Global Indemnity Group LLC Reports Strong First Quarter 2024 Earnings, Surpassing Analyst Estimates

Net Income: $11.3 million, a significant increase from $2.4 million in the prior year's same quarter.

Earnings Per Share (EPS): Reported at $0.82, surpassing the estimated earnings of $0.60 per share.

Gross Written Premiums: Totaled $93.5 million, down from $123.0 million in the previous year.

Investment Income: Rose to $14.5 million from $12.0 million year-over-year.

Combined Ratio: Improved to 94.9% from 101.0% in the prior year, indicating better profitability in underwriting activities.

Book Value Per Share: Increased to $48.18 from $47.53 at the end of the previous quarter.

Shareholders Equity: Grew to $659.5 million, up from $648.8 million at the end of the last quarter.

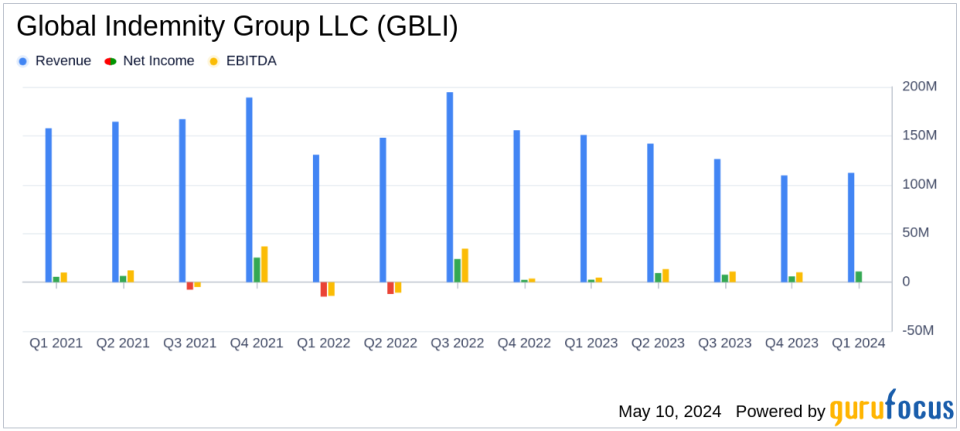

On May 8, 2024, Global Indemnity Group LLC (NYSE:GBLI) disclosed its first quarter results through an 8-K filing, revealing a substantial increase in net income and improved underwriting performance compared to the same period in the previous year. The insurance provider, known for its specialty property and casualty insurance coverages in the United States and reinsurance globally, reported a net income available to shareholders of $11.3 million for the quarter ended March 31, 2024, a significant rise from $2.4 million in 2023.

Company Overview

Global Indemnity Group LLC operates primarily through three segments: Commercial Specialty, Reinsurance operations, and Exited Lines, with the majority of its revenue stemming from the Commercial Specialty segment. The company's operations are predominantly based in California, emphasizing both admitted and non-admitted insurance coverages.

Financial Performance Insights

The first quarter results were particularly strong, with net income per share rising to $0.82 from $0.17 in the previous year. This performance significantly exceeds the analyst's estimated earnings per share of $0.60 for the quarter. Adjusted operating income also saw an increase, reaching $10.7 million, up from $3.7 million in the prior year, and adjusted operating income per share grew to $0.77 from $0.26.

Underwriting income turned positive at $5.3 million, a notable recovery from a loss of $1.1 million in the first quarter of 2023. This improvement is reflected in the combined ratio, which improved to 94.9% from 101.0%, driven by a more favorable loss ratio of 55.3% compared to 62.8% last year.

Investment income contributed positively, increasing to $14.5 million from $12.0 million, underscoring a robust investment performance. However, gross written premiums saw a decline to $93.5 million from $123.0 million, indicating a shift in the company's underwriting strategies or market conditions.

Balance Sheet and Cash Flow

The balance sheet remains solid with shareholders' equity increasing to $659.5 million from $648.8 million at the end of December 2023. Cash and invested assets also grew to $1,417.3 million from $1,390.4 million. Book value per share improved slightly to $48.18 from $47.53, reflecting the company's ongoing financial health.

Operational Highlights and Challenges

Despite the drop in gross written premiums, the company managed to improve its underwriting results significantly. The shift in premium volume could be indicative of strategic adjustments in the company's portfolio or varying market dynamics. Monitoring how these changes impact long-term performance will be crucial.

Conclusion

Global Indemnity Group LLC's first quarter performance in 2024 demonstrates a strong start to the year, with significant improvements in profitability and underwriting efficiency. The company's ability to exceed analyst expectations for EPS and enhance shareholder value through improved operational performance sets a positive tone for its outlook in the upcoming quarters. Investors and stakeholders will likely watch closely how the company navigates market fluctuations and leverages its strategic initiatives to sustain growth.

For detailed financial figures and further information, refer to the full 8-K filing.

Explore the complete 8-K earnings release (here) from Global Indemnity Group LLC for further details.

This article first appeared on GuruFocus.

Yahoo Finance

Yahoo Finance