Here's Why Omnicell (OMCL) Should be in Your Portfolio Now

Omnicell OMCL is likely to grow in the coming quarters due to its robust advanced services offerings. The company’s cost-saving measures are driving success, which is highly encouraging. Sound, stable solvency buoys optimism. Meanwhile, macroeconomic constraints and competitive disadvantages remain concerns for Omnicell’s operations.

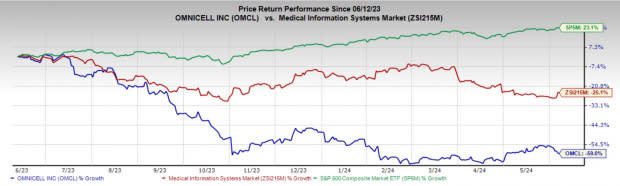

In the past year, this Zacks Rank #3 (Hold) stock has declined 59% compared with the 25.1% fall of the industry and the 23.1% growth of the S&P 500 composite.

The renowned healthcare technology company has a market capitalization of $1.36 billion. Omnicell surpassed estimates in each of the trailing four quarters, delivering an average negative earnings surprise of 93.2%.

Let’s delve deeper.

Tailwinds

Robust Pipeline for Advanced Services Portfolio: Omnicell’s suite of Advanced Services, featuring a combination of robotics, smart devices, intelligent software and expert services, provides a stable recurring revenue stream. In recent years, the company has made key acquisitions such as Specialty Pharmacy Services (formerly ReCept), FDS Amplicare and MarkeTouch Media, LL, to broaden its advanced services offerings.

As of the first quarter of 2024, the customer base for Specialty Pharmacy Services has exceeded 400 hospitals and clinics. Omnicell also offers 340B solutions, which are related to the federal 340B Drug Pricing Program. The EnlivenHealth brand had a strong first quarter of 2024, with a large buying cooperative choosing its analytics solution to enhance patient care and operational efficiency. Further, central pharmacy dispensing services are gaining market traction as several health systems automate their central pharmacy inventory and dispensing operations.

Image Source: Zacks Investment Research

Anticipated Benefits of Cost-Containment Measures: Omnicell introduced restructuring initiatives in 2022, including plans to reduce the global workforce across a majority of its functions. In 2023, the company placed a heightened focus on managing costs, including an approximate 7% reduction in its workforce and annualized savings of $50 million from operating expenses by the end of this year.

In the first quarter of 2024, Omnicell’s non-GAAP EBITDA and non-GAAP earnings per share exceeded their expectations, led by strong cost and operating expense management. The company also progressed the holistic review of the business to identify areas for operational and financial improvement that can potentially create sustained stockholder value.

Strong Liquidity and Capital Structure: Omnicell exited the first quarter of 2024 with cash and cash equivalents of $512 million, while short-term debt on its balance sheet was nil. The long-term debt remained unchanged at $570 compared to the fourth quarter of 2023, while the debt-to-capital ratio of 32.4% also remained consistent sequentially.

Headwinds

Macro Concerns Put Pressure on the Bottom Line: Myriad Genetics has been grappling with escalated expenses for a while. Deteriorating international trade, global inflationary pressure leading to a tough situation related to raw material and labor costs, as well as freight charges and rising interest rates, all have put the medical device space in a tight spot. These are creating significant pressure on the company’s profitability.

Increasing Competition: With the entry of new players, imminent price competition is another cause of concern. Per management, Myriad Genetics is currently facing competition in its key BRACAnalysis market. The company expects competition to intensify in its current fields with recently observed advancements in technology.

Furthermore, other companies may also launch their molecular diagnostic tests, which may compete with its testing products and services. In our opinion, competitive headwinds might push down prices for the high-priced tests provided by Myriad Genetics. This might deter margin improvement going forward.

Estimate Trend

The Zacks Consensus Estimate for OMCL’s 2024 earnings per share has moved to $1.10 from $1.08 in the past 30 days.

The Zacks Consensus Estimate for the company’s 2024 revenues is pegged at $1.07 billion. This suggests a 7.1% fall from the year-ago reported number.

Key Picks

Some better-ranked stocks in the broader medical space are Hims & Hers Health HIMS, Medpace MEDP and ResMed RMD.

Hims & Hers Health’s earnings are expected to surge 263.6% in 2024 compared with the industry’s 17.8%. HIMS’ earnings surpassed estimates in three of the trailing four quarters and missed in one, delivering an average surprise of 79.2%. Its shares have surged 131.3% against the industry’s 25.1% decline in the past year.

HIMS sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Medpace, also sporting a Zacks Rank #1 at present, has an estimated 2024 earnings growth rate of 27.1% compared with the industry’s 12.2%. Shares of MEDP have rallied 84% compared with the industry’s 4.7% growth over the past year.

MEDP’s earnings surpassed estimates in each of the trailing four quarters, delivering an average surprise of 12.8%. In the last reported quarter, it delivered an earnings surprise of 30.6%.

ResMed, sporting a Zacks Rank #1 at present, has an estimated fiscal 2024 earnings growth rate of 19.6% compared with the industry’s 12.8%. Shares of RMD have dropped 1.8% against the industry’s 4.9% growth over the past year.

RMD’s earnings surpassed estimates in three of the trailing four quarters and missed in one, delivering an average surprise of 2.8%. In the last reported quarter, it delivered an earnings surprise of 10.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Omnicell, Inc. (OMCL) : Free Stock Analysis Report

ResMed Inc. (RMD) : Free Stock Analysis Report

Medpace Holdings, Inc. (MEDP) : Free Stock Analysis Report

Hims & Hers Health, Inc. (HIMS) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance