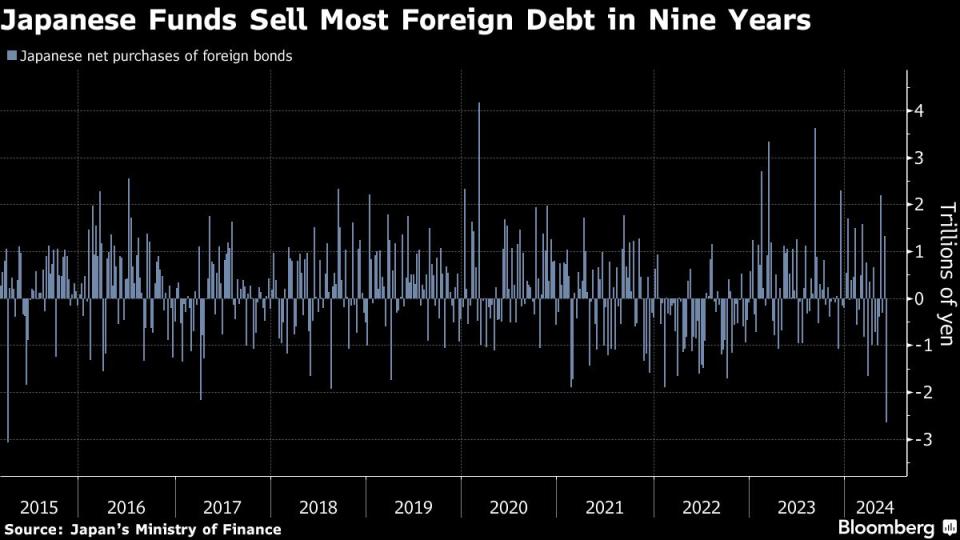

Japanese Investors Sell Most Foreign Debt in Nine Years

(Bloomberg) -- Japanese investors sold the largest amount of foreign debt in nine years amid a shift in global central bank policy.

Most Read from Bloomberg

Apple to ‘Pay’ OpenAI for ChatGPT Through Distribution, Not Cash

Hunter Biden Was Convicted. His Dad’s Reaction Was Remarkable.

US Producer Prices Surprise With Biggest Decline Since October

Gavin Newsom Wants to Curb a Labor Law That Cost Businesses $10 Billion

Chinese Trader’s $20 Million Pile of Russian Copper Goes Missing

Net sales totaled ¥2.65 trillion ($16.9 billion) in the week through June 7, the most since April 2015, preliminary figures from Japan’s Ministry of Finance showed on Thursday. That followed purchases of ¥2.3 trillion in May. Last week saw an interest-rate cut by central banks in the euro zone and Canada as well as weak US data on manufacturing and job openings.

“It is likely that banks sold large amounts of Treasuries in proprietary trading,” said Shoki Omori, chief desk strategist at Mizuho Securities Co. in Tokyo. “They have been accumulating shorter-tenor US bonds and saw a good opportunity” to take profit following data on manufacturing and job openings, he said.

The preliminary weekly data don’t provide details such as types of bonds sold. Fukuhiro Ezawa, head of financial markets in Tokyo at Standard Chartered Bank, said investors may have sold foreign notes with high hedging costs to buy Japanese government debt.

“JGB yields were rising toward the end of last month, and local auctions last week met strong demand,” he said.

Sales of 10-year notes on June 4 and 30-year bonds on June 6 both drew a higher cut-off price than traders estimated. Yield on the longer-tenor debt reached the highest since April 2011 on June 3 and has fallen since then.

--With assistance from Hidenori Yamanaka.

(Replaces first comment and add strategist comment.)

Most Read from Bloomberg Businessweek

Israeli Scientists Are Shunned by Universities Over the Gaza War

The World’s Most Online Male Gymnast Prepares for the Paris Olympics

Grieving Families Blame Panera’s Charged Lemonade for Leaving a Deadly Legacy

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance