLtd

Simply Wall St Growth Rating: ★★★★★☆

Overview: JUSUNG ENGINEERING Co., Ltd. is a South Korean company that manufactures and sells semiconductor, display, solar, and lighting equipment globally, with a market capitalization of approximately ₩1.79 billion.

Operations: The company's revenue from semiconductor equipment and services totals approximately ₩272.61 billion.

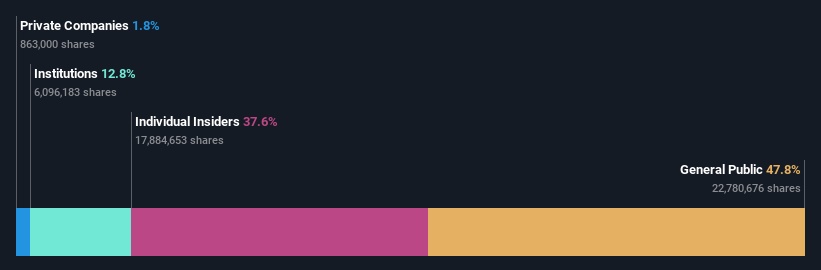

Insider Ownership: 36.8%

Revenue Growth Forecast: 24.7% p.a.

JUSUNG ENGINEERING Co., Ltd. is poised for robust growth with earnings and revenue forecasted to outpace the South Korean market, growing at 37.91% and 24.7% per year respectively. However, profit margins have dipped from the previous year, now at 14.6%, and quality of earnings is affected by large one-off items. Despite these challenges, analysts expect a significant price increase of 24.1%. The company's Return on Equity is expected to remain low at 17.2% in three years.

Techwing

Simply Wall St Growth Rating: ★★★★★★

Overview: Techwing, Inc. operates globally, specializing in the development, manufacturing, sale, and servicing of semiconductor inspection equipment with a market capitalization of approximately ₩2.17 trillion.

Operations: The company generates revenue primarily through the development, manufacturing, sale, and servicing of semiconductor inspection equipment.

Insider Ownership: 18.7%

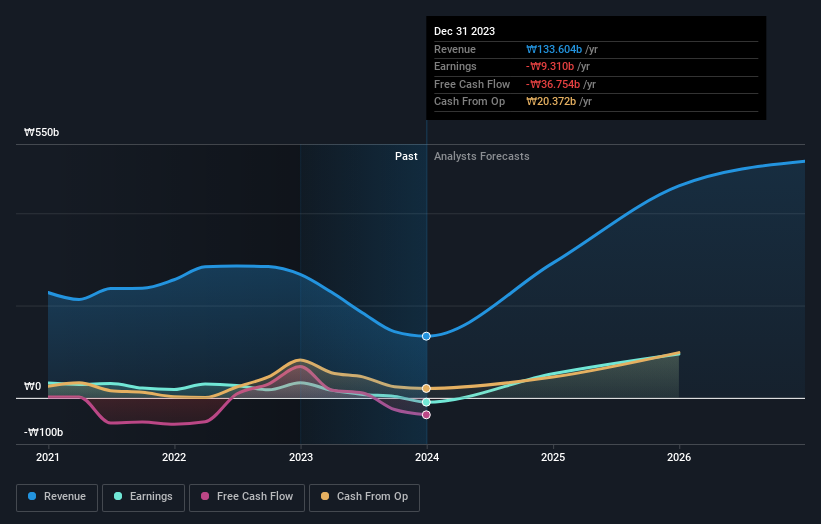

Revenue Growth Forecast: 41.3% p.a.

Techwing is anticipated to see substantial growth, with earnings forecasted to increase by 118.23% annually. Revenue growth is also strong, projected at 41.3% per year, significantly outstripping the South Korean market's average of 10.8%. However, the company faces challenges with a highly volatile share price and poor coverage of interest payments by earnings. Despite these hurdles, Techwing's Return on Equity is expected to reach a high 33.1% in three years, indicating potential for substantial value creation if it can stabilize its financial health.

Enchem

Simply Wall St Growth Rating: ★★★★★☆

Overview: Enchem Co., Ltd. is a South Korean company specializing in the production and sale of electrolytes and additives for secondary batteries and electric double-layer capacitors (EDLC), with a market capitalization of approximately ₩4.94 billion.

Operations: The company generates revenue primarily from the electronic components and parts segment, totaling approximately ₩357.37 million.

Insider Ownership: 19.8%

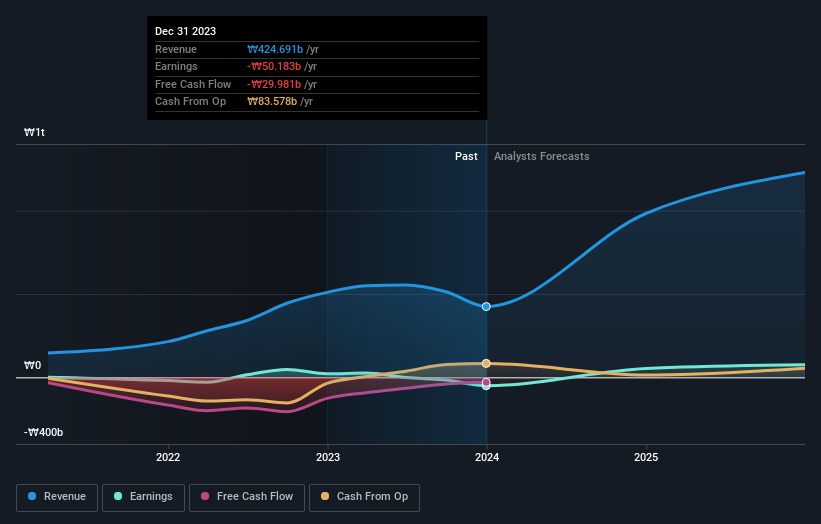

Revenue Growth Forecast: 56.5% p.a.

Enchem is poised for rapid expansion, with revenue growth predicted at 56.5% annually, far surpassing South Korea's market average of 10.8%. This growth trajectory positions Enchem well above typical market performance expectations. However, the company's path to profitability within three years comes amidst concerns such as shareholder dilution and a highly volatile share price recently. Despite these challenges, the lack of substantial insider trading in the past three months suggests stable insider confidence in its strategic direction.

Click here and access our complete growth analysis report to understand the dynamics of Enchem.

Our expertly prepared valuation report Enchem implies its share price may be too high.

Summing It All Up

Delve into our full catalog of 87 Fast Growing KRX Companies With High Insider Ownership here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KOSDAQ:A036930 KOSDAQ:A089030 and KOSDAQ:A348370.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance