Gap (NYSE:GPS) Beats Expectations in Strong Q1, Stock Jumps 22%

Clothing and accessories retailer The Gap (NYSE:GPS) reported Q1 CY2024 results exceeding Wall Street analysts' expectations , with revenue up 3.4% year on year to $3.39 billion. It made a GAAP profit of $0.41 per share, improving from its loss of $0.05 per share in the same quarter last year.

Is now the time to buy Gap? Find out in our full research report.

Gap (GPS) Q1 CY2024 Highlights:

Revenue: $3.39 billion vs analyst estimates of $3.29 billion (3.1% beat)

Gross Margin (GAAP): 41.2%, up from 37.2% in the same quarter last year

Free Cash Flow was -$63 million compared to -$102 million in the same quarter last year

Locations: 3,571 at quarter end, up from 3,453 in the same quarter last year

Same-Store Sales rose 3% year on year (-3% in the same quarter last year)

Market Capitalization: $8.09 billion

"Gap Inc. delivered a strong quarter that exceeded expectations across key metrics. We gained market share for the 5th consecutive quarter with positive comparable sales at all brands, demonstrating improved relevance with our customers as we execute against our brand reinvigoration playbook. Our first quarter results are giving us confidence to raise both sales and operating income guidance for the full year," said Gap Inc. President and Chief Executive Officer, Richard Dickson.

Operating under The Gap, Old Navy, Banana Republic, and Athleta brands, The Gap (NYSE:GPS) is an apparel and accessories retailer that sells its own brand of casual clothing to men, women, and children.

Apparel Retailer

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

Sales Growth

Gap is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

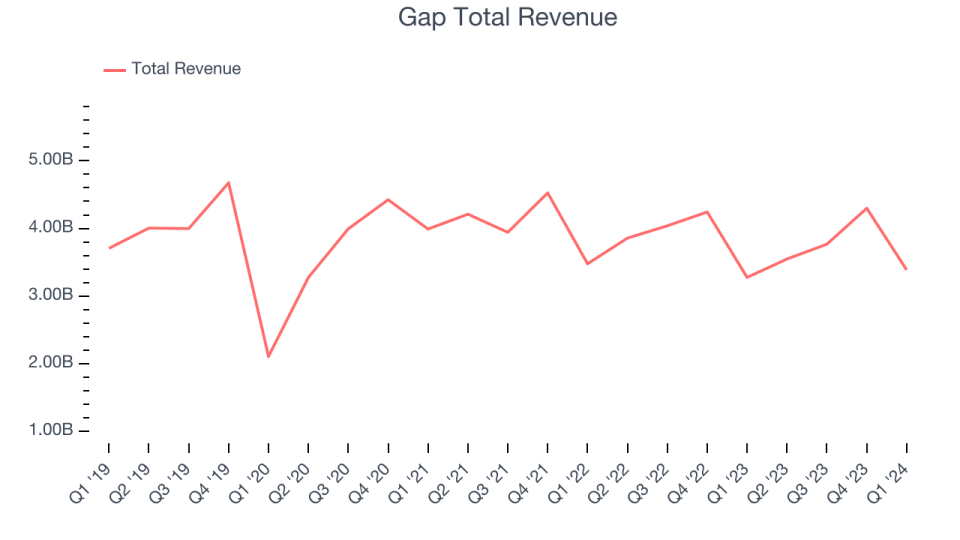

As you can see below, the company's revenue has declined over the last four years, dropping 1.9% annually as it failed to grow its store footprint meaningfully and observed lower sales at existing, established stores.

This quarter, Gap reported decent year-on-year revenue growth of 3.4%, and its $3.39 billion in revenue topped Wall Street's estimates by 3.1%. Looking ahead, Wall Street expects revenue to remain flat over the next 12 months, a deceleration from this quarter.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Same-Store Sales

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

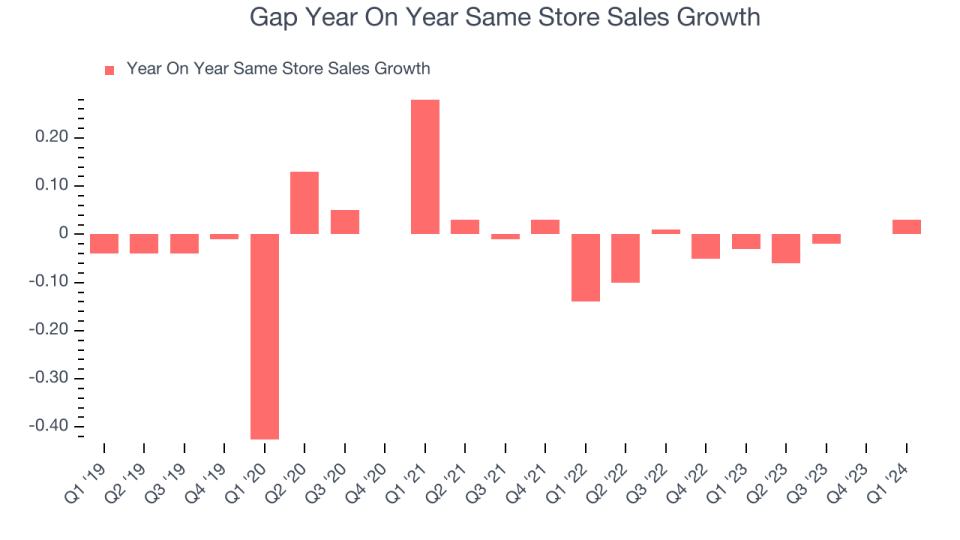

Gap's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 2.8% year on year. This performance is quite concerning and the company should reconsider its strategy before investing its precious capital into new store buildouts.

In the latest quarter, Gap's same-store sales rose 3% year on year. This growth was a well-appreciated turnaround from the 3% year-on-year decline it posted 12 months ago, showing the business is regaining momentum.

Key Takeaways from Gap's Q1 Results

We were impressed by how significantly Gap blew past analysts' EPS expectations this quarter. We were also excited its gross margin outperformed Wall Street's estimates. The highlight of the quarter, however, was its full-year operating income guidance, which was lifted to mid-40% year-on-year growth from its previous outlook of low-to-mid teens growth. Zooming out, we think this was a fantastic quarter that should have shareholders cheering. The stock is up 22% after reporting and currently trades at $27.35 per share.

Gap may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

Yahoo Finance

Yahoo Finance