Insider Sale: President and CEO Gary Smith Sells 4,166 Shares of Ciena Corp (CIEN)

On May 15, 2024, Gary Smith, President and Chief Executive Officer of Ciena Corp (NYSE:CIEN), executed a sale of 4,166 shares of the company. The transaction was filed with the SEC and can be viewed in detail through the SEC Filing.

Ciena Corp, headquartered in Hanover, Maryland, is a global supplier of telecommunications networking equipment, software, and services. The company's products are used by telecommunications service providers, cable operators, governments, and enterprises to support and enhance their communication infrastructures.

The shares were sold at a price of $49.16, resulting in a total transaction amount of $204,618.56. Following this transaction, the insider's remaining holdings in Ciena Corp amount to a significant number of shares, directly aligning their interests with the long-term success of the company.

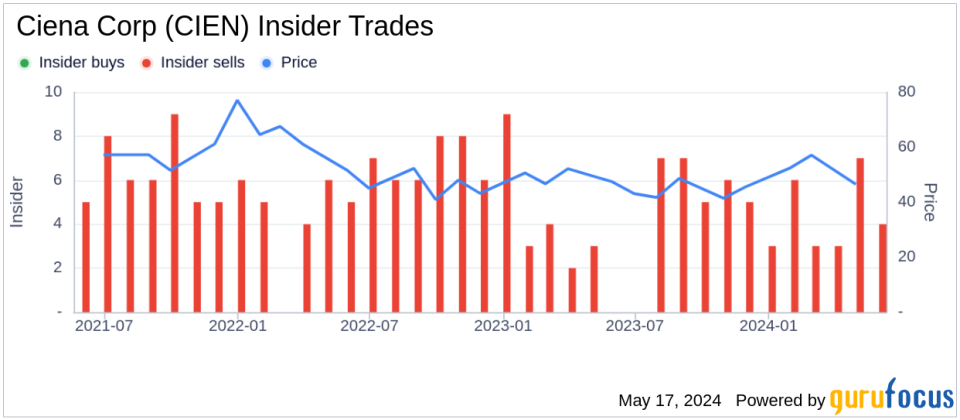

Over the past year, the insider has sold a total of 162,498 shares of Ciena Corp and has not purchased any shares. This recent sale is part of a broader trend observed over the last year, where there have been 56 insider sells and no insider buys. This pattern of transactions provides insights into the insider's perspective on the stock's valuation and future prospects.

As of the latest sale date, Ciena Corp's shares are trading at $49.16, giving the company a market cap of approximately $7.07 billion. The price-earnings ratio stands at 31.76, which is above both the industry median and the company's historical median.

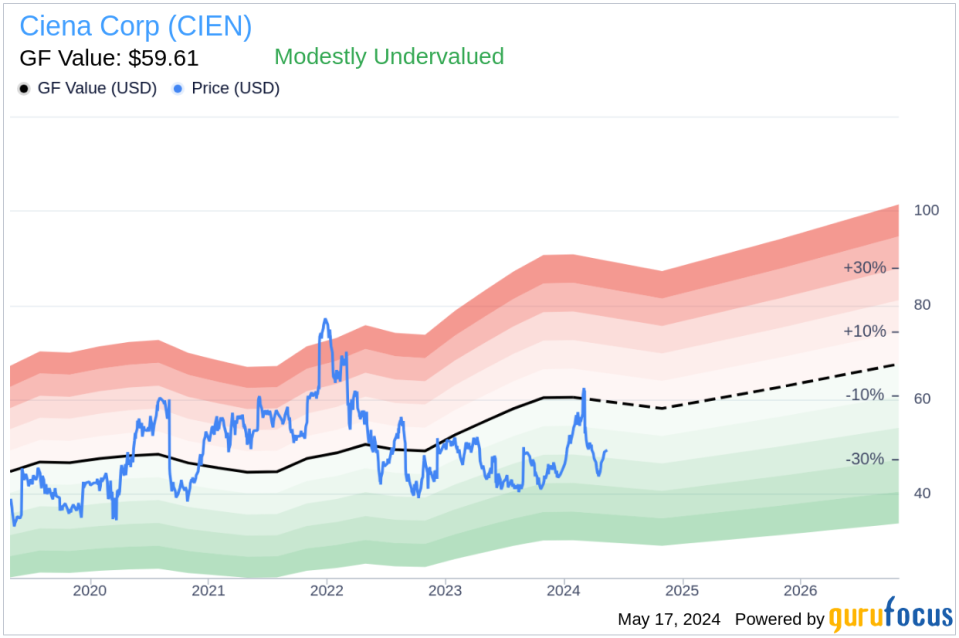

The stock's valuation according to the GF Value is $59.61, suggesting that Ciena Corp is modestly undervalued with a price-to-GF-Value ratio of 0.82. The GF Value is calculated considering historical trading multiples, an adjustment factor based on past returns and growth, and future business performance estimates.

The insider's recent selling activity might raise questions among investors, especially when considering the stock's current valuation and its position relative to the GF Value.

Investors and stakeholders in Ciena Corp will continue to monitor insider transactions and broader market trends to gauge the potential impact on their investment decisions and the company's future stock performance.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance