New Gold (NGD) Hits 52-Week High: What's Aiding the Stock?

New Gold Inc. NGD shares scaled a new 52-week high of $2.31 on May 30 before closing the session lower at $2.20. This came following the company’s announcement of an exploration update for the New Afton copper-gold mine on May 29, 2024.

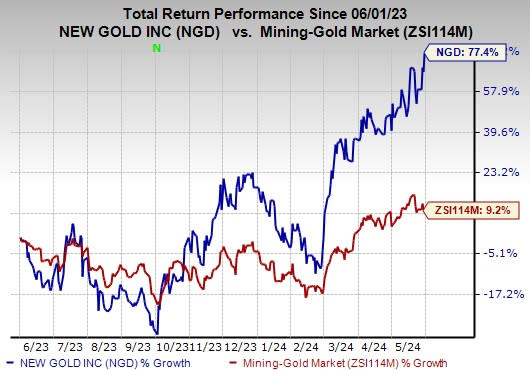

NGD has a market capitalization of $1.64 billion. Shares of New Gold have gained 77.4% in the past year compared with the industry's 9.2% growth.

Image Source: Zacks Investment Research

What’s Driving New Gold?

Ongoing Exploration Efforts Show Promise: The company provided an exploratory update for its New Afton copper-gold project in British Columbia, Canada. Underground exploratory drilling from C-Zone infrastructure encountered bornite-rich mineralization across strike lengths greater than 200 meters and estimated true widths of up to 40 meters. Copper and gold grades are greater in the K-Zone's bornite-bearing core than in the copper-gold mineralization surrounded by chalcopyrite.

The identification of high-grade bornite-bearing mineralization indicates the strong mineral prospectivity surrounding the New Afton mine and gives the company assurance as it aims to expand K-Zone with drilling from the underground exploration drift.

At Rainy River, exploration drilling from both the surface and underground is proceeding as planned. It is evaluating the down-plunge extension of the ODM Main and 17 East Zones at depth and exploring the Gap zone between the Intrepid and Main Zones. In addition, New Gold has identified two subsurface exploration opportunities near existing infrastructure that would likely require little capital investment to bring into production.

Rainy River's aim continues to sustain mill throughput beyond 2029. As such, infill drilling of near-surface targets with open pit extraction potential, such as NW-Trend and ODM East, is set to begin in the second quarter of 2024.

Strategic Partnership: On May 13, 2024, New Gold announced that it signed an agreement relating to its strategic partnership with the Ontario Teachers’ Pension Plan at the New Afton Mine. Under the partnership, New Gold will increase its effective free cash flow interest in New Afton to 80.1%. On completion of the deal, Ontario Teachers' free cash flow interest in New Afton will be decreased from 46.0% to 19.9% in consideration of a $255-million upfront cash payment from New Gold.

This transaction is projected to result in a significant increase in attributable life-of-mine cash flow while keeping New Gold's balance sheet strong and financially liquid.

Strong Q1 Operating Performance: In the first quarter of 2024, New Gold’s New Afton delivered a strong operating quarter, producing 18,179 ounces of gold and 13.3 million pounds of copper. Both gold and copper productions were in line with the company’s guidance.

Moreover, Rainy River made significant progress in sequencing waste stripping in order to secure the substantial increase in production expected in the second half of the year.

The company is on track to meet the 2024 consolidated production forecast of 310,000-350,000 ounces of gold and 50-60 million pounds of copper at all-in-sustaining costs of $1,240-$1,340 per gold ounce sold.

On-Track to Increase Production Over Next Three Years: At Rainy River, the underground Main Zone is on target to produce its first ore in the fourth quarter of 2024. The aim for 2024 is to build the primary ventilation circuit and get access to several mining zones, allowing for an increase in underground output to around 5,500 tons per day by 2027.

Rainy River gold production is likely to expand dramatically over the next three years as underground mill feed increases. The average gold grade is nearly three times higher than the open pit.

Upbeat Gold Prices: Since the start of 2024, gold prices have risen 14.6%, remaining consistently above the $2,000-per-ounce mark. The yellow metal peaked at an unprecedented $2,431.55 per ounce in April.

Several factors have contributed to this upward trajectory, including increased geopolitical tensions, a depreciating U.S. dollar, the potential for monetary policy easing and continuous purchasing by central banks. Physical demand has also been strong in China of late since the weaker yuan, volatile stock market and comparatively low deposit rates have led investors to explore alternatives for their savings.

Currently, the gold price is around $2,343 per ounce. This trend in the price of gold is likely to improve New Gold’s results in the upcoming quarters.

Zacks Rank & Other Stocks to Consider

The company currently sports a Zacks Rank #1 (Strong Buy).

Some other top-ranked stocks from the basic materials space are Carpenter Technology Corporation CRS, Ecolab Inc. ECL and ATI Inc. ATI. CRS sports a Zacks Rank #1 at present, and ECL and ATI have a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Carpenter Technology’s 2024 earnings is pegged at $4.18 per share. The consensus estimate for 2024 earnings has moved 6% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 15.1%. CRS shares have gained 134.9% in a year.

The Zacks Consensus Estimate for Ecolab’s 2024 earnings is pegged at $6.59 per share, indicating an increase of 26.5% from the prior year’s reported number. It has an average trailing four-quarter earnings surprise of 1.3%. ECL shares have gained 34.5% in a year.

The Zacks Consensus Estimate for ATI’s 2024 earnings is pegged at $2.41 per share. The Zacks Consensus Estimate for ATI’s current-year earnings has been revised 3% north in the past 60 days. It has an average trailing four-quarter earnings surprise of 8.3%. The company’s shares have rallied 65.9% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ecolab Inc. (ECL) : Free Stock Analysis Report

ATI Inc. (ATI) : Free Stock Analysis Report

Carpenter Technology Corporation (CRS) : Free Stock Analysis Report

New Gold Inc. (NGD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance