Hong Kong and China Gas Co Ltd's Dividend Analysis

An In-depth Look at Upcoming Dividends and Company Fundamentals

Hong Kong and China Gas Co Ltd (HOKCF) recently announced a dividend of $0.23 per share, slated for distribution on June 24, 2024, with the ex-dividend date set for June 6, 2024. As investors anticipate this forthcoming payment, it's crucial to explore the company's dividend history, yield, and growth rates. This analysis utilizes comprehensive data from GuruFocus to evaluate the dividend performance of Hong Kong and China Gas Co Ltd and its sustainability.

Overview of Hong Kong and China Gas Co Ltd

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

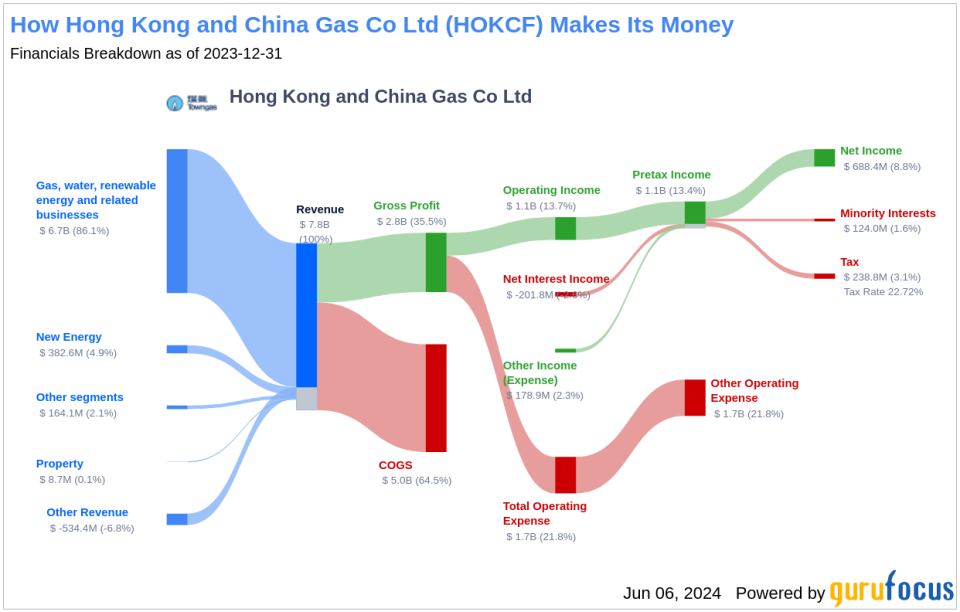

Hong Kong and China Gas Co Ltd, known as HKCG, stands as the oldest public utility company in Hong Kong. The company primarily engages in the production and distribution of town gas, holding a monopoly in its distribution and retail sectors within Hong Kong. Expansion into mainland China has seen HKCG undertaking 267 gas distribution projects across 26 provinces. Additionally, the company diversifies its portfolio by investing in water, upstream gas, and new energy sectors, with a significant 15.8% stake in the International Financial Center, a premier office building in Hong Kong's central business district. This diversified business model underpins its financial stability and growth prospects.

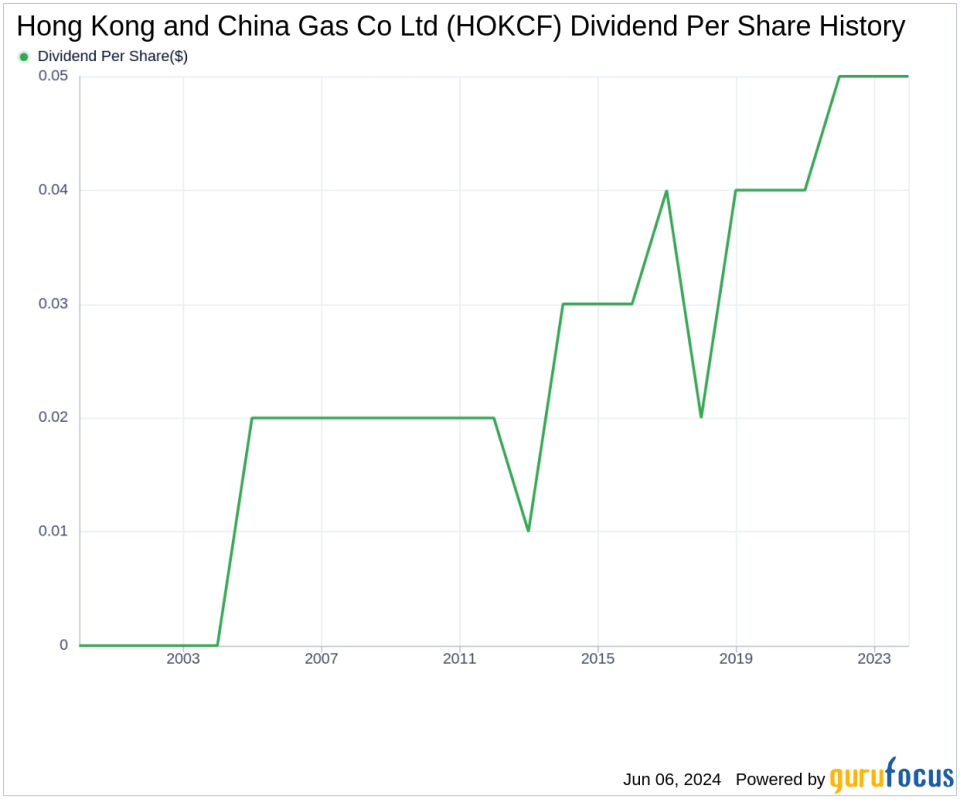

Examining Hong Kong and China Gas Co Ltd's Dividend History

Hong Kong and China Gas Co Ltd has upheld a robust track record of consistent dividend payments since 2004, distributing dividends bi-annually. This consistent payout reflects the company's strong financial management and commitment to returning value to shareholders.

Detailed Analysis of Dividend Yield and Growth

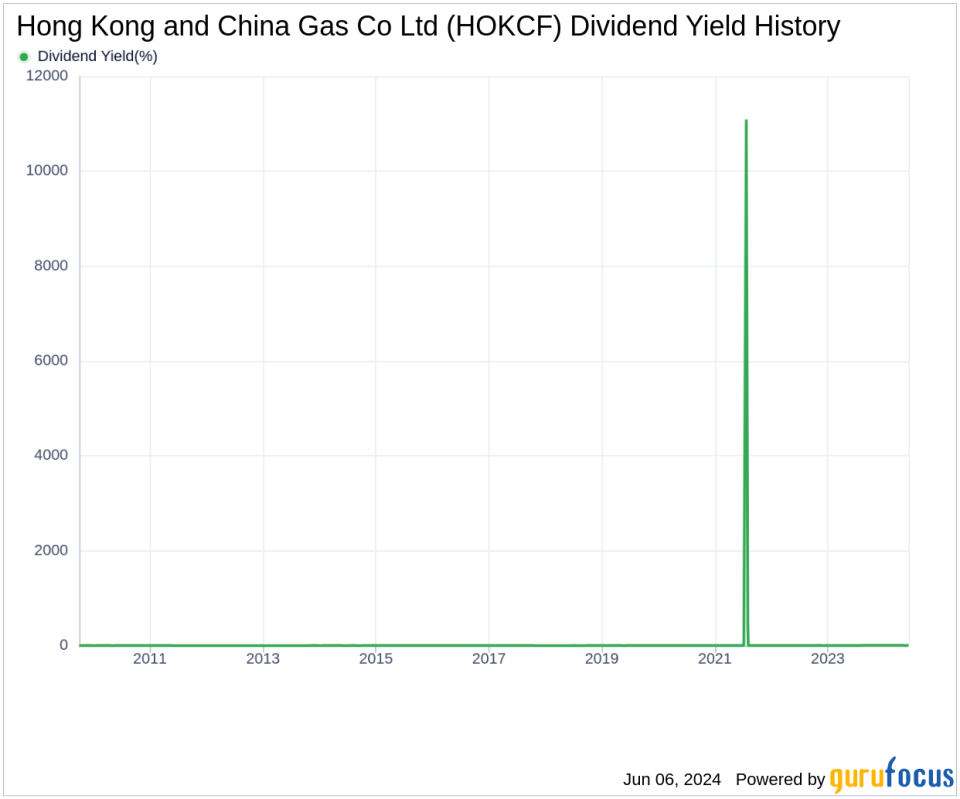

As of the latest data, Hong Kong and China Gas Co Ltd boasts a trailing twelve-month dividend yield of 5.86% and a forward dividend yield of 5.86%, indicating stable dividend expectations over the next year. Over the past three years, the company's annual dividend growth rate was 2.70%, which increased to 5.40% over a five-year period, and reached 8.30% over the past decade. These figures illustrate a promising trend in dividend growth, reinforcing the attractiveness of HKCG as a dividend-paying stock.

The Sustainability of Dividends: Payout Ratio and Profitability

To evaluate the sustainability of dividends, it is essential to consider the dividend payout ratio, which currently stands at 1.05 for Hong Kong and China Gas Co Ltd. This ratio suggests a potential concern regarding the sustainability of future dividends if not managed carefully. However, the company's profitability rank of 8 out of 10, alongside consistent positive net income over the past decade, provides a counterbalance, indicating strong earnings capabilities that could support ongoing dividend payments.

Future Growth Prospects and Metrics

Strong growth metrics are crucial for sustaining dividends. Hong Kong and China Gas Co Ltd's growth rank of 8 out of 10 implies a robust growth trajectory. The company has demonstrated a solid revenue model with a 3-year revenue growth rate of 11.70% annually, outperforming 62.58% of global competitors. However, its 3-year EPS growth rate and 5-year EBITDA growth rate indicate areas needing improvement to maintain a sustainable dividend policy in the long term.

Conclusion: Evaluating Hong Kong and China Gas Co Ltd's Dividend Strategy

In conclusion, while Hong Kong and China Gas Co Ltd presents a strong dividend yield and a history of consistent payments, investors should closely monitor the payout ratio and growth metrics to gauge the long-term sustainability of dividends. The company's robust profitability and strategic investments in diversified energy sectors provide a solid foundation for future growth, potentially enhancing its ability to maintain and increase dividend distributions. For those interested in exploring high-dividend yield opportunities, consider using the High Dividend Yield Screener available to GuruFocus Premium users.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance