Janus International Group Inc. Reports Q1 2024 Earnings: Surpasses Analyst Revenue Forecasts

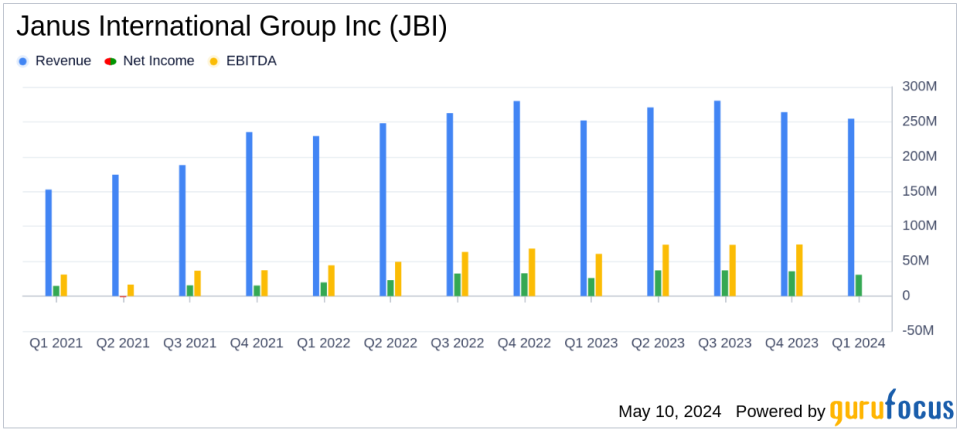

Revenue: Reported at $254.5 million, marking a 1.0% increase year-over-year, slightly surpassing the estimated $252.90 million.

Net Income: Grew by 18.1% to $30.7 million, surpassing the estimated $28.62 million.

Earnings Per Share (EPS): Achieved $0.21 per diluted share, surpassing the estimated $0.19.

Adjusted EBITDA: Rose by 8.3% to $66.3 million, with a margin improvement of 180 basis points due to favorable segment mix and reduced material costs.

Share Repurchases: Deployed $15.3 million towards repurchasing 1.02 million shares during the quarter.

Debt Management: Reduced long-term debt to net income ratio to 4.4x and net leverage ratio to 1.5x, improving financial stability.

2024 Full-Year Guidance: Reiterated, with expected revenue between $1.092 billion and $1.125 billion and Adjusted EBITDA between $286 million and $310 million.

On May 9, 2024, Janus International Group Inc (NYSE:JBI) disclosed its first quarter financial results for the year, demonstrating a robust performance characterized by revenue growth and significant net income increases. The detailed earnings report can be accessed through the company's 8-K filing. Janus, a global leader in building product solutions and innovative access control technologies for various sectors, including self-storage and commercial industries, continues to enhance its market position through strategic financial management and operational efficiency.

Financial Performance Overview

For the quarter ending March 30, 2024, Janus reported revenues of $254.5 million, marking a 1.0% increase from the previous year's $251.9 million, slightly above the analysts' expectation of $252.90 million. This growth was primarily fueled by an 11.0% increase in Self-Storage revenues, although tempered by a 19.2% decline in Commercial and Other revenues. Net income saw an 18.1% rise to $30.7 million, or $0.21 per diluted share, aligning with the estimated earnings per share of $0.19 and showcasing the company's ability to maintain profitability amidst varying market conditions.

Strategic Financial Movements

Janus has been proactive in capital management, evidenced by the repurchase of 1.02 million shares for $15.3 million and a significant debt repayment of $21.9 million post-quarter. These actions reflect a strong balance sheet and a commitment to shareholder value. The company's adjusted EBITDA also increased by 8.3% to $66.3 million, with an improved margin of 26.1%, up by approximately 180 basis points from the previous year, driven by better segment mix and reduced material costs.

Operational Highlights and Future Outlook

The company's operational strategy emphasizes technological innovation and market expansion, which are evident from the growth in its Self-Storage segment. Looking forward, Janus reaffirmed its full-year 2024 guidance, projecting revenues between $1.092 billion and $1.125 billion and an adjusted EBITDA between $286 million and $310 million. This guidance anticipates a continuation of the firm's growth trajectory and operational efficiency.

Analysis of Financial Health

Janus's financial stability is further underscored by a healthy liquidity position, with a notable increase in cash from $171.7 million at the end of 2023 to $178.4 million by March 2024. The company's strategic efforts in managing its debt profile and optimizing its asset base have contributed to a net leverage ratio decrease, positioning it well for sustainable growth.

Management's Perspective

CEO Ramey Jackson expressed confidence in the company's strategic direction and its alignment with long-term objectives.

Driven by strength in our Self-Storage segment we delivered first quarter results in-line with our expectations, and we believe we are set up well for a successful 2024,"

stated Jackson. This sentiment is reflective of Janus's robust foundational strategies and its agility in navigating market dynamics.

Conclusion

Janus International Group Inc's first quarter results of 2024 reflect a company that is not only growing in terms of revenue but also enhancing its operational efficiencies and shareholder value through strategic capital management. The company's consistent performance, aligned with analyst expectations and its strategic market positioning, suggests a positive outlook for the upcoming periods.

For detailed insights and further information, investors and stakeholders are encouraged to review the full earnings report and stay tuned for the latest updates from Janus International Group Inc.

Explore the complete 8-K earnings release (here) from Janus International Group Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance