IPOs Proving to Be June’s Blockbuster Attraction in Saudi Arabia

(Bloomberg) -- Companies going public in Saudi Arabia in the lead up to summer are serving up lucrative returns, making investors keen to come back for more.

Most Read from Bloomberg

Wells Fargo Fires Over a Dozen for ‘Simulation of Keyboard Activity’

Apple to ‘Pay’ OpenAI for ChatGPT Through Distribution, Not Cash

Hunter Biden Was Convicted. His Dad’s Reaction Was Remarkable.

US Producer Prices Surprise With Biggest Decline Since October

Supreme Court Backs Full Access to Widely Used Abortion Pill

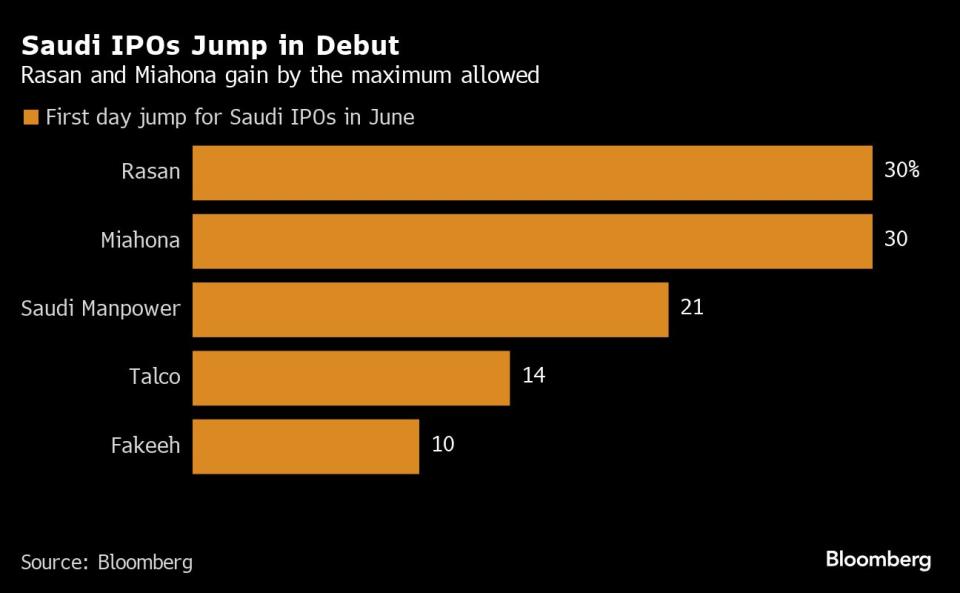

June’s newcomers have scored a full-house of gains on their first trading day. Miahona and Rasan Information Technology Co. both soared 30% — the maximum pop that the Tadawul exchange in Riyadh allows. Saudi Manpower Solutions Co. and Al Taiseer Group Talco Industrial Co. also notched double-digit jumps.

Saudi Arabia has encouraged companies to go public to grow its exchange and attract investors. These listings are typically met with massive demand, regardless of their size. But smaller share sales seem to be doing particularly well.

Saudi Manpower drew orders worth 115 billion riyals ($30.6 billion), or 128 times more than the shares available to fund managers. Rasan, one of the first fintech firms to go public in Riyadh, fielded 108.6 billion riyals of demand for its 841 million riyal initial public offering, while water treatment firm Miahona’s listing was covered 170 times by investors.

“Most of the IPOs were small and well priced, thereby attracting investor interest,” said Faisal Hasan, chief investment officer at Al Mal Capital. “We will see more activity post Eid,” he said, referring to the period following next week’s exchange shutdown for a holiday.

Being the biggest hasn’t always proved a guarantee of post-listing market success.

Dr. Soliman Abdul Kader Fakeeh Hospital Co., the largest Saudi IPO of the year, rose 10% on debut last week — the least spectacular first-day rally for a company raising at least $100 million in the past 12 months, data compiled by Bloomberg show. That’s a sharp contrast to when institutional investors flooded the 2.86 billion-riyal IPO with 341 billion riyals of orders.

The hospital operator’s shares have dropped every day since. Many of the positive aspects for Fakeeh were already priced in to the stock when it came to market at a high valuation, Aljazira Capital analyst Ibrahim Elaiwat wrote in a note.

Fakeeh ended its first session priced at 52 times forward earnings. That ratio is now pulling back closer to sector peers like Dr. Sulaiman Al Habib Medical Services Group Co. The multiple is still around 47 times, making Fakeeh more expensive than even AI-boom powered Nvidia Corp. by that metric.

Still, investors seeking fresh opportunities can look forward to a flurry of further market debuts in Saudi Arabia this year, big and small. Last month, the chief executive officer of the Tadawul stock exchange said upward of 50 firms have applied for listings across various sectors and sizes.

“There will always be a strong appetite for IPOs that are rightly priced and have solid underlying business models,” said Divye Arora, senior portfolio manager at Daman Investments Psc in Dubai.

Most Read from Bloomberg Businessweek

Israeli Scientists Are Shunned by Universities Over the Gaza War

Grieving Families Blame Panera’s Charged Lemonade for Leaving a Deadly Legacy

The World’s Most Online Male Gymnast Prepares for the Paris Olympics

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

©2024 Bloomberg L.P.

Yahoo Finance

Yahoo Finance