Haemonetics Corp (HAE) Fiscal 2024 Earnings: Aligns with EPS Projections, Reveals Robust ...

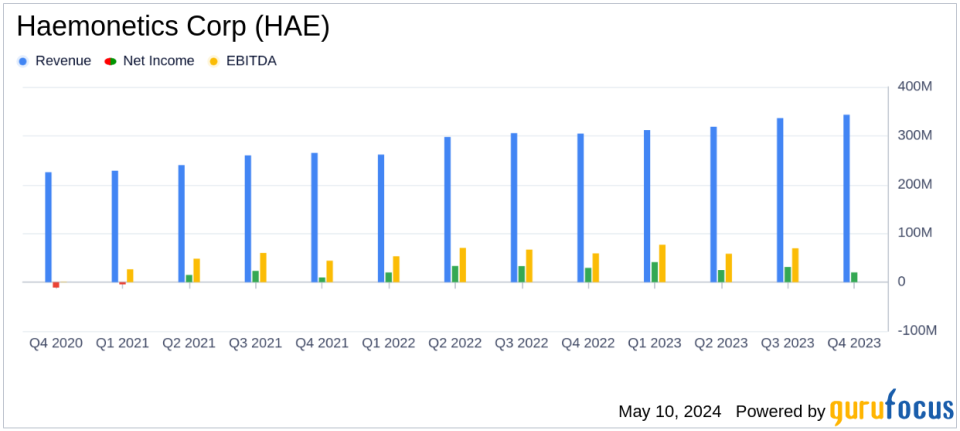

Revenue: Reported $343 million for Q4 and $1.309 billion for FY 2024, surpassing quarterly estimates of $329.11 million and annual estimates of $1.294 billion.

Net Income: Q4 adjusted net income reached $46.0 million, meeting the estimated $46.00 million.

Earnings Per Share: Adjusted EPS for Q4 was $0.90, slightly above the estimate of $0.89.

Annual EPS: Reported at $3.96, aligning exactly with the annual estimate.

Free Cash Flow: FY 2024 free cash flow before restructuring was $127 million, below the previous year's $190.4 million.

Gross Margin: Q4 adjusted gross margin improved by 220 basis points to 54.0% year-over-year.

Operating Margin: Adjusted operating margin for Q4 increased by 110 basis points to 18.8% compared to the same period last year.

On May 9, 2024, Haemonetics Corp (NYSE:HAE) disclosed its financial outcomes for the fourth quarter and the full fiscal year of 2024, showcasing significant revenue growth and strategic expansions. The details were released in their recent 8-K filing. Haemonetics, a global leader in blood and plasma supplies and services, reported a 13% increase in quarterly revenue, amounting to $343 million, and a 12% rise annually, reaching $1.309 billion.

Company Overview

Haemonetics Corp is pivotal in enhancing patient care and reducing healthcare costs through its innovative medical products for blood and plasma component collection, surgical suite, and hospital transfusion services. The company operates across three segments: plasma, blood center, and hospital, with a particular focus on the plasma and hospital segments due to their high growth potential.

Fiscal Year 2024 Performance Highlights

The fiscal year 2024 has been marked by robust growth, particularly in the hospital segment which saw a remarkable revenue increase of 28.1%. This growth is attributed to strategic acquisitions and portfolio optimization. Adjusted earnings per diluted share for the quarter stood at $0.90, perfectly aligning with analyst expectations of $0.89, and reaching $3.96 for the year, consistent with annual estimates.

Financial Metrics and Challenges

Despite the impressive revenue growth, Haemonetics faced challenges including increased operating expenses, which rose due to investments in growth and digital transformation, as well as the integration costs from recent acquisitions. The operating margin slightly declined to 8.7% in Q4 from 11.6% in the previous year, reflecting these increased costs.

Strategic Moves and Future Guidance

Chris Simon, CEO of Haemonetics, highlighted the company's strategic initiatives, stating,

Fourth quarter and fiscal 2024 performance was strong. We advanced our market leadership and portfolio evolution by investing selectively, acquiring attractive new products and rationalizing non-strategic assets to accelerate revenue growth and margin expansion."

For fiscal 2025, Haemonetics projects a total company revenue growth between 5% and 8%, with an adjusted operating margin between 23% and 24%, and adjusted earnings per diluted share ranging from $4.45 to $4.75.

Operational and Financial Planning

The company reported a cash flow from operating activities at $182 million for the year, with a free cash flow before restructuring and related costs at $127 million. These figures represent a decrease from the previous year, primarily due to increased inventory balances following strategic acquisitions.

Investor and Analyst Engagement

Haemonetics has scheduled a conference call with investors and analysts to discuss the detailed results and forward-looking guidance. This proactive engagement underscores the company's commitment to transparency and shareholder communication.

In conclusion, Haemonetics Corp's fiscal 2024 performance demonstrates a solid trajectory of growth and strategic positioning. Although faced with increased operational costs, the company's focus on innovative expansions and market leadership is poised to foster sustained growth and profitability, aligning with its long-term strategic goals.

Explore the complete 8-K earnings release (here) from Haemonetics Corp for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance