Indian Exchange Growth Companies With High Insider Ownership And Up To 70% Earnings Growth

The Indian market has shown robust performance, climbing by 5.1% over the past week and achieving a remarkable 44% growth over the last 12 months, with earnings expected to grow by 16% per annum. In this thriving environment, stocks with high insider ownership and significant earnings growth are particularly compelling, as they often signal strong confidence from those who know the company best.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.1% |

Pitti Engineering (BSE:513519) | 33.6% | 28.0% |

Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 33.4% |

Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 38% | 22.9% |

Jupiter Wagons (NSEI:JWL) | 11.1% | 27.2% |

Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

Kirloskar Pneumatic (BSE:505283) | 30.6% | 27.7% |

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 33.1% |

Aether Industries (NSEI:AETHER) | 31.1% | 39.8% |

Let's explore several standout options from the results in the screener.

Archean Chemical Industries

Simply Wall St Growth Rating: ★★★★★★

Overview: Archean Chemical Industries Limited, with a market capitalization of ₹77.02 billion, is engaged in the manufacturing and international sale of specialty marine chemicals.

Operations: The company generates its revenue primarily from the sale of specialty marine chemicals, totaling ₹13.30 billion.

Insider Ownership: 22.9%

Earnings Growth Forecast: 28.1% p.a.

Archean Chemical Industries is trading below its estimated fair value, presenting a good relative value compared to its peers. It's expected to outpace the Indian market with a revenue growth of 23.5% per year and earnings growth of 28.1% per year, significantly above the market average. However, concerns arise from its unstable dividend track record and recent executive departure, which could impact investor confidence despite strong forecasted returns on equity and high insider ownership levels.

Greenlam Industries

Simply Wall St Growth Rating: ★★★★★☆

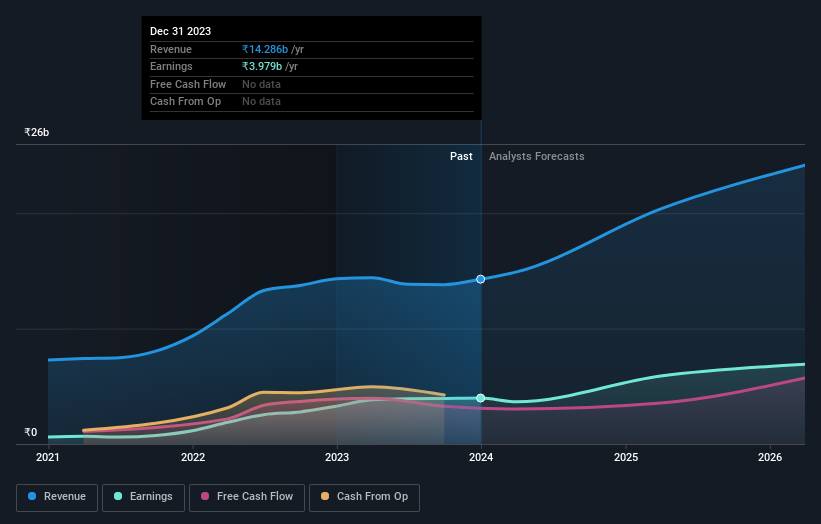

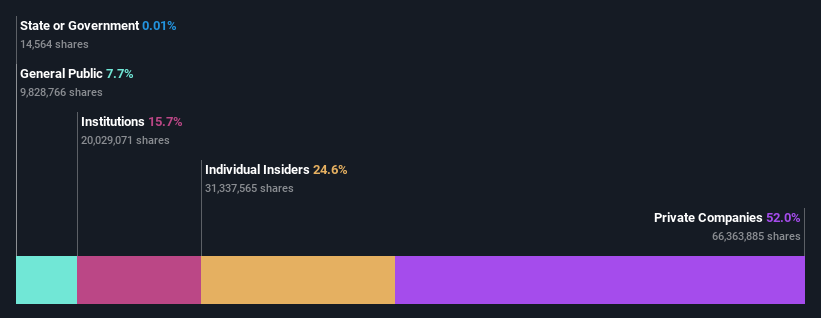

Overview: Greenlam Industries Limited is a company that specializes in manufacturing and selling laminates, decorative veneers, and related products across India and globally, with a market capitalization of approximately ₹77.23 billion.

Operations: The company's revenue is generated from three main segments: plywood (₹0.58 billion), veneers and allied products (₹2.09 billion), and laminate and allied products (₹20.40 billion).

Insider Ownership: 24.6%

Earnings Growth Forecast: 28.7% p.a.

Greenlam Industries, a company with high insider ownership, reported a robust financial year with revenues rising to INR 23.28 billion and net income increasing to INR 1.38 billion. The firm has announced a dividend of INR 1.65 per share, reflecting confidence in its financial health. Despite debt concerns due to poor coverage by operating cash flow, Greenlam is expected to see significant earnings growth at an annual rate of 28.74%, outpacing the broader Indian market's average.

Hindware Home Innovation

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hindware Home Innovation Limited operates in the consumer appliances, retail, and building products sectors within India, with a market capitalization of approximately ₹27.75 billion.

Operations: The company generates revenue primarily through its building products segment at ₹23.55 billion, followed by consumer appliances at ₹4.22 billion, and retail business at ₹0.24 billion.

Insider Ownership: 15.1%

Earnings Growth Forecast: 70.4% p.a.

Hindware Home Innovation, amidst leadership changes with Naveen Malik's appointment as CEO, faces mixed financial dynamics. While the company's revenue growth at 10.8% per year outpaces the Indian market, its profit margins have declined from last year’s 2% to a current 0.9%. Additionally, significant earnings growth is anticipated at an annual rate of 70.4%, although concerns linger due to poor coverage of interest payments by earnings and recent adjustments in dividend payouts to INR 0.40 per share.

Seize The Opportunity

Explore the 80 names from our Fast Growing Indian Companies With High Insider Ownership screener here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:ACI NSEI:GREENLAM and NSEI:HINDWAREAP.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finance

Yahoo Finance