Japan Likely Sold Treasuries to Fund Record Yen Intervention

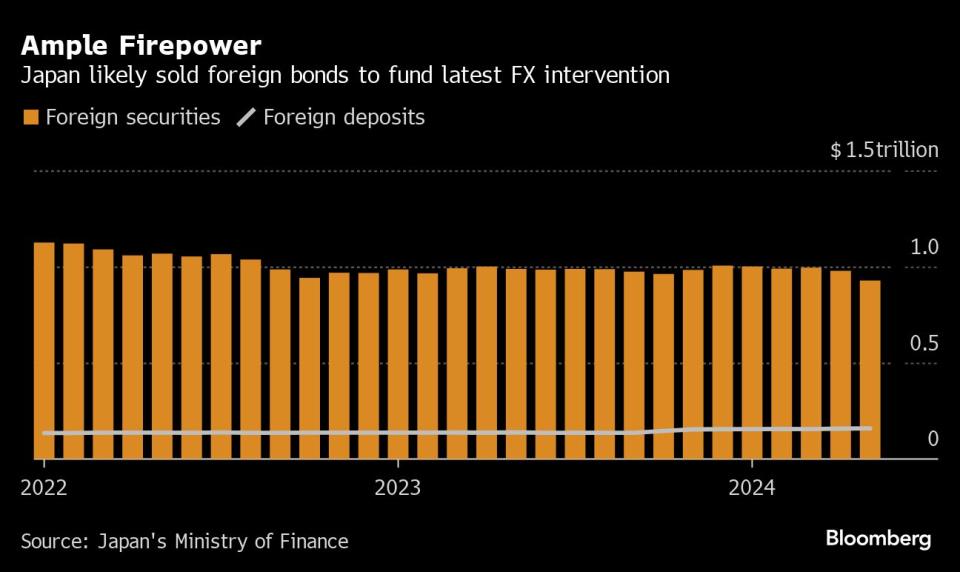

(Bloomberg) -- Japan’s holdings of foreign securities dropped sharply in May, indicating that the government likely financed most of its recent record currency market intervention by selling Treasuries and other foreign securities and still has ample firepower to step into markets again.

Most Read from Bloomberg

Real Estate Investors Are Wiped Out in Bets Fueled by Wall Street Loans

Billionaire-Friendly Modi Humbled by Indians Who Make $4 a Day

The country’s holdings of foreign securities dropped by $50.4 billion in May, finance ministry data showed Friday, following Japan’s ¥9.8 trillion ($62.7 billion) foray into markets to prop up the yen in the past month. As Treasury prices rose last month, the market value of Japan’s foreign securities was expected to rise if assets were left untouched.

Foreign deposits, often seen as an easier funding source for intervention, edged up a fraction to $159 billion, as total official reserves shrank to $1.23 trillion. That suggests they were not a key source of intervention funding.

A willingness to sell Treasuries means Japan has far more intervention firepower at its disposal than just its deposits in foreign currencies. That provides officials in Tokyo with scope to take action again multiple times if needed.

“There’s a high possibility the finance ministry sold foreign securities and US Treasuries in particular, to fund its interventions,” said Kaoru Shoji, FX strategist at SMBC Nikko Securities. “Japan isn’t coming close to the limit of its intervention firepower, though any action it takes will still require very close communication with foreign counterparts.”

The decline in foreign security holdings suggests Japanese authorities tapped the same sources to fund market intervention this time as they did in 2022, when they spent ¥9.2 trillion to prop up the currency. The government is believed to have financed three operations partly through the sale of US government bonds at that time.

While the selling of US bonds suggests Japanese officials may have gained some kind of tacit approval from the US, their counterparts in Washington have indicated a preference for action in the market to be limited.

US Treasury Secretary Janet Yellen has repeatedly said in recent weeks that currency intervention should be a seldom-used tool and officials should give fair warning in advance. She said the Group of Seven nations have agreed not to tinker with exchange rates unless they are tamping down extreme volatility.

“This indicates Japan was getting pre-approval from US on interventions,” Shoji said, referring to the likely cashing in of Treasuries.

Finance Minister Shunichi Suzuki declined to comment Friday on how the interventions were funded, following the release of the reserves data. He said officials need to consider the need and effectiveness of stepping into the market.

Suzuki defended the latest interventions earlier in the week, saying they had a certain effect in countering excessive currency moves.

Some analysts flagged the clear use of securities as a possible gambit by the finance ministry to push back against the view it is running out of scope to intervene in markets again.

“They may have shown a reduction in securities on purpose,” said Tsuyoshi Ueno, senior economist at NLI Research Institute, pointing to the disparity in use of securities and deposits to fund the intervention. “That’s probably intended to dispel the view that the remaining leeway is running short.”

Despite the record spending in the past month on propping up the yen, the impact of interventions is generally short-lived and doesn’t reverse the dynamics in the market. Intervention with the yen around 157.52 per dollar at the beginning of May took the currency close to 153. Then the move reversed course, with the dollar rising back to the lower 156 yen range within a matter of hours.

Still, intervention can discourage speculators betting heavily against the currency for a while out of fear of further action. In that sense it can buy time until a change in the fundamentals underlying the exchange rate takes place.

The yen is expected to stay under pressure due to the wide gap between interest rates in Japan and the US, with Japan’s short-term rate just 0.1% compared with the Fed’s 5.5%. While the BOJ is expected to raise interest rates in coming months, forecasts for Fed rate cuts have receded recently as the US economy continues to hum along.

“They still have more bullets to shoot if USD/JPY rises above 158 and then 160, the level markets are already being cautious about intervention,” said Shoki Omori, chief desk strategist at Mizuho Securities Co.

--With assistance from Toru Fujioka, Ruth Carson and Daisuke Sakai.

(Adds comments from analysts)

Most Read from Bloomberg Businessweek

Sam Altman Was Bending the World to His Will Long Before OpenAI

David Sacks Tried the 2024 Alternatives. Now He’s All-In on Trump

Legacy Airlines Are Thriving With Ultracheap Fares, Crushing Budget Carriers

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance