Home Depot (NYSE:HD) Misses Q1 Revenue Estimates

Home improvement retail giant Home Depot (NYSE:HD) fell short of analysts' expectations in Q1 CY2024, with revenue down 2.3% year on year to $36.42 billion. It made a GAAP profit of $3.63 per share, down from its profit of $3.82 per share in the same quarter last year.

Is now the time to buy Home Depot? Find out in our full research report.

Home Depot (HD) Q1 CY2024 Highlights:

Revenue: $36.42 billion vs analyst estimates of $36.65 billion (small miss)

EPS: $3.63 vs analyst expectations of $3.59 (in line)

Full year guidance calling for 1% revenue and EPS growth (in line for revenue, slightly below for EPS)

Gross Margin (GAAP): 34.1%, up from 33.7% in the same quarter last year

Free Cash Flow of $4.65 billion, similar to the same quarter last year

Same-Store Sales were down 2.3% year on year (slight miss vs. expectations of down 2.0% year on year)

Store Locations: 2,337 at quarter end, increasing by 13 over the last 12 months

Market Capitalization: $337.9 billion

"The team executed at a high level in the quarter, and we continued to grow market share," said Ted Decker, chair, president and CEO.

Founded and headquartered in Atlanta, Georgia, Home Depot (NYSE:HD) is a home improvement retailer that sells everything from tools to building materials to appliances.

Home Improvement Retailer

Home improvement retailers serve the maintenance and repair needs of do-it-yourself homeowners as well as professional contractors. Home is where the heart is, so any homeowner will want to keep that home in good shape by maintaining the yard, fixing leaks, or improving lighting fixtures, for example. Home improvement stores win with depth and breadth of product, in-store consultations for customers who need help, and services that cater to professionals. It is hard for non-focused retailers and e-commerce competitors to match these. However, the research, convenience, and prices of online platforms means they can’t be fully written off, either.

Sales Growth

Home Depot is a behemoth in the consumer retail sector and benefits from economies of scale, an important advantage giving the business an edge in distribution and more negotiating power with suppliers.

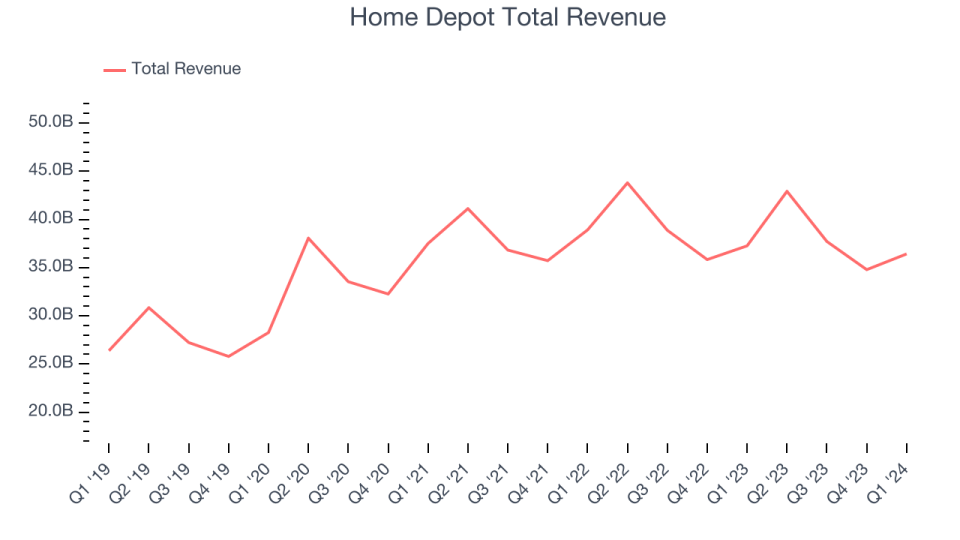

As you can see below, the company's annualized revenue growth rate of 6.7% over the last five years was weak as its store footprint remained relatively unchanged.

This quarter, Home Depot missed Wall Street's estimates and reported a rather uninspiring 2.3% year-on-year revenue decline, generating $36.42 billion in revenue. Looking ahead, Wall Street expects sales to grow 2.6% over the next 12 months, an acceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Same-Store Sales

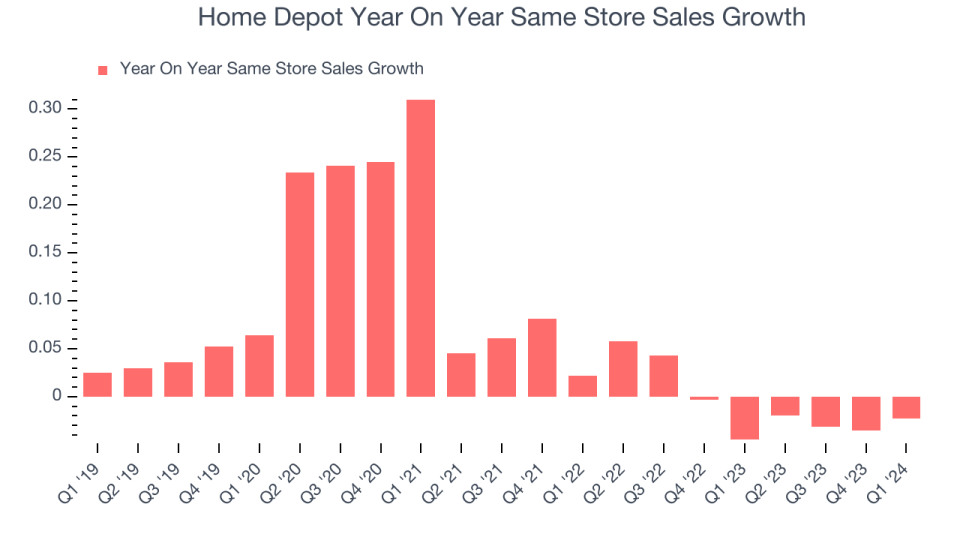

Home Depot's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 0.7% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Home Depot's same-store sales fell 2.3% year on year. This decrease was a further deceleration from the 4.5% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

Key Takeaways from Home Depot's Q1 Results

Home Depot's revenue missed analysts' expectations, although the difference was quite small. EPS was in line. Looking ahead, the company guided to 1% year on year growth for both full year revenue and EPS. The former was in line while the latter was slightly below expectations. Overall, this was an unexciting quarter for Home Depot, with the company calling out a "delayed start to spring and continued softness in certain larger discretionary projects". The stock is flat after reporting and currently trades at $338 per share.

So should you invest in Home Depot right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance