Himax (NASDAQ:HIMX) Exceeds Q1 Expectations, Stock Soars

Semiconductor maker Himax Technologies (NASDAQ:HIMX) reported results ahead of analysts' expectations in Q1 CY2024, with revenue down 15% year on year to $207.6 million. It made a GAAP profit of $0.07 per share, down from its profit of $0.09 per share in the same quarter last year.

Is now the time to buy Himax? Find out in our full research report.

Himax (HIMX) Q1 CY2024 Highlights:

Revenue: $207.6 million vs analyst estimates of $203.4 million (2% beat)

EPS: $0.07 vs analyst estimates of $0.05 ($0.02 beat)

Qualitative guidance: "With that being said, Company believes Q1 will be the low point for this year and sees sales starting to pick up in Q2, especially in the automotive sector. With several other upcoming demand catalysts on the horizon, including major sporting events and festival shopping seasons, business momentum is expected to continue to steadily improve throughout the second half."

Gross Margin (GAAP): 29.3%, up from 28.1% in the same quarter last year

Inventory Days Outstanding: 125, in line with the previous quarter

Free Cash Flow of $53.74 million, similar to the previous quarter

Market Capitalization: $912.1 million

“We believe Q1 will be the low point for this year and see sales starting to pick up in Q2, especially in the automotive sector. With several other upcoming demand catalysts on the horizon, including major sporting events and festival shopping seasons, business momentum is expected to continue to steadily improve throughout the second half,” said Mr. Jordan Wu, President and Chief Executive Officer of Himax.

Taiwan-based Himax Technologies (NASDAQ:HIMX) is a leading manufacturer of display driver chips and timing controllers used in TVs, laptops, and mobile phones.

Analog Semiconductors

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

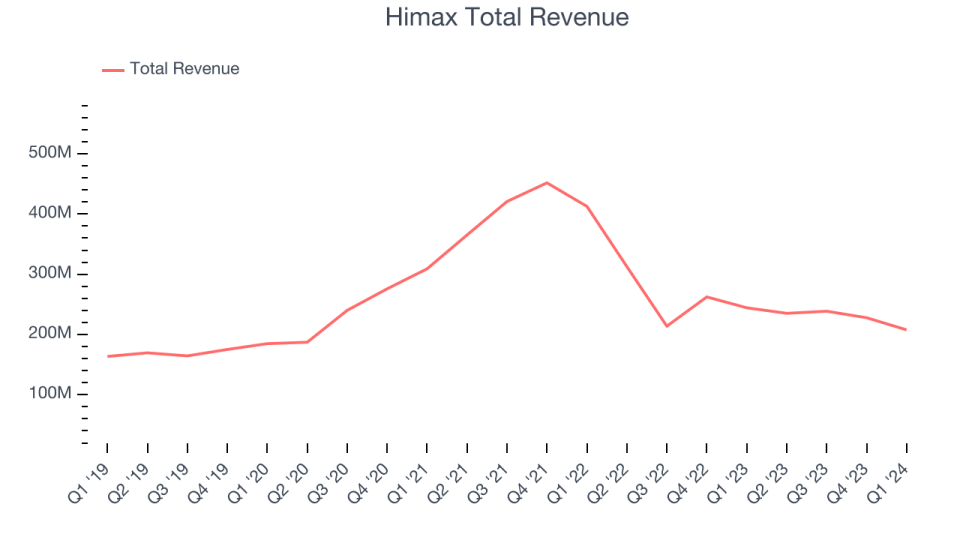

Sales Growth

Himax's revenue growth over the last three years has been unimpressive, averaging 6.7% annually. This quarter, its revenue declined from $244.2 million in the same quarter last year to $207.6 million. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Even though Himax surpassed analysts' revenue estimates, this was a slow quarter for the company as its revenue dropped 15% year on year. This could mean that the current downcycle is deepening.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

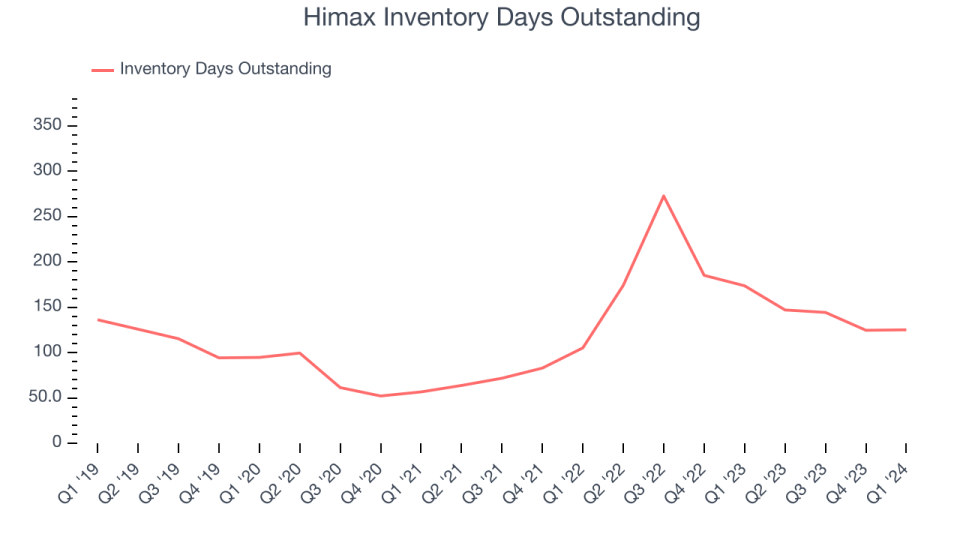

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business' capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Himax's DIO came in at 125, which is 7 days above its five-year average, suggesting that the company's inventory levels are higher than what we've seen in the past.

Key Takeaways from Himax's Q1 Results

It was good to see Himax improve its gross margin this quarter. We were also glad its revenue outperformed Wall Street's estimates. The company stated that "Q1 will be the low point for this year and sees sales starting to pick up in Q2, especially in the automotive sector. With several other upcoming demand catalysts on the horizon, including major sporting events and festival shopping seasons, business momentum is expected to continue to steadily improve throughout the second half." Overall, this was a solid quarter for Himax. The stock is up 5.5% after reporting and currently trades at $5.5 per share.

So should you invest in Himax right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance