John Hess Personally Calls Investors to Support Chevron Deal Before Vote

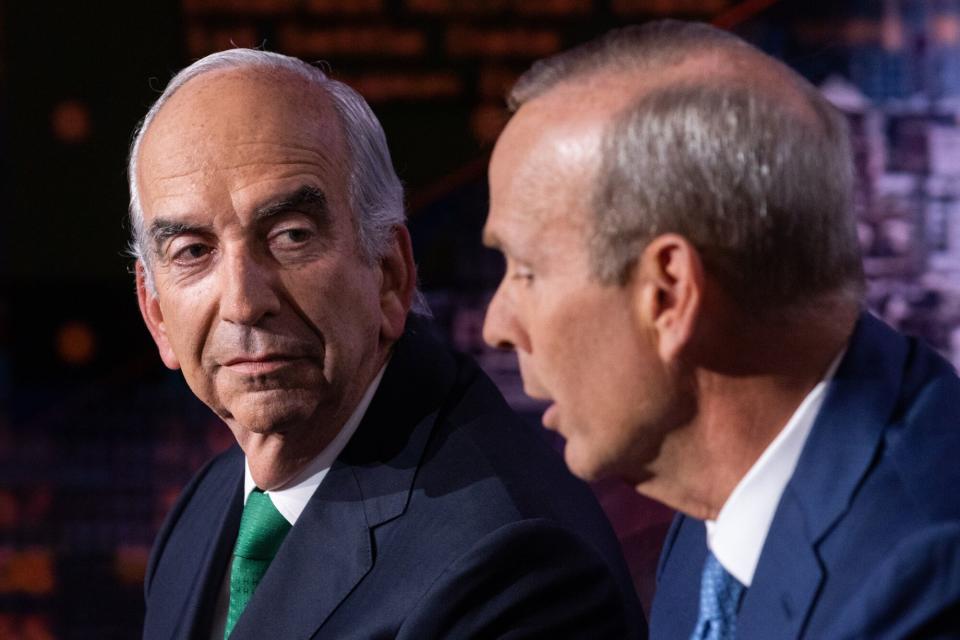

(Bloomberg) -- John Hess, the boss of the oil company that bears his family name, is talking to directly with shareholders in a last-ditch effort to ensure enough support for a $53 billion takeover by Chevron Corp., according to people familiar with the matter.

Most Read from Bloomberg

Nvidia Delivers on AI Hopes, Igniting $140 Billion Stock Rally

Citi Trader Got 711 Warning Messages Before Sparking Flash Crash

Harvard Defies Faculty Vote to Block 13 Students From Graduating

US Justice Department to Seek Breakup of Live Nation-Ticketmaster

The Hess Corp. chief executive officer is telling investors he got the best deal possible and that Chevron could walk away if the takeover doesn’t get voted through at a May 28 shareholder meeting, according to the people, who asked not to be identified because the discussions are private.

When the transaction was announced in October, it appeared to be the capstone of John Hess’s career. The sale of the oil producer founded by his father, Leon Hess, 90 years earlier would see the company’s prized position in Guyana’s fast-growing oil industry passed to Chevron. In return, the Hess family would get about $5 billion in Chevron stock, and John Hess would join the oil giant’s board.

However, doubts about the transaction emerged earlier this year after Exxon moved to assert what it says are rights of first refusal over Hess Corp.”s 30% stake in Guyana’s Stabroek oil field. The dispute between Exxon and Chevron has now moved to arbitration.

Events took a further bad turn for Hess Corp. and Chevron earlier this month after proxy adviser Institutional Shareholder Services Inc. recommended investors abstain from voting for the deal and back a motion to delay the vote.

The transaction had only a “modest” premium and uncertainty over the outcome of the arbitration case creates a “risk of a potentially broken deal without any compensation,” ISS said. Hess Corp. shareholders won’t receive any Chevron dividends until the arbitration case ends, which Exxon’s CEO has said could be next year.

Hess Corp. didn’t immediately comment. “We look forward to Hess obtaining a successful shareholder vote and completing the transaction on the terms of our merger agreement,” a Chevron spokesperson said.

Several large investors including HBK Capital Management and D.E. Shaw & Co. have said they agree with ISS’s advice. Glass Lewis & Co., another proxy adviser, has recommended investors support what it calls a “sound and reasonable” deal.

John Hess, 70, is telling investors the vote is still going ahead as planned next week and that he has full confidence in Chevron prevailing in its arbitration case, the people said. Hess contends that the deal’s long-term value outweighs concerns that the dispute will deprive investors of Chevron dividends for multiple quarters, they said.

The takeover has also yet to be approved by by the Federal Trade Commission.

Hess Corp.’s non-operated stake in the Guyana oil field is the main reason Chevron wants to buy the company, making the outcome of the arbitration crucial to the deal. Stabroek is the world’s largest crude discovery of the past decade. Exxon owns 45% of the site and is the operator. Chevron has said it would walk away were it to lose the arbitration.

(Updates with Chevron’s comment in seventh paragraph.)

Most Read from Bloomberg Businessweek

A Hidden Variable in the Presidential Race: Fears of ‘Trump Forever’

The Dodgers Mogul and the Indian Infrastructure Giant That Wasn’t

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance