Insider Sale: EVP & President Medical Michael Garrison Sells Shares of Becton Dickinson ...

On April 30, 2024, Michael Garrison, Executive Vice President and President of Medical at Becton Dickinson & Co (NYSE:BDX), executed a sale of 1,715 shares of the company. The transaction was filed with the SEC and can be viewed in detail through the SEC Filing.

Becton Dickinson & Co (NYSE:BDX), a global medical technology company, is primarily engaged in the development, manufacture, and sale of a broad range of medical supplies, devices, laboratory equipment, and diagnostic products. The company serves healthcare institutions, life science researchers, clinical laboratories, the pharmaceutical industry, and the general public.

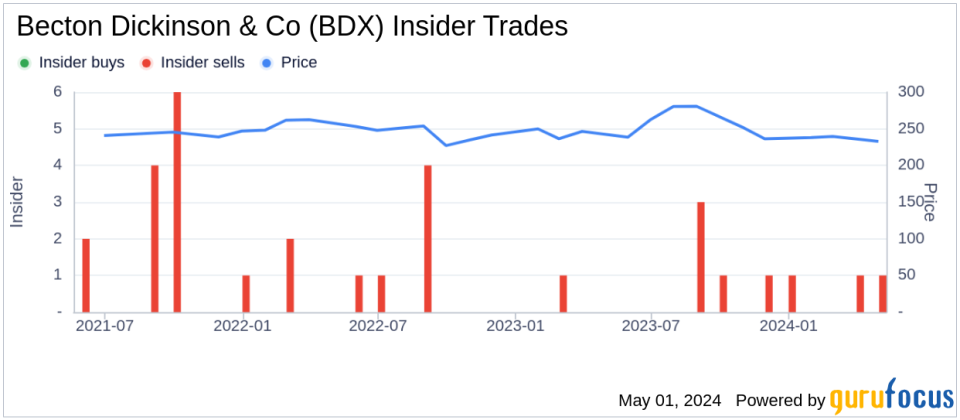

Over the past year, Michael Garrison has sold a total of 4,254 shares of Becton Dickinson & Co and has not made any purchases. The company's insider transaction history reveals a total of 8 insider sales and no insider buys over the same period.

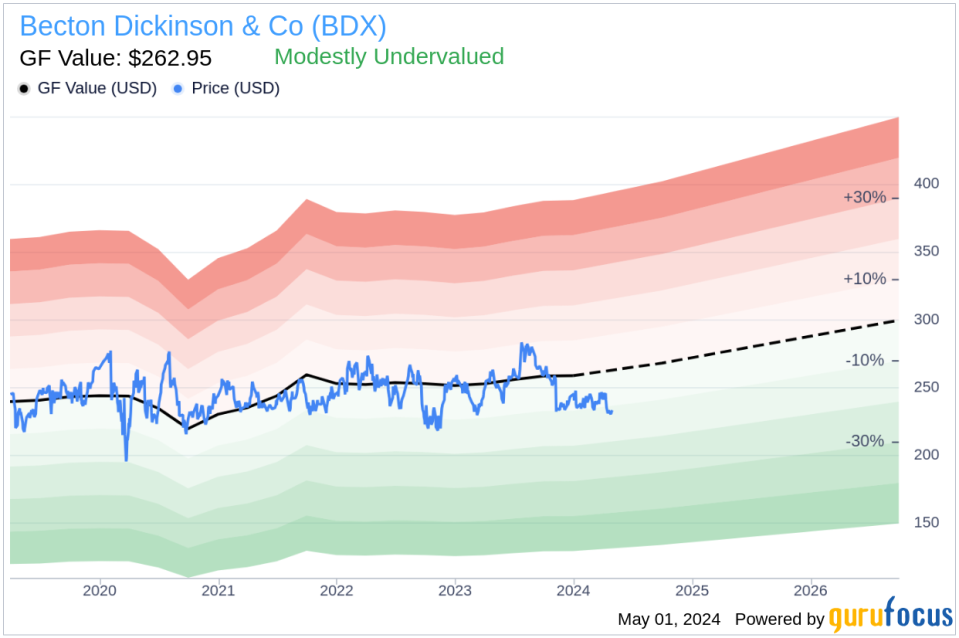

On the date of the sale, shares of Becton Dickinson & Co were priced at $232.81, resulting in a market cap of approximately $67.76 billion. The price-earnings ratio of the stock stood at 55.58, which is above both the industry median of 29.17 and the company's historical median.

According to the GF Value, which is an intrinsic value estimate used to determine fair stock pricing, Becton Dickinson & Co is considered modestly undervalued with a price-to-GF-Value ratio of 0.89. The GF Value of $262.95 suggests a potential undervaluation of the stock.

The sale by the insider might be of interest to current and potential investors, providing insight into how company executives are acting within the market context and the valuation metrics provided by GuruFocus.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance