Iovance Biotherapeutics Inc (IOVA) Q1 2024 Earnings: Aligns with EPS Projections Amidst Strong ...

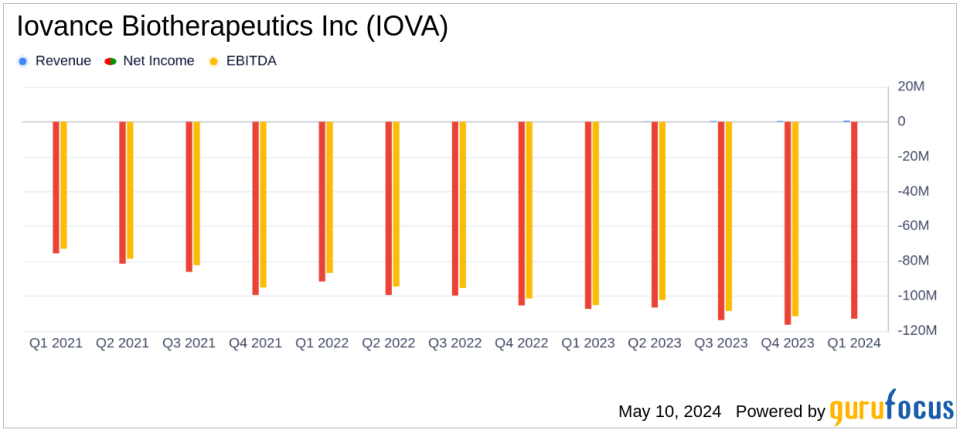

Revenue: Reported $0.7 million, significantly below the estimated $2.08 million.

Net Loss: Recorded at $113.0 million, slightly above the estimated $114.10 million.

Earnings Per Share (EPS): Reported at -$0.42, meeting the estimated EPS of -$0.42.

Research and Development Expenses: Decreased to $79.8 million from $82.7 million in the prior year's quarter.

Selling, General, and Administrative Expenses: Increased to $31.4 million, up from $28.1 million in the same quarter last year.

Cost of Sales: Stood at $7.3 million, primarily related to Proleukin sales and non-cash amortization expenses.

Iovance Biotherapeutics Inc (NASDAQ:IOVA), a trailblazer in the development of novel cancer treatments, disclosed its financial results for the first quarter of 2024 on May 9, 2024, through its 8-K filing. The company, known for its pioneering T-cell therapies for solid tumor cancers, reported a net loss of $113.0 million, or $0.42 per share, aligning closely with analyst estimates of -$0.42 per share. This performance marks a significant step following the U.S. FDA approval and commercial launch of Amtagvi (Lifileucel) for advanced melanoma.

Company Overview

Iovance Biotherapeutics Inc is at the forefront of the biopharmaceutical industry, focusing on the development and commercialization of personalized T-cell therapies. With the recent U.S. regulatory approval of Amtagvi, the company is expanding its footprint, aiming to establish itself as a leader in the treatment of solid tumor cancers through its innovative TIL (tumor infiltrating lymphocyte) therapies.

Financial and Operational Highlights

The first quarter saw Iovance generate $0.7 million in revenue from Proleukin sales in licensed markets outside the U.S., a new development compared to the same period last year. The cost of sales stood at $7.3 million, mainly due to inventoriable costs and non-cash amortization expenses. Research and development expenses decreased slightly by $2.9 million to $79.8 million, reflecting a shift to commercial manufacturing of Amtagvi, offset by increased costs in clinical trials and preparations for regulatory submissions in the EU.

Selling, general, and administrative expenses rose to $31.4 million, up $3.3 million from the previous year, driven by an increase in headcount and costs related to the commercialization of Amtagvi and Proleukin. This increase supports the company's strategic growth and infrastructure expansion as it scales operations globally.

Strategic Developments and Future Outlook

Frederick Vogt, Ph.D., J.D., Interim President and CEO of Iovance, highlighted the transformative impact of Amtagvi's market introduction, noting the enrollment of over 100 patients and the strong demand across treatment centers. The company anticipates continued growth with plans to expand authorized treatment centers (ATCs) and regulatory submissions for Amtagvi in the EU, UK, and Canada slated for 2024.

The company's robust clinical pipeline and expansion in manufacturing capacity underscore its commitment to meeting the increasing demand for its innovative therapies. With a focus on both immediate commercial success and long-term strategic growth, Iovance is poised to maintain its leadership in the biotechnology sector, delivering novel treatments that promise to improve patient outcomes significantly.

Financial Position and Market Movements

As of March 31, 2024, Iovance reported a healthy financial position with $356.2 million in cash, cash equivalents, and investments, an increase from $279.9 million at the end of 2023. This financial stability supports the company's aggressive research and development initiatives and commercial expansion plans.

The detailed financial tables and additional corporate updates can be accessed through the company's recent 8-K filing, providing stakeholders with comprehensive insights into its operational and financial status.

For further details, investors and interested parties are encouraged to access the live or archived webcast of the earnings call via the Investors section of Iovance's website or directly through the provided registration link.

Iovance continues to make significant strides in the biotechnology industry, driven by innovative therapies and a strategic approach to global market expansion. With a strong start to 2024, the company is well-positioned to build on its current momentum and achieve its operational and financial targets for the year.

Explore the complete 8-K earnings release (here) from Iovance Biotherapeutics Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance