June 2024 SEHK Growth Companies With High Insider Ownership

Amidst a backdrop of mixed global economic signals, the Hong Kong market has shown resilience with the Hang Seng Index experiencing a notable rise. This environment sets an intriguing stage for examining growth companies in Hong Kong, particularly those with high insider ownership, which can be indicative of confidence in long-term prospects by those closest to the company.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 20.1% | 104.1% |

Fenbi (SEHK:2469) | 32.2% | 43% |

DPC Dash (SEHK:1405) | 38.2% | 89.7% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.5% | 79.3% |

Adicon Holdings (SEHK:9860) | 22.3% | 29.6% |

Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

RemeGen (SEHK:9995) | 12.2% | 54.9% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 75.4% |

Beijing Airdoc Technology (SEHK:2251) | 27.7% | 83.9% |

Here's a peek at a few of the choices from the screener.

Fenbi

Simply Wall St Growth Rating: ★★★★★☆

Overview: Fenbi Ltd. is an investment holding company specializing in non-formal vocational education and training services in the People's Republic of China, with a market capitalization of approximately HK$9.73 billion.

Operations: The company generates revenue primarily through tutoring services and book sales, totaling CN¥2.51 billion and CN¥0.66 billion respectively.

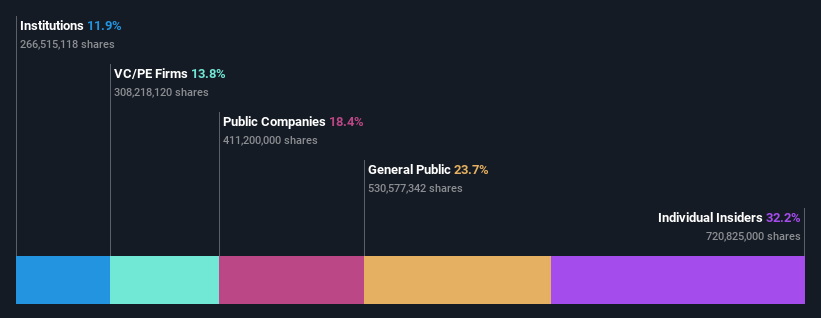

Insider Ownership: 32.2%

Earnings Growth Forecast: 43% p.a.

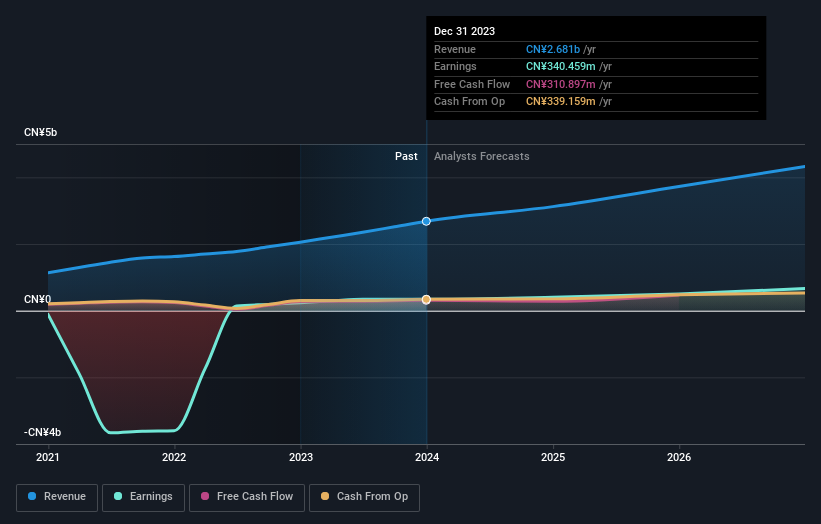

Fenbi Ltd., a growth company in Hong Kong, recently announced a share repurchase program valued at HK$300 million, signaling confidence from its board and aligning with insider interests. The company turned profitable this year with reported annual sales of CNY 3.02 billion and net income of CNY 188.57 million, reversing previous losses. Analysts predict robust future growth for Fenbi, expecting earnings to increase by 43% annually over the next three years, significantly outpacing the local market's forecasted growth.

Delve into the full analysis future growth report here for a deeper understanding of Fenbi.

Our valuation report here indicates Fenbi may be undervalued.

Bairong

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Bairong Inc. is a provider of cloud-based AI turnkey services in China, with a market capitalization of approximately HK$4.31 billion.

Operations: The company's revenue is primarily generated from data processing services, amounting to CN¥2.68 billion.

Insider Ownership: 19.1%

Earnings Growth Forecast: 21.1% p.a.

Bairong Inc., a Hong Kong-based growth company, has demonstrated strong financial performance with a significant increase in sales and net income in the latest fiscal year. Despite high insider ownership, recent executive changes and amendments to company bylaws reflect ongoing adjustments to corporate governance. Analysts are optimistic, projecting substantial stock price increases and earnings growth exceeding local market trends. However, Bairong's Return on Equity is expected to remain modest compared to benchmarks.

China Youran Dairy Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: China Youran Dairy Group Limited operates in the upstream dairy industry in China, with a market capitalization of approximately HK$4.44 billion.

Operations: The company generates revenue primarily from two segments: the Raw Milk Business, which brought in CN¥12.90 billion, and Comprehensive Ruminant Farming Solutions, contributing CN¥8.09 billion.

Insider Ownership: 14.9%

Earnings Growth Forecast: 73.8% p.a.

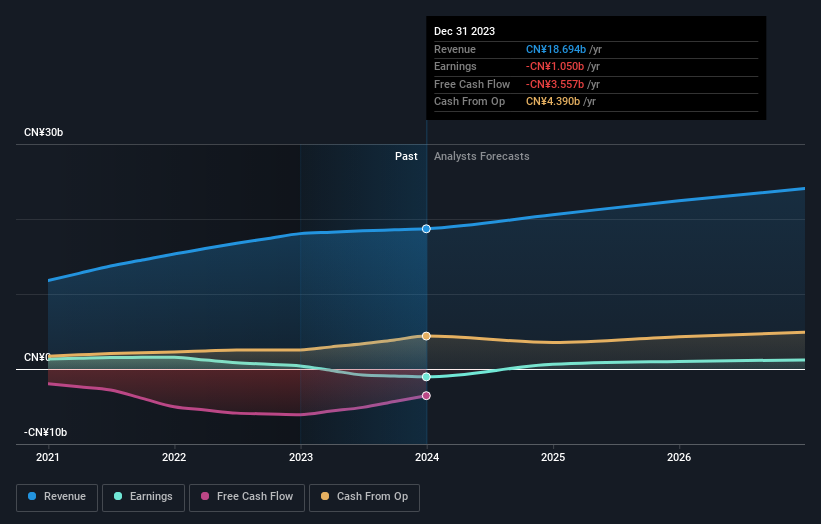

China Youran Dairy Group, despite a challenging year with no final dividend and a shift from profit to a net loss of CNY 1.05 billion, is positioned for recovery. Analysts forecast an impressive revenue growth rate of 8.4% annually, outpacing the Hong Kong market's 7.8%. However, financial strains are evident as interest payments are poorly covered by earnings. The company's insider ownership remains high, suggesting confidence among stakeholders in its long-term prospects amidst current volatility.

Seize The Opportunity

Dive into all 51 of the Fast Growing SEHK Companies With High Insider Ownership we have identified here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:2469 SEHK:6608 and SEHK:9858.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance