Intrepid Potash (IPI) Q1 Earnings Lag, Sales Beat Estimates

Intrepid Potash, Inc. IPI recorded a loss of 24 cents per share in first-quarter 2024. The company had reported earnings of 35 cents per share in the year-ago quarter.

Barring one-time items, the adjusted loss in the reported quarter was 14 cents per share. The Zacks Consensus Estimate was earnings of 4 cents.

The company registered revenues of $79.3 million for the quarter, down around 9% year over year. Revenues beat the Zacks Consensus Estimate of $62.9 million.

Segment Highlights

Revenues in the Potash segment tumbled 28% year over year to roughly $37.6 million in the reported quarter. It was above the consensus estimate of $31.6 million. The downside was caused by a lower average net realized sales price per ton and lower volumes.

The Trio unit raked in revenues of around $36.5 million, up around 21% year over year. The metric was above the consensus estimate of $26.3 million. Higher sales volumes aided sales, which were partly offset by lower average net realized sales price per ton.

Revenues from the Oilfield Solutions unit were roughly $5.3 million, up around 25% year over year. This figure was above the consensus estimate of $4.9 million. Sales were driven by higher water sales, brine water sales and other oilfield solution products and services sales.

Financials

The company had roughly $46.5 million in cash and cash equivalents, no outstanding borrowings, and $150 million available to borrow under its revolving credit facility at the end of the quarter.

Cash flow from operations was $41.5 million in the reported quarter.

Outlook

The company still sees capital expenditure of between $40 million and $50 million for 2024. IPI's capital spending remains focused on potash assets to allow it to meet its objective of maximizing brine availability and underground brine residence time, which are expected to help drive potash production and improve unit economics.

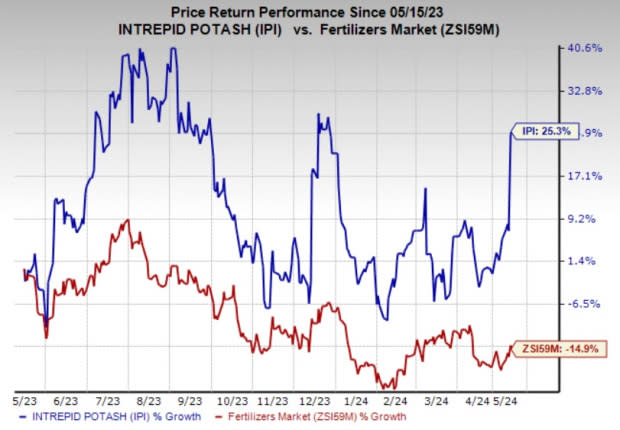

Price Performance

Shares of Intrepid Potash have gained 25.3% in a year compared with the industry’s decline of 14.9%.

Image Source: Zacks Investment Research

Zacks Rank & Other Fertilizers Releases

IPI currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Mosaic Company MOS logged first-quarter adjusted earnings per share of 65 cents, beating the Zacks Consensus Estimate of 60 cents.

MOS noted that agricultural fundamentals remain strong, with grains and oilseeds stock-to-use ratios are expected to remain under pressure. Although corn and soybean prices have softened, farmers worldwide remain profitable. Many growers in certain parts of the world, after years of reduced fertilizer use, are aiming to restore soil nutrients.

Nutrien Ltd. NTR recorded adjusted earnings per share of 46 cents for the first quarter. The figure beat the Zacks Consensus Estimate of 36 cents.

NTR expects potash sales volumes of between 13 and 13.8 million tons for 2024, assuming a more balanced distribution of volumes between the first and second halves compared to the prior year. It also sees nitrogen sales volumes in the range of 10.6-11.2 million tons. Phosphate sales volumes are forecast in the band of 2.6-2.8 million tons for 2024.

CF Industries Holdings, Inc. CF reported first-quarter earnings of $1.03 per share, down from $2.85 per share in the year-ago quarter. The figure missed the Zacks Consensus Estimate of $1.47.

CF anticipates that worldwide demand will continue to be strong in the near future due to recovering industrial demand and farmer economics, while global nitrogen trade flows will adjust to account for the extra supply of nitrogen that is available for international trade.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CF Industries Holdings, Inc. (CF) : Free Stock Analysis Report

The Mosaic Company (MOS) : Free Stock Analysis Report

Intrepid Potash, Inc (IPI) : Free Stock Analysis Report

Nutrien Ltd. (NTR) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance