Should Investors Buy JPMorgan or Citigroup's Stock as Q2 Earnings Approach?

The heart of the Q2 earnings season is upon us with several big banks set to report their quarterly results on Friday, July 12.

Wall Street will be closely monitoring JPMorgan’s JPM results as the largest bank in the United States but also paying close attention to Citigroup C which is the third largest domestic bank. To that point, Citigroup recently announced a significant restructuring plan to streamline its operations in a bid to enhance efficiency.

That said, let’s see if now is a good time to buy JPMorgan or Citigroup’s stock as their much anticipated Q2 results approach.

Image Source: Zacks Investment Research

Q2 Expectations for JPMorgan

Following a tough to-compete-against prior-year quarter, JPMorgan’s Q2 sales are still projected to rise 10% to $45.67 billion. However, Q2 earnings are thought to have dipped -4% to 4.19 per share. Notably, JPMorgan has exceeded earnings expectations for seven consecutive quarters and has posted an average earnings surprise of 12.31% in its last four quarterly reports.

Image Source: Zacks Investment Research

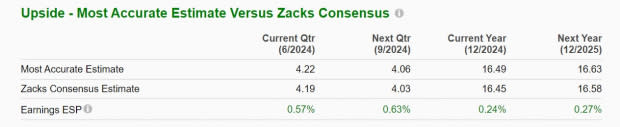

Furthermore, the Zacks ESP (Expected Surprise Prediction) does indicate JPM could once again exceed bottom line expectations with the Most Accurate Estimate having Q2 EPS pegged at $4.22 and slightly above the Zacks Consensus.

Image Source: Zacks Investment Research

Citigroup Q2 Expectations

With market sentiment high for Citigroup amid its restructuring plan, Q2 sales are projected to be up 3% to $20.03 billion. Plus, Q2 EPS is expected to increase 2% to $1.40. Citigroup has surpassed earnings expectations for five consecutive quarters posting a very impressive average earnings surprise of 20.03% in its last four quarterly reports.

The Zacks ESP indicates Citigroup should reach earnings expectations with the Most Accurate Estimate also having Q2 EPS slated at $1.40.

Image Source: Zacks Investment Research

Recent Performance & Valuation Comparison

Year to date, Citigroup’s stock has climbed +28% to edge JPMorgan’s +22% with both outperforming the S&P 500 and their Zacks Banks-Major Regional Market’s +19%.

Image Source: Zacks Investment Research

More intriguing is that Citigroup’s stock still trades at 11.4X forward earnings with JPMorgan shares at 12.6X. Offering sharp discounts to the S&P 500’s 23.7X, this is near their industry average of 12X.

Image Source: Zacks Investment Research

Dividend Comparison

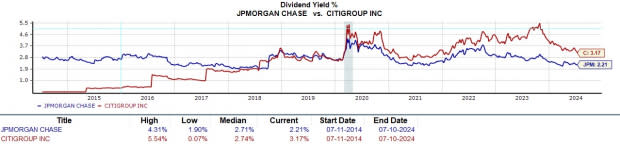

Generous dividends often draw investors to big bank stocks and Citigroup’s 3.17% annual dividend yield edges JPMorgan’s 2.21% although both have yields that impressively top the S&P 500’s 1.24% average.

Image Source: Zacks Investment Research

Takeaway

Ahead of their Q2 results on Friday, JPMorgan and Citigroup’s stock both land a Zacks Rank #3 (Hold). While JPMorgan’s robust top and bottom lines are certainly attractive the ability to reach or exceed Q2 expectations and offer positive guidance may largely dictate more upside after such a sharp YTD rally.

The same can be said for Citigroup as its stock could have more long-term upside than JPMorgan, especially if management can pull off a successful restructuring plan.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JPMorgan Chase & Co. (JPM) : Free Stock Analysis Report

Citigroup Inc. (C) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance