Johnson Controls International PLC (JCI) Q2 Earnings: Solid Performance with Adjusted EPS ...

Adjusted EPS: Reported at $0.78, surpassing the estimated $0.75.

Net Income: Adjusted net income reached $533 million, exceeding estimates of $513.33 million.

Revenue: Reported at $6.7 billion, closely aligning with the estimated $6715.66 million.

Organic Sales Growth: Achieved a 1% increase organically year-over-year.

Orders: Grew organically by 12% compared to the previous year.

Backlog: Building Solutions backlog grew to $12.6 billion, marking a 10% organic increase year-over-year.

Guidance: Maintains full-year fiscal 2024 guidance with an adjusted EPS forecast of $3.60 to $3.75.

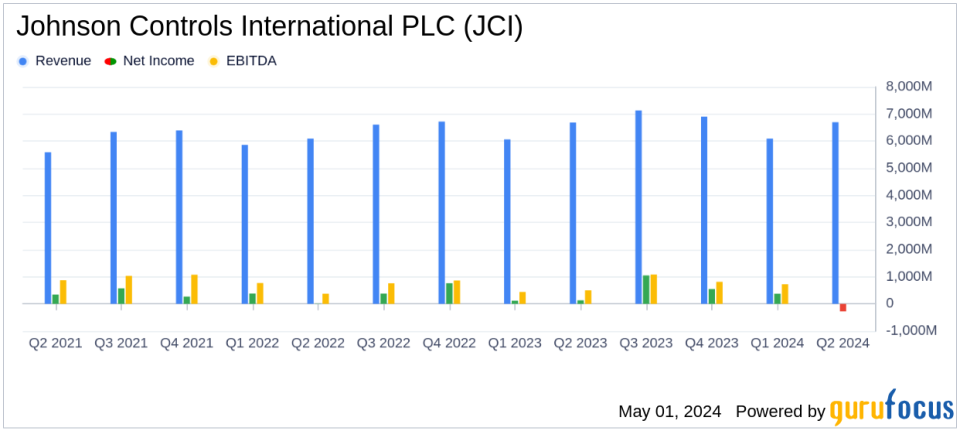

On May 1, 2024, Johnson Controls International PLC (NYSE:JCI) released its 8-K filing, announcing the results for the second quarter of fiscal year 2024. The company reported a GAAP earnings per share (EPS) of $(0.41) and an adjusted EPS of $0.78, surpassing the analyst estimate of $0.75. While GAAP results showed a net loss of $(277) million, adjusted net income reached $533 million, also exceeding the estimated $513.33 million. Total revenue for the quarter was reported at $6.7 billion, aligning closely with the estimated $6715.66 million, demonstrating a flat year-over-year performance but a 1% increase organically.

Johnson Controls, a global leader in smart, healthy, and sustainable building technologies, continues to leverage its extensive portfolio across HVAC systems, building management, industrial refrigeration, and fire and security solutions. With commercial HVAC making up over 45% of sales, the company's broad market presence is bolstered by a significant 40% contribution from its fire and security segment, while the rest comes from residential HVAC and other technologies.

Quarterly Financial and Operational Highlights

The quarter saw a robust 12% organic increase in orders year-over-year, with the Building Solutions backlog growing by 10% organically to $12.6 billion. This backlog growth underscores the company's strong market position and future revenue potential. Notably, the Building Solutions North America segment reported a 9% increase in sales, reaching $2.7 billion, with an 18% rise in GAAP and adjusted Segment EBITA. This performance reflects a successful conversion of a higher-margin backlog and ongoing growth in services.

However, the Asia Pacific segment faced challenges, with a 26% decline in sales, primarily due to continued market weakness in China. This was partially offset by growth in service revenues, which grew in the high single digits organically. The Global Products segment also experienced a slight downturn, with a 3% drop in sales, influenced by declines in residential HVAC and Fire & Security, despite growth in commercial HVAC.

Strategic Moves and Future Outlook

Johnson Controls has initiated guidance for the fiscal third quarter of 2024, projecting organic revenue growth and an adjusted segment EBITA margin of approximately 17.0%. The full-year guidance remains unchanged, with expected organic revenue growth and an improvement in adjusted segment EBITA margin. Adjusted EPS for the full year is anticipated to be between $3.60 and $3.75, aligning with the annual estimates.

Chairman and CEO George Oliver commented on the quarter's achievements, stating,

We are proud of the work underway at Johnson Controls as we delivered another successful quarter, underscored by accelerating sales growth and margin expansion."

This statement highlights the company's focus on strengthening its balance sheet and enhancing shareholder value through strategic initiatives and operational efficiencies.

Investor Considerations

Despite facing macroeconomic challenges and market volatility, Johnson Controls has demonstrated resilience through its diversified business model and strong order backlog. Investors should consider the company's capacity to maintain stable revenue streams and its strategic positioning in the sustainable building technologies market. The ongoing investments in digital transformation and operational enhancements further bolster its long-term growth prospects.

As Johnson Controls continues to navigate the complexities of the global market, its latest earnings report provides a solid foundation for understanding its financial health and strategic direction. For more detailed insights and updates, investors and stakeholders are encouraged to review the full earnings report and supplementary materials available on the company's investor relations website.

Explore the complete 8-K earnings release (here) from Johnson Controls International PLC for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance