Insmed (INSM) Beats on Q1 Earnings, Posts Upbeat Pipeline Updates

Insmed INSM reported a loss of $1.06 per share in the first quarter of 2024, narrower than the Zacks Consensus Estimate of a loss of $1.22. In the year-ago quarter, the company posted a loss of $1.17.

Insmed generated total revenues of $75.5 million during the quarter, which were up 16% year over year. The reported sales missed the Zacks Consensus Estimate of $78.9 million.

Quarter in Detail

In the reported quarter, total revenues were generated entirely from product revenues of Insmed’s only marketed drug, Arikayce, which is approved for treating refractory mycobacterium avium complex (MAC) lung disease in adults with limited or no alternative treatment options.

The rise in Arikayce sales was driven by continued growth in demand across all marketed regions. Sales of the drug were up 15% to $56.3 million in the United States, while sales in Japan rose 13% to $14.9 million. Sales in Europe and the rest of the world surged 42% to $4.3 million.

In the reported quarter, selling, general and administrative (SG&A) expenses rose 17% year over year to $93.1 million, driven by increases in compensation and benefit-related expenses.

Research and development (R&D) expenses were $121.1 million, down 5% from the year-ago quarter’s figure. The downtick is attributable to the recognition of a non-cash charge of $10.3 million in the year-ago period related to the acquisition of Vertuis Bio.

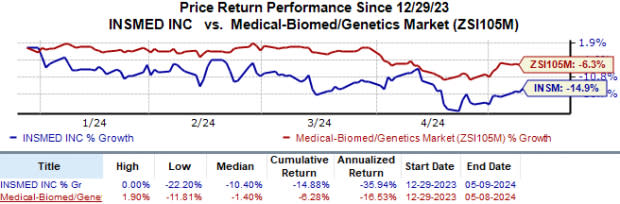

Year to date, shares of Insmed have lost 14.9% compared with the industry’s 6.3% fall.

Image Source: Zacks Investment Research

As of Mar 31, 2024, Insmed had cash, cash equivalents and marketable securities of $595.7 million compared with $780.4 million on Dec 31, 2023.

2024 Guidance

Management reiterated its sales guidance for Arikayce for the full year. It expects product sales for the drug to be between $340 million and $360 million in 2024, indicating 15% year-over-year growth at the midpoint.

Recent Updates

Alongside the earnings release, management reported positive topline safety and tolerability data from a mid-stage study evaluating treprostinil palmitil inhalation powder (TPIP) in patients with pulmonary hypertension associated with interstitial lung disease (PH-ILD).

Data from the study showed that 20.7% of TPIP-treated patients experienced serious adverse effects, compared to 40% of placebo-treated patients. In fact, treatment-emergent adverse events (TEAEs) which led to treatment discontinuation occurred in 13.8% of patients in the TPIP arm, compared to 30.0% in the placebo arm. None of the deaths in the study were deemed related to the drug.

Management also claimed that a majority of the patients (79.3%) who received TPIP reached the maximum dose of 640 micrograms (µg) following five weeks of treatment, compared to 100% in the placebo arm. Per management, 640 µg of TPIP dosed one-time daily contains roughly 60% more treprostinil than current market products dosed four times daily.

A notable difference in the occurrence of clinical worsening was observed between the treatment groups, with 10.3% of patients experiencing worsening in the TPIP arm compared to 50% in placebo. Based on these results, management intends to advance discussions with global regulatory authorities on the design of a late-stage study in PH-ILD, which INSM is aiming to start next year.

Insmed also shared updated blinded and blended data from the first 40 patients who completed the full 16 weeks of treatment in the ongoing mid-stage study of TPIP in pulmonary arterial hypertension (PAH) indication. Per management, treatment with the drug achieved an average reduction in pulmonary vascular resistance (PVR) of 19.9% and an average improvement in 6-minute walk distance (6MWD) from baseline was 43 meters. Topline results from this study are expected in the next year.

Management reiterated its plans to report topline data from the late-stage ASPEN study on brensocatib in non-CF bronchiectasis before June 2024-end. If this data is positive, management intends to proceed with an FDA filing, with a commercial launch anticipated in mid-2025.

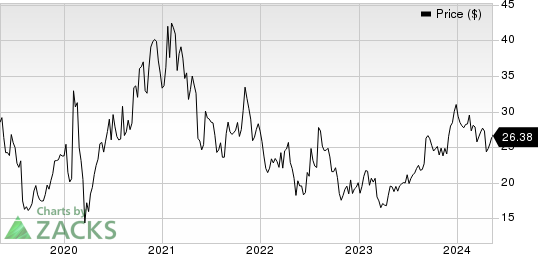

Insmed, Inc. Price

Insmed, Inc. price | Insmed, Inc. Quote

Zacks Rank & Key Picks

Insmed currently has a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include ANI Pharmaceuticals ANIP, Ligand Pharmaceuticals LGND and United Therapeutics UTHR, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2024 earnings per share (EPS) have risen from $4.40 to $4.44. During the same period, EPS estimates for 2025 have improved from $5.01 to $5.04. Year to date, shares of ANIP have rallied 19.5%.

Earnings of ANI Pharmaceuticals beat estimates in each of the last four quarters. ANI delivered a four-quarter average earnings surprise of 109.06%.

In the past 60 days, estimates for Ligand Pharmaceuticals’ 2024 EPS have risen from $4.42 to $4.56. During the same period, EPS estimates for 2025 have improved from $5.11 to $5.27. Year to date, LGND’s shares have risen 20.6%.

Earnings of Ligand Pharmaceuticals beat estimates in each of the last four quarters. Ligand delivered a four-quarter average earnings surprise of 56.02%.

In the past 60 days, estimates for United Therapeutics’ 2024 EPS have improved from $23.15 to $24.20. During the same period, EPS estimates for 2025 have risen from $24.12 to $26.74. Year to date, shares of UTHR have inched up 21.0%.

Earnings of United Therapeutics beat estimates in each of the last four quarters. UTHR delivered a four-quarter average earnings surprise of 12.41%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

United Therapeutics Corporation (UTHR) : Free Stock Analysis Report

Ligand Pharmaceuticals Incorporated (LGND) : Free Stock Analysis Report

Insmed, Inc. (INSM) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance